EnerVest, Ltd. Increases Stake in Magnolia Oil & Gas Corp

Overview of the Recent Transaction

On September 23, 2024, EnerVest, Ltd. (Trades, Portfolio), a prominent investment firm, executed a significant transaction by acquiring an additional 4,067,042 shares of Magnolia Oil & Gas Corp (NYSE:MGY). This purchase was made at a price of $26.28 per share, reflecting a substantial investment and a notable increase in EnerVest's holdings in the company. Following this transaction, EnerVest now controls a total of 8,232,003 shares of Magnolia Oil & Gas, making it a pivotal player in the company's financial ecosystem. This move has increased the firm's position in its portfolio to an impressive 101.84%, indicating a strong conviction in the potential of Magnolia Oil & Gas.

Profile of EnerVest, Ltd. (Trades, Portfolio)

EnerVest, Ltd. (Trades, Portfolio), headquartered at 1001 Fannin Street, Houston, TX, is known for its strategic investment selections, primarily focusing on high-value opportunities. With a portfolio centered around Magnolia Oil & Gas Corp, EnerVest demonstrates a targeted investment approach, emphasizing significant holdings in sectors where it predicts substantial growth and returns. The firm's current equity stands at approximately $106 million, showcasing its robust financial footing and investment capabilities.

Detailed Trade Action

The recent acquisition by EnerVest marks a strategic enhancement of its portfolio, with the firm now holding over 8 million shares of Magnolia Oil & Gas. This adjustment not only bolsters its influence over the company but also reflects a deepened commitment to its growth prospects. The trade impact of this transaction is quantified at 50.32%, underscoring its significance in terms of portfolio dynamics and market perception.

Insight into Magnolia Oil & Gas Corp

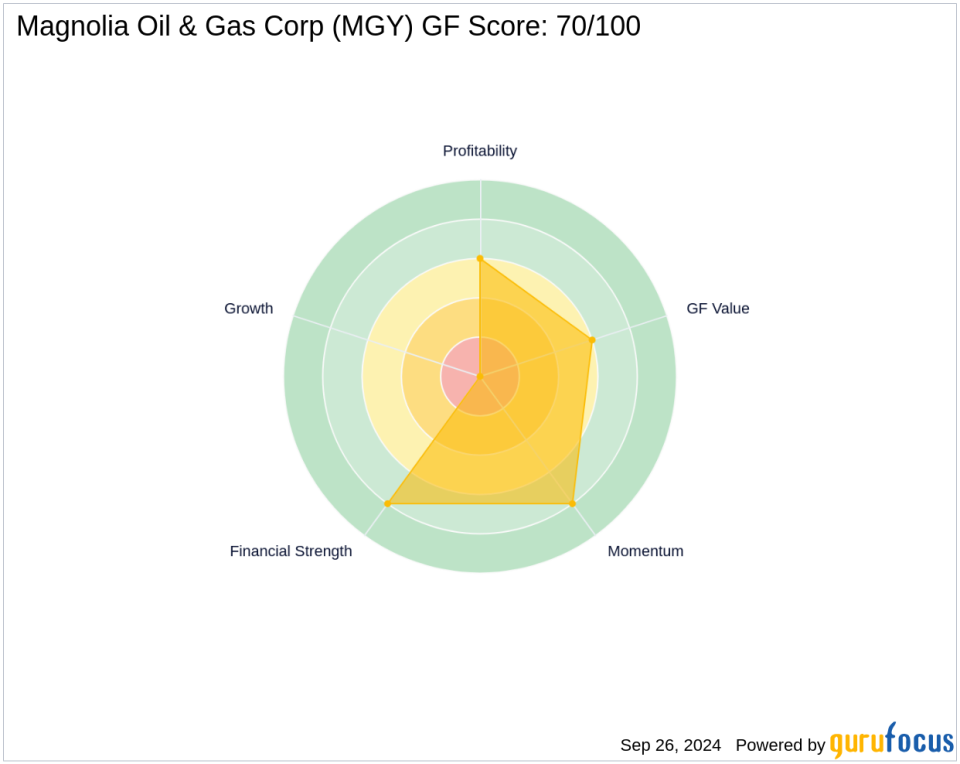

Magnolia Oil & Gas Corp, an independent oil and natural gas company, is engaged in the exploration and production of oil, natural gas, and NGL reserves. Since its IPO on June 26, 2017, the company has focused on lucrative locations in South Texas, targeting the Eagle Ford Shale and Austin Chalk formations. Despite a recent price dip of 6.35% since the transaction, the company maintains a "Fairly Valued" GF Valuation, with a GF Value of $22.98 and a price to GF Value ratio of 1.07.

Comparative Market Analysis

Other significant shareholders in Magnolia Oil & Gas include Barrow, Hanley, Mewhinney & Strauss, alongside notable investors like Keeley-Teton Advisors, LLC (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). This diverse interest from various investment powerhouses underscores the company's strong market position and potential for growth.

Strategic Implications of the Transaction

The strategic increase in EnerVest's stake in Magnolia Oil & Gas is indicative of its confidence in the company's future performance. This move is likely to have considerable implications for both EnerVest's portfolio and the broader market, potentially influencing future investment trends and market dynamics in the oil and gas sector.

Conclusion

EnerVest, Ltd. (Trades, Portfolio)'s recent acquisition of additional shares in Magnolia Oil & Gas Corp significantly alters its investment landscape, reinforcing its position in the market. With a strong focus on this single entity, EnerVest's portfolio strategy is clear, reflecting a bullish outlook on the oil and gas industry's prospects. As the market continues to evolve, the impact of this transaction will undoubtedly be a key point of analysis for investors and market watchers alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.