Edwards Lifesciences (EW) Gains From Innovation Amid Cost Woe

Edwards Lifesciences EW benefits from the huge untapped potential in the structural heart device market. Yet, persistent forex woes and rising costs do not bode well. The stock carries a Zacks Rank #3 (Hold)

Edwards Lifesciences registered year-over-year growth in both earnings and revenues during the third quarter. The company registered strong underlying growth across all product groups. Adjusted EPS grew despite aggressive investment in R&D and commercial infrastructure to support new therapies.

Critical Care sales were up 3% on an underlying basis in the third quarter of 2022. Sales growth was driven by increased adoption of the broad portfolio of smart recovery products, including FloTrac and ClearSight sensors with unique hypotension prediction index algorithms. Additionally, demand for the HemoSphere monitoring platform remains strong.

Edwards Lifesciences expects full-year 2022 underlying sales growth in the mid-single-digit range on the back of strength in demand for products used in more intense surgeries.

In the third quarter, the company’s Surgical Structural Heart sales improved 8.2% on an underlying basis. The company continues to witness strong momentum of the RESILIA portfolio globally as it bolsters the overall body of evidence, including four abstracts recently presented at the European Association for Cardiothoracic Surgery Annual Meeting in Milan. Edwards Lifesciences continues to believe that physicians value the features and benefits of this advanced tissue technology for both aortic and mitral surgical valve replacement procedures. The company also noted that the adoption of the MITRIS valve launched in the United States in April 2022 now represents the majority of the mitral valve sales in this region.

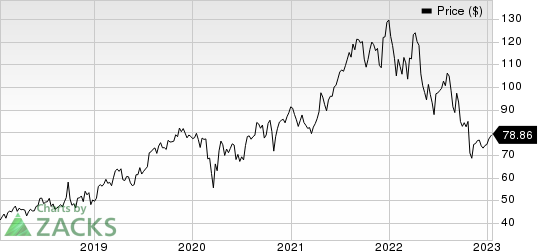

Edwards Lifesciences Corporation Price

Edwards Lifesciences Corporation price | Edwards Lifesciences Corporation Quote

Edwards Lifesciences expects underlying sales growth for 2022 in the mid-single-digit range, driven by market growth and the adoption of premium technologies.

On the flip side, Edwards Lifesciences’ revenues and earnings per share for the third quarter missed the Zacks Consensus Estimate. U.S. TAVR sales were impacted by slower-than-expected improvement in hospital staffing and temporary contrast agent shortages. Selling, general and administrative expenses rose 3.5% year over year, driven by the resumption of in-person commercial activities. These developments drove operating costs by 10%, building pressure on the company’s bottom line.

The choppy market conditions due to the continued foreign exchange impact and COVID-related hospital staffing issues are concerning. The company has lowered its sales outlook for full-year 2022, taking these macroeconomic challenges into account.

In the past year, Edwards Lifesciences has underperformed its industry. The stock has lost 39.8% compared with the 23.5% decline of the industry.

Key Picks

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Progyny Inc. PGNY and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has lost 4.2% compared with the industry’s 24.5% decline in the past year.

Progyny, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 21.1%. PGNY’s earnings surpassed estimates in all the trailing four quarters, the average beat being 233.75%.

PGNY has lost 23% compared with the industry’s 24.5% decline in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 21.7% against the industry’s 4.6% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Progyny, Inc. (PGNY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance