Ecolab (ECL) Earnings and Revenues Miss Estimates in Q4

Ecolab Inc. ECL reported fourth-quarter 2019 adjusted earnings per share of $1.66, missing the Zacks Consensus Estimate of $1.68. Nonetheless, adjusted EPS rose 7.8% on a year-over-year basis.

This Zacks Rank #3 (Hold) company’s quarterly net sales amounted to $3.82 billion, up 1.7% from the year-ago figure. However, net sales lagged the Zacks Consensus Estimate of $3.87 billion.

2019 at a Glance

Ecolab’s 2019 revenues were $14.91 billion, missing the Zacks Consensus Estimate of $14.98 billion but increasing 1.6% from the prior-year quarter.

Adjusted EPS was $5.93, beating the Zacks Consensus Estimate of $5.86 and rising 13% from the year-ago quarter.

Segmental Analysis

Global Industrial

Sales at the segment grew 5.5% year over year to $1.47 billion, driven by solid growth in Water, Food & Beverage, and Life Sciences units. Geographically, all regions recorded impressive sales growth in the quarter.

Global Institutional

Sales improved 3.3% year over year to $1.34 billion, led by robust growth in the Specialty business. Sales at the segment significantly grew across all geographies.

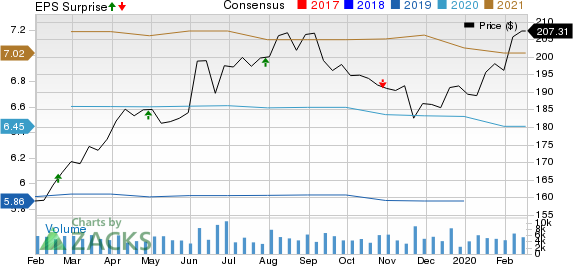

Ecolab Inc. Price, Consensus and EPS Surprise

Ecolab Inc. price-consensus-eps-surprise-chart | Ecolab Inc. Quote

Global Energy

Sales at the segment dropped 3% year over year to $845.4 million. Per management, upstream sales dropped slightly owing to a decline in the well-stimulation business.

Other

Sales rose 3.8% year over year to $227.4 million, reflecting strong gains in both Pest Elimination and Colloidal Technologies across all geographies.

Margin Analysis

Ecolab registered adjusted gross profit of $1.62 billion, up 4.6% year over year. As a percentage of revenues, adjusted gross margin in the fourth quarter was 42.4%, up 120 basis points (bps).

Adjusted operating income in the quarter was $645.6 million, up 6.9% year over year. Adjusted operating margin in the quarter was 16.9%, which expanded 80 bps year over year.

Guidance

For 2020, Ecolab expects adjusted EPS within $6.33-$6.53, calling for 9-12% growth from 2019. The Zacks Consensus Estimate for the same stands at $6.45 per share.

Adjusted gross margin is expected to be 42-43% of net sales.

For first-quarter 2020, Ecolab expects adjusted EPS within $1.05-$1.13, mirroring year-over-year growth of 6-13%. The corresponding Zacks Consensus Estimate is pegged at $1.17 per share.

The coronavirus outbreak is expected to have a 5-cent unfavorable impact on adjusted EPS.

Adjusted gross margin is expected to be 41-42% of quarterly sales.

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks — which reported solid results this earnings season — include Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker reported fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Fourth-quarter reported revenues of $4.13 billion surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2 (Buy).

Accuray reported second-quarter fiscal 2020 adjusted EPS of a penny against the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the Zacks Consensus Estimate by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance