Eni (E) Announced Plans to Postpone Milan Listing of Plenitude

Eni SPA E announced that it would postpone the initial public offering (IPO) of its Plenitude retail and renewable business on the Euronext Milan stock exchange due to the declining market conditions.

Eni has witnessed extensive investor interest in Plenitude and gained crucial support for its strategy. However, the inconsistency and uncertainty currently affecting the markets require another evaluation phase.

The company will continue to assess market conditions and implement its strategy to provide customers with decarbonized energy by developing renewables and investing in electric mobility.

The decision came a week after Eni announced plans to list Plenitude in order to capitalize on renewed investor interest in energy stocks in a depressed IPO market.

Since then, the U.S. Federal Reserve and the Bank of England have raised interest rates, and investors have turned risk-averse amid concerns over rising inflation. The challenging moves came on top of the Russia-Ukraine conflict, which is decelerating the economic recovery.

Eni is currently discussing with consultants whether to accept a lower valuation or wait for a favorable environment. The decision to postpone could enable Eni to secure its desired valuation once the market improves. It could also fail if investors’ opinion continues to deteriorate. Notably, Eni did not reveal whether it plans to list the unit by the end of 2022.

Plenitude has a portfolio of 1.4 gigawatts (GW) installed renewable energy capacity in operation. It plans to increase the capacity to more than 6 GW by 2025 and 15 GW by 2030. Plenitude provides natural gas and energy to around 10 million customers. The spin-off would be the most significant structural move by an energy major in response to the rising pressure to curb climate change.

The creation of Plenitude will help Eni lower its Scope 3 emissions. The move reflects the company’s strong focus on capitalizing on mounting demand for renewables and green energy products.

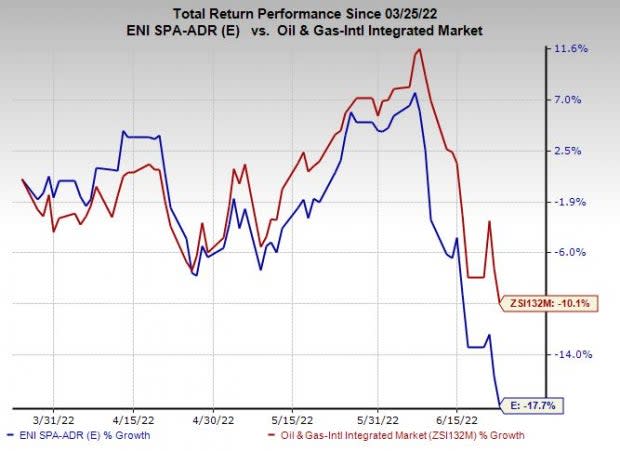

Price Performance

Shares of Eni have underperformed the industry in the past three months. The stock has lost 17.7% compared with the industry’s 10.1% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

Eni currently has a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Suncor Energy, Inc. SU is Canada’s premier integrated energy company. In 2021, Suncor reduced net debt by almost C$4 billion and returned it to shareholders through dividends and share repurchases.

Suncor’s robust liquidity position will allow it to sustain its dividend, even if oil prices stay lower for longer. The company recently hiked its dividend by 12% to 47 Canadian cents per share (after doubling it previously) and increased the buyback authorization to 10% of its public float.

Enterprise Products Partners EPD is among the leading midstream energy players in North America. EPD is also well-positioned to generate additional cash flow from under-construction growth capital projects worth $4.6 billion.

Enterprise Products Partners is strongly committed to returning cash to shareholders. The partnership’s board of directors increased its cash distribution to 46.5 cents per unit, suggesting a 3.3% hike from the previous dividend of 45 cents.

PBF Energy Inc. PBF, based in New Jersey, is a leading refiner of crude. The company’s daily processing capacity of 1,000,000 barrels of crude oil is higher than peers.

In 2021, PBF Energy’s crude oil and feedstocks throughput volumes were 834.5 thousand barrels per day (bpd), higher than the year-ago figure of 727.7 thousand bpd. Moreover, it expects total throughput volumes of 865-925 thousand bpd in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance