Energizer (ENR) Beats on Q2 Earnings, Raises FY22 Sales View

Energizer Holdings, Inc. ENR reported second-quarter fiscal 2022 results, wherein the top and the bottom line surpassed the Zacks Consensus Estimate. However, sales were flat and earnings decreased on a year-over-year basis. Solid pricing execution across the brands and higher organic growth in auto care business aided sales. Also, robust pricing actions and supply-chain performances somewhat offset the inflationary cost pressures.

ENR’s shares have declined 9.2% in the past three months compared with the industry’s fall of 6.3%.

Q2 Metrics

Energizer’s adjusted earnings of 47 cents per share surpassed the Zacks Consensus Estimate of 35 cents but decreased nearly 39% from the year-ago quarter’s level. The bottom line decrease was due to elevated input expenses.

ENR reported net sales of $685.4 million, beating the Zacks Consensus Estimate of $644 million. The top line was almost flat on a year-over-year basis. Organic sales inched up 1.3% in the quarter under review. Pricing was executed in the battery and auto care businesses, boosting an organic increase of nearly 5%. Also, new distribution in the battery and auto care, predominantly in the International markets, contributed 1% to organic growth.

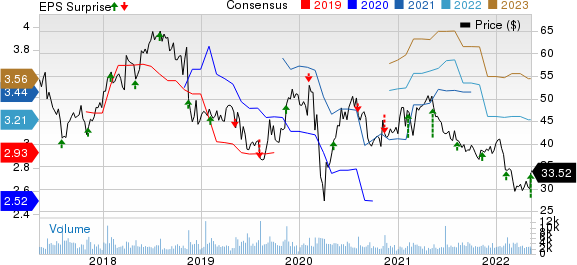

Energizer Holdings, Inc. Price, Consensus and EPS Surprise

Energizer Holdings, Inc. price-consensus-eps-surprise-chart | Energizer Holdings, Inc. Quote

Energizer exited the Russian market in the reported quarter, dipping 0.5% sales year over year.

Segments in Detail

On Oct 1, 2021, Energizer changed its segments from two geographies — Americas and International — to two reporting units, namely Battery & Lights and Auto Care. The move followed the acquisition of Spectrum Brands’ battery and auto care units in the first quarter of fiscal 2022.

Energizer’s Batteries & Lights segment’s revenues declined 4.9% year over year to $516.5 million in second-quarter fiscal 2022, while revenues in the Auto Care segment increased 18.8% to $168.9 million.

Margins

In the fiscal second quarter, Energizer’s adjusted gross margin contracted 560 basis points (bps) to 34.9%. The downside was caused by elevated operating costs like transportation, material and labor, partly offsetting the impact of executed price increases in battery and auto care.

Excluding costs related to the acquisition and integration, and exiting the Russian market, SG&A as a rate of sales was 17.2% compared with 16.7% recorded in the prior-year quarter. On a dollar basis, SG&A rose $3.5 million due to increased IT spend related to the digital transformation.

Adjusted EBITDA was $114.6 million, down 22.4% year over year.

Other Financial Details

As of Mar 31, 2022, Energizer’s cash and cash equivalents were $213.2 million, with a long-term debt of $3,592.6 million and shareholders' equity of $461.3 million.

For the six months ending Mar 31, 2022, this currently Zacks Rank #4 (Sell) player used $108.7 million cash from continuing operations.

In the reported quarter, the mandatory convertible preferred stock converted to nearly 4,700,000 shares. It paid out dividends of $22.3 million or 30 cents per share.

Outlook

Management updated view for fiscal 2022. It expects sales to increase in low-single digits from the prior guided view of flat with the year-ago quarter’s reported figure.

However, management stated that the operating landscape remains volatile but reiterated its earnings view on pricing actions and cost management. For fiscal 2022, Energizer continues to expect adjusted earnings per share of $3.00-$3.30 and an adjusted EBITDA of $560-$590 million.

Stocks to Consider

Some better-ranked stocks from the broader Consumer Staples space are McCormick & Company MKC, The Duckhorn Portfolio NAPA and Sysco Corporation SYY.

McCormick is one of the leading manufacturers, marketers and distributors of spices, seasonings, specialty foods and flavors. The stock currently carries a Zacks Rank #2 (Buy). MKC has an expected long-term earnings growth rate of 6.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for McCormick’s current financial-year sales and EPS suggests growth of 5% and 3.9% each from the year-ago period’s respective reported figures. MKC has a trailing four-quarter earnings surprise of 7.3%, on average.

Duckhorn, a premier producer of wines in North America, currently has a Zacks Rank of 2 and an expected long-term earnings growth rate of 11.3%. NAPA has a trailing four-quarter earnings surprise of 122.4%, on average.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings per share suggests growth of 9.6% and 3.5%, respectively, from the corresponding year-ago reported numbers. The consensus mark for NAPA’s earnings per share has been stable in the past 30 days.

Sysco, a marketer and distributer of food and related products, is currently Zacks #2 Ranked. The stock has an expected long-term earnings growth rate of 11%. SYY has a trailing four-quarter earnings surprise of 3.7%, on average.

The Zacks Consensus Estimate for Sysco’s current financial-year sales and earnings per share suggests growth of 35.9% and 145.5%, respectively, from the corresponding year-ago reported numbers. The consensus mark for SYY’s earnings per share has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance