Edwards Lifesciences (EW) Q2 Earnings Meet Estimates, Margins Up

Edwards Lifesciences Corporation EW delivered second-quarter 2022 adjusted earnings per share (EPS) of 63 cents, in line with the Zacks Consensus Estimate. The figure, however, declined 1.6% year over year.

Our model projected an adjusted EPS of 64 cents in Q2.

GAAP EPS was 65 cents in the quarter compared with the year-ago quarter’s EPS of 78 cents, down 16.7%.

Sales Details

Second-quarter net sales were $1.37 billion, down 0.2% year over year on a reported basis. On an underlying basis, growth was 5%. The metric missed the Zacks Consensus Estimate by 1.6%.

The second-quarter revenue compares to our own estimate of $1.41 billion.

Segmental Details

In the second quarter, global sales in the Transcatheter Aortic Valve Replacement (TAVR) product group amounted to $906.9 million, up 0.6% from the prior-year quarter’s figure on a reported basis. On an underlying basis, growth was 4.9%. Average selling prices were stable worldwide. Outside the United States, total TAVR sales increased in the mid-teens on a year-over-year basis.

For TAVR segment, we projected $913.1 million of revenues in the second quarter.

Transcatheter Mitral and Tricuspid Therapies (TMTT) sales totaled $27.9 million, up 26.2% from the prior-year quarter’s figure on a reported basis. On an underlying basis, the upside was 38.3%. The company continued to register strong momentum on increased adoption of the PASCAL platform in Europe.

For TMTT segment, we projected $33.9 million of revenues in the second quarter.

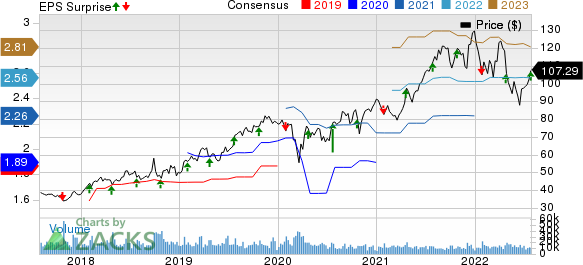

Edwards Lifesciences Corporation Price, Consensus and EPS Surprise

Edwards Lifesciences Corporation price-consensus-eps-surprise-chart | Edwards Lifesciences Corporation Quote

Surgical Structural Heart sales in the quarter totaled $228.5 million, down 3.8% from the year-ago quarter on a reported basis and up 1.6% on an underlying basis. Revenue growth was lifted by increased penetration of premium RESILIA products.

This figure compares to our Surgical Structural Heart segment’s Q2 projection of $246.6 million.

Critical Care sales totaled $210.6 million in the second quarter, down 2.1% from the year-ago quarter on a reported basis and up 2.7% on an underlying basis. The revenue uptick resulted from the increased uptake of the company's Hypotension Prediction Index algorithm and broad portfolio of sensors.

This figure compares to our Critical Care segment’s Q2 projection of $216.1 million.

Margins

In the second quarter, gross profit was $1.10 billion, up 6%. The gross margin expanded 469 basis points (bps) to 80.4%.

We projected a gross margin of 76.1% for Q2.

The company-provided adjusted gross margin was 80.5%, reflecting a year-over-year expansion of 460 bps. This increase was primarily driven by the favorable impact from the company's foreign exchange program, which comprises natural hedges and hedge contract gains to offset the sales impact of the weakening of the euro and yen against the dollar.

Selling, general and administrative expenses rose 9.2% year over year to $409 million, driven by the resumption of in-person commercial activities, partially offset by the weakening of the euro and yen against the dollar. Research and development expenditures were $250.8 million, up 11.3% year over year. This increase was driven by continued investments in the company's transcatheter innovations, including increased clinical trial activity. These developments drove operating costs by 10% to $659.8 million.

During the reported quarter, operating income rose 0.6% year over year to $444.7 million. The operating margin expanded 25 bps to 32.4%.

The adjusted operating margin, according to our model, was 33.3% for Q2.

Cash Position

Edwards Lifesciences exited the second quarter of 2022 with cash and cash equivalents and short-term investments of $1.52 billion compared with $1.50 billion recorded at the end of first-quarter 2022. Long-term debt was $596 million at the end of the second quarter of 2022, similar to the first-quarter long-term debt level.

Cumulative net cash provided by operating activities at the end of the second quarter of 2022 was $289 million compared with $457 million a year ago. Capital expenditure for the same period was $43 million compared with $69 million a year ago.

Guidance

The company has provided its third-quarter 2022 guidance.

For the quarter, the company projects total sales in the range of $1.30-$1.37 billion. The Zacks Consensus Estimate for the same is pegged at $1.45 billion.

Adjusted earnings per share are expected in the band of 58-66 cents. The Zacks Consensus Estimate for the metric is pegged at 65 cents.

The company has updated its guidance for full-year 2022.

Full-year 2022 sales are expected in the range of $5.35-$5.55 billion (down from the earlier projected range of $5.50-$6.00 billion). The Zacks Consensus Estimate for the same is pegged at $5.70 billion.

The company expects full-year 2022 adjusted earnings per share to grow at a double-digit rate at the lower end of its original guidance range of $2.50-$2.65. The Zacks Consensus Estimate for the metric is pegged at $2.56.

Our Take

Edwards Lifesciences exited the first quarter of 2022 with earnings matching the Zacks Consensus Estimate. The company registered strong year-over-year growth sales growth across TAVR and TMTT product groups, instilling optimism. The continued strong adoption of the company’s newly-launched MITRIS RESILIA mitral valve in the United States during the reported quarter looks encouraging. Expansion of both margins seems promising as well.

However, revenues for the second quarter missed the consensus mark. The uptick in operating costs is worrying. The choppy market conditions due to the continued foreign exchange impact and COVID-related hospital staffing issues are concerning. The company has lowered its sales outlook for full-year 2022, taking these macroeconomic challenges into account.

Zacks Rank and Other Key Picks

Edwards Lifesciences currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Quest Diagnostics Incorporated DGX, Medpace Holdings, Inc. MEDP and Alkermes plc ALKS.

Quest Diagnostics, carrying a Zacks Rank #2 (Buy), reported second-quarter 2022 adjusted EPS of $2.36, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $2.45 billion outpaced the consensus mark by 7.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quest Diagnostics has an earnings yield of 7.1% compared with the industry’s 3.2%. DGX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average being 12.1%.

Medpace Holdings, having a Zacks Rank #2, reported second-quarter 2022 adjusted EPS of $1.46, which beat the Zacks Consensus Estimate by 8.9%. Revenues of $351.2 million outpaced the consensus mark by 1.3%.

Medpace Holdings has an estimated growth rate of 22.7% for full-year 2022. MEDP’s earnings surpassed estimates in the trailing four quarters, the average being 17.3%.

Alkermes reported second-quarter 2022 adjusted earnings of 6 cents per share, beating the Zacks Consensus Estimate by 50%. Revenues of $276.2 million beat the Zacks Consensus Estimate by 1.2%. It currently has a Zacks Rank #2.

Alkermes has a long-term estimated growth rate of 25.1%. ALKS’s earnings surpassed estimates in all of the trailing four quarters, the average surprise being 325.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance