DuPont's (DD) Earnings and Revenues Top Estimates in Q1

DuPont de Nemours, Inc. DD recorded earnings (on a reported basis) from continuing operations of 42 cents per share for first-quarter 2022, down from 64 cents per share in the year-ago quarter.

Barring one-time items, earnings came in at 82 cents per share for the reported quarter, topping the Zacks Consensus Estimate of 67 cents.

DuPont raked in net sales of $3,274 million, up 9% from the year-ago quarter. It also beat the Zacks Consensus Estimate of $3,249.9 million. The company saw a 9% rise in organic sales in the quarter, supported by 3% higher volumes and 6% pricing gains. It witnessed sales gain in all regions globally.

Volume growth was driven by sustained strong demand in electronics, industrial technologies, water and construction end-markets, partly masked by continued supply-chain challenges. The price increase mainly reflects actions taken by the company to offset raw material, logistics and energy cost inflation. Supply-chain constraints and cost inflation were exacerbated during the quarter by the Russia-Ukraine conflict.

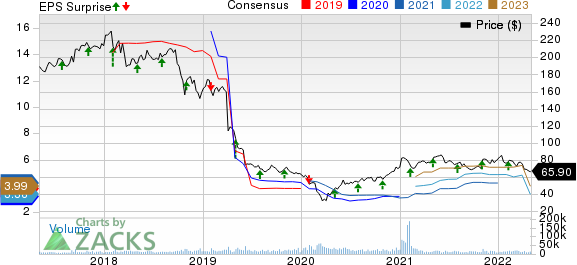

DuPont de Nemours, Inc. Price, Consensus and EPS Surprise

DuPont de Nemours, Inc. price-consensus-eps-surprise-chart | DuPont de Nemours, Inc. Quote

Segment Highlights

The company’s Electronics & Industrial segment recorded net sales of $1,536 million in the reported quarter, up 18% on a year-over-year comparison basis. Organic sales rose 9% on higher volumes and prices. Semiconductor Technologies organic sales rose on strong demand. Industrial Solutions also registered higher sales while organic sales declined in Interconnect Solutions on lower volumes.

Net sales in the Water & Protection unit were $1,429 million, up 8% year over year. Organic sales rose 10% on pricing actions across the segment. Volumes were flat as the growth in Shelter Solutions and Water Solutions were offset by declines in Safety Solutions.

Financials

DuPont had cash and cash equivalents of $1,672 million at the end of the quarter, down around 62% year over year. Long-term debt was $10,634 million, roughly flat year over year.

The company also generated operating cash flow of $209 million during the quarter. It returned $544 million to shareholders through share repurchases and dividends during the quarter.

Outlook

The company sees net sales from continuing operations for 2022 to be between $13.3 billion and $13.7 billion. It also expects adjusted earnings per share (EPS) for 2022 in the band of $3.20-$3.50.

DuPont expects net sales of between $3.2 billion and $3.3 billion for the second quarter of 2022. Adjusted EPS is forecast in the range of 70-80 cents for the quarter.

The company expects end-market demand to remain strong. However, uncertainties surrounding global supply-chain challenges, including the impact of the ongoing war in Ukraine and new pandemic-related shutdowns in China continues, DuPont noted. It sees external uncertainties in the macro environment to further tighten supply chains, leading to a slower volume growth and sequential margin contraction in the second quarter.

DuPont, in Feb 2022, entered into definitive deal to divest a majority of its Mobility & Materials segment, excluding certain Advanced Solutions and Performance Resins businesses, to Celanese Corporation. The deal, which is subject to regulatory approvals and customary closing conditions, is expected to complete around the end of 2022.

Price Performance

DuPont’s shares are down 17.1% over a year compared with an 8.3% decline recorded by the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

DuPont carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth considering in the basic materials space include Nutrien Ltd. NTR, AdvanSix Inc. ASIX and Commercial Metals Company CMC.

Nutrien, sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 127.9% for the current year. The Zacks Consensus Estimate for NTR's current-year earnings has been revised 31.1% upward over the last 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 5.9%, on average. NTR has rallied around 70% in a year.

Commercial Metals, carrying a Zacks Rank #1, has a projected earnings growth rate of 78.2% for the current fiscal year. The Zacks Consensus Estimate for CMC's current fiscal year earnings has been revised 31.9% upward over the past 60 days.

Commercial Metals beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 16%, on average. CMC has gained around 29% in a year.

AdvanSix, carrying a Zacks Rank #1, has an expected earnings growth rate of 54.7% for the current year. ASIX's consensus estimate for current-year earnings has been revised 31.9% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 23.6%, on average. ASIX has rallied around 41% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance