What Is an Economic Moat? Why Warren Buffett Says It Matters for Investors

When you think of a moat, you might be picturing a castle or fortress surrounded by a deep, broad ditch that’s filled with water. In these cases, moats defend against potential invaders or intruders.

Check Out: Warren Buffett Sold His Apple Stock — Here’s Why

Read Next: 5 Genius Things All Wealthy People Do With Their Money

However, an economic moat is a bit different, with a specific significance in the business world.

What Is An Economic Moat?

The Motley Fool defined an economic moat as “a sustainable competitive advantage that protects a company’s market position and profitability from rivals.” Ultimately, it’s explained that having a strong economic moat is crucial for a business if it intends to grow profit margins while at the same time retaining its market share.

Learn More: I’m a Financial Advisor — These 5 Index Funds Are All You Really Need

Buffet Explains That Economic Moats Are Important For Investors

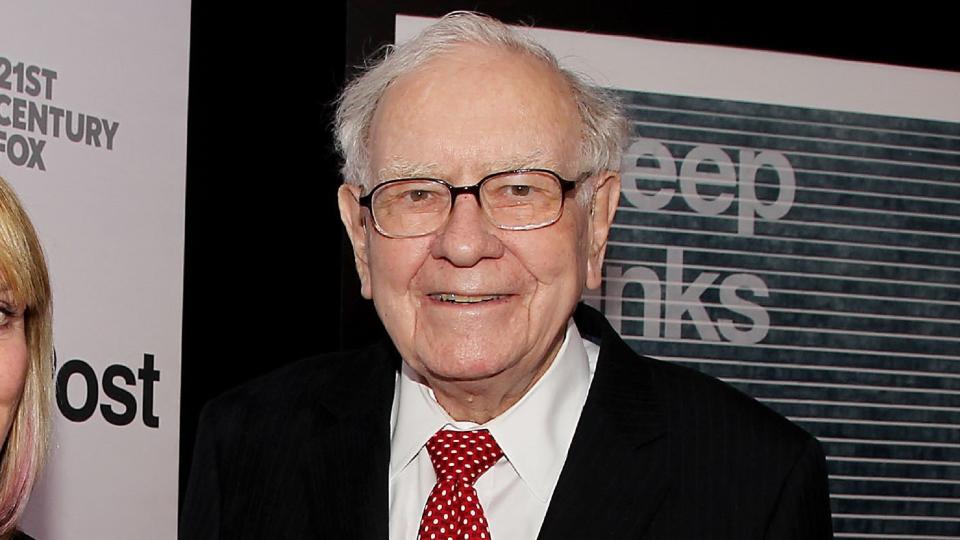

Warren Buffet, CEO of Berkshire Hathaway, has an estimated real-time net worth of about $136.8 billion as of March 27, 2024, according to Forbes. For most of us, this is an unspeakable amount of wealth.

He has been dubbed the “Oracle of Omaha” after his hometown, and for good reason. Buffett knows how to invest and grow money and explained that economic moats do matter, per The Motley Fool via Nasdaq.

“A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital,” Buffett said.

The advantage of a “moat” is that it protects a business from challengers. The key elements of a strong moat, as explained by Buffett:

“The dynamics of capitalism guarantee that competitors will repeatedly assault any business ‘castle’ that is earning high returns. Therefore a formidable barrier such as a company’s being the low-cost producer… or possessing a powerful worldwide brand… is essential for sustained success.”

Geico, Costco, and Coke — Case Studies in Brief

For example, Geico Insurance company — and the famous wholesaler Costco — both operate on a discount model that differentiates them from their competitors. Each of these companies exhibits a prime example of an economic “moat” because both Geico and Costco are difficult to compete with.

One other great example is the Coca-Cola Company. Despite there being other discount colas available for purchase, the brand name carries authority and customers are willing to pay higher prices for the brand name cola beverage. It’s no surprise that the company remains the largest beverage brand in the world by sales.

Overall, maintaining an economic moat is imperative for long-term business growth and success.

More From GOBankingRates

This is One of the Best Ways to Boost Your Retirement Savings in 2024

6 Things You Should Never Do With Your Tax Refund (Do This Instead)

This article originally appeared on GOBankingRates.com: What Is an Economic Moat? Why Warren Buffett Says It Matters for Investors