Eaton (ETN) Surpasses Q4 Earnings and Revenue Estimates

Eaton Corporation ETN has reported fourth-quarter 2022 earnings of $2.06 per share, which surpassed the Zacks Consensus Estimate by 0.9%. Earnings were up 20% year over year.

GAAP earnings for the reported quarter were $1.8 per share compared with $1.37 in the year-ago quarter. The difference between GAAP and operating earnings for the reported quarter was due to charges of 24 cents for intangible amortization, 2 cents for a multi-year restructuring program, and 4 cents for acquisitions and divestitures.

GAAP earnings for 2022 were $6.14 per share, up 15% from $5.34 reported in 2021.

Revenues

Total quarterly revenues were $5,384 million, which surpassed the Zacks Consensus Estimate of $5,310 million by 1.4%. Total revenues improved 12.2% from the year-ago quarter. Total revenues for 2022 were $20.8 billion, up 5.8% from 2021.

Fourth-quarter revenues gained from a 15% increase in organic sales and a 1% increase in acquisitions. This was partially offset by 4% from negative currency translation.

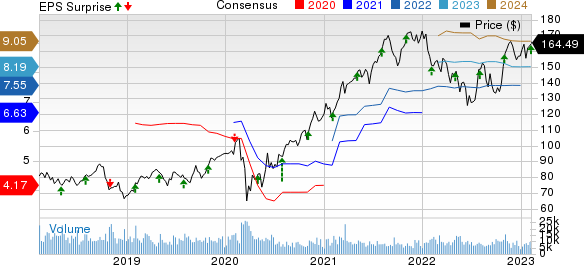

Eaton Corporation, PLC Price, Consensus and EPS Surprise

Eaton Corporation, PLC price-consensus-eps-surprise-chart | Eaton Corporation, PLC Quote

Segmental Details

Electrical Americas’ total fourth-quarter sales were $2,296 million, up 19.8% from the year-ago quarter. The improvement was due to increased organic sales.

Operating profits were $545 million, up 48.1% year over year.

Electrical Global’s total sales were $1,430 million, up 0.4% from the year-ago quarter. Organic sales were up 8% from the year-ago quarter, offset by a negative currency translation of 7%. Operating profits were $268 million, down 3.2% from the year-ago quarter.

Aerospace’s total sales were $812 million, up 7% from the year-ago quarter. Organic sales were up 11% from the year-ago quarter, offset by a negative currency translation of 4%.

Operating profits were $199 million, up 5.3% year over year.

Vehicle’s total sales were $707 million, up 16% from the year-ago quarter due to an increase in organic sales, partially offset by negative currency translation.

Operating profits were $107 million, up 7% year over year.

The eMobility segment’s total sales were $139 million, up 58% year over year due to an improvement in organic sales and the acquisition of Royal Power Solutions, offset marginally by a negative currency translation. The operating loss was $2 million in fourth-quarter 2022, narrower than the $8-million loss registered in the year-ago quarter.

Highlights of the Release

Selling and administrative expenses were $796 million, up 6% from the year-ago quarter.

ETN’s fourth-quarter research and development expenses were $167 million, up 3.1% from the prior-year period. Interest expenses for the quarter were $44 million, up 37.5% from the year-ago quarter.

Eaton’s backlog growth with orders increased 25% in Electrical and 24% in Aerospace on a rolling 12-month basis.

Financial Update

As of Dec 31, 2022, the company’s cash was $294 million, down from $297 million as of Dec 31, 2021.

As of Dec 31, 2022, the company’s long-term debt was $8,321 million, up 21.8% from $6,831 million as of Dec 31, 2021.

Guidance

Eaton’s first-quarter 2023 earnings are expected to be $1.72-$1.82 per share. ETN expects an organic growth of 8-10%.

Eaton expects earnings per share (EPS) of $8.04-$8.44 for 2023. ETN expects organic revenue growth of 7-9% for 2023. The segmental operating margin for 2022 is expected to be 20.7-21.1%.

Capital expenditure for 2023 is expected to be $630 million. Eaton expects to generate free cash flow of $2.6-$3 billion in 2023 and buy back shares of $300-$600 million in 2023.

Zacks Rank

Currently, Eaton has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Upcoming Releases

Deere & Company DE is scheduled to report first-quarter results on Feb 17, before market open. The Zacks Consensus Estimate for earnings is pegged at $5.51 per share, indicating a year-over-year increase of 88.7%.

Long-term (three to five years) earnings growth of Deere & Company is currently pegged at 11.92%. The Zacks Consensus Estimate for 2023 earnings per share is $28.01, implying a year-over-year increase of 20.32%.

Lincoln Electric LECO is scheduled to report fourth-quarter results on Feb 21, before market open. The Zacks Consensus Estimate for earnings is pegged at $1.9 per share, indicating a year-over-year increase of 18.01%.

The long-term earnings growth of Deere & Company is currently pegged at 15%. The Zacks Consensus Estimate for 2023 EPS is $8.61, implying a year-over-year increase of 4.64%.

Donaldson DCI is scheduled to report first-quarter results on Mar 1, before market open. The Zacks Consensus Estimate for earnings is pegged at 69 cents per share, indicating a year-over-year increase of 21.05%.

Long-term earnings growth of Deere & Company is currently pegged at 10.5%. The Zacks Consensus Estimate for 2023 EPS is pegged at $3, implying a year-over-year increase of 11.94%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Lincoln Electric Holdings, Inc. (LECO) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance