Drug/Biotech Stocks Q4 Earnings Due on Feb 16: ALKS, RARE & Others

The fourth-quarter 2022 reporting cycle of the Medical sector is currently in full swing. The sector mainly comprises pharma/biotech and medical device companies.

With many pharma and biotech bigwigs having already reported results, the earnings picture has been mixed. Though nearly all of these companies have beat bottom-line estimates, a majority have missed out on the top line. Last week, AbbVie and AstraZeneca reported mixed fourth-quarter results, as earnings beat the mark but missed out on sales. While AstraZeneca’s top line were hurt due to declining COVID-19 vaccine sales, AbbVie’s sales fell due to lower Imbruvica and Juvederm product sales.

The Earnings Trends report indicates that as of Feb 1, 28.6% of the companies in the Medical sector — representing 51.2% of the sector’s market capitalization — reported quarterly earnings. While 81.3% of participants beat on earnings, only 62.5% outperformed on revenues. Earnings and revenues increased 3.6% and 7.6% year over year, respectively. Overall, fourth-quarter earnings of the Medical sector are expected to decline by 9.0% while sales are expected to rise by 4.3%, each from the year-ago quarter’s respective reported figures.

Alkermes ALKS, Blueprint Medicines BPMC, Ironwood Pharmaceuticals IRWD and Ultragenyx Pharmaceutical RARE are scheduled to release Q4 earnings on Feb 16.

Let’s analyze the performance of the biotech/drug companies mentioned above.

Alkermes

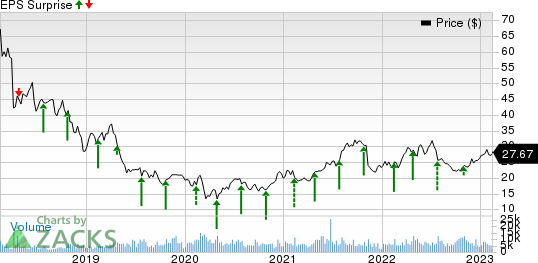

Alkermes, with a decent earnings track record so far, is scheduled to report quarterly results before the opening bell.

Alkermes beat earnings estimates in three of the last four quarters and met the mark on one occasion, delivering an average earnings surprise of 306.73%. In the last reported quarter, ALKS’ earnings met estimates.

Our proven model indicates that the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

For the quarter to be reported, Alkermes has an Earnings ESP of +49.57% and a Zacks Rank #2, suggesting a likely earnings surprise. The Zacks Consensus Estimate and our model estimate for earnings are pegged at 6 cents and 1 cent per share, respectively. You can see the complete list of today’s Zacks #1 Rank stocks here.

Alkermes’ revenues are being driven by its proprietary products – Vivitrol and Aristada – and some partnered products. We expect these products to continue contributing to the company’s top-line growth in the to-be-reported quarter.

Alkermes plc Price and EPS Surprise

Alkermes plc price-eps-surprise | Alkermes plc Quote

Blueprint Medicines

Blueprint Medicines, which has a mixed earnings track record so far, is scheduled to report quarterly results before the opening bell.

Blueprint Medicines missed earnings estimates in two of the last four quarters, beat the mark on one occasion while met the mark on another occasion. On average, Blueprint Medicines reported a negative earnings surprise of 12.12%. In the last reported quarter, BPMC beat earnings estimates by 11.16%.

For the quarter to be reported, Blueprint Medicines has an Earnings ESP of -3.17% and a Zacks Rank #3. The Zacks Consensus Estimate and our model estimate for earnings are pegged at a loss of $2.72 and $2.77 per share, respectively.

Sales of Blueprint Medicines’ cancer drug Ayvakit are likely to have been a major contributor to the company’s top line in the to-be-reported quarter.

Blueprint Medicines Corporation Price and EPS Surprise

Blueprint Medicines Corporation price-eps-surprise | Blueprint Medicines Corporation Quote

Ironwood Pharmaceuticals

Ironwood, with a negative earnings track record to date, is scheduled to report quarterly results before market open.

Ironwood missed earnings estimates in each of the last three quarters while beating the mark on one occasion, delivering an average negative earnings surprise of 15.92%. In the last reported quarter, IRWD beat earnings estimates by 3.70%.

For the quarter to be reported, Ironwood has an Earnings ESP of -4.93% and a Zacks Rank #3. The Zacks Consensus Estimate and our model estimate for earnings are pegged at 28 cents and 29 cents per share, respectively.

Ironwood’s sole marketed drug Linzess is likely to have witnessed robust growth during the fourth-quarter driven by the acceleration in the new prescription volume.

Ironwood Pharmaceuticals, Inc. Price and EPS Surprise

Ironwood Pharmaceuticals, Inc. price-eps-surprise | Ironwood Pharmaceuticals, Inc. Quote

Ultragenyx Pharmaceutical

Ultragenyx, which has a negative earnings track record so far, is scheduled to report quarterly results after the closing bell.

Ultragenyx’s earnings have missed estimates in each of the trailing four quarters, delivering an average negative surprise of 24.39%. In the last reported quarter, Ultragenyx’s earnings missed estimates by 6.11%.

For the quarter to be reported, Ultragenyx has an Earnings ESP of -2.16% and a Zacks Rank #3. The Zacks Consensus Estimate for the bottom line is pegged at a loss of $2.03 per share.

During the fourth quarter, higher demand and volume growth for its key drug Crysvita is likely to have provided continued top-line support.

Ultragenyx Pharmaceutical Inc. Price and EPS Surprise

Ultragenyx Pharmaceutical Inc. price-eps-surprise | Ultragenyx Pharmaceutical Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Ultragenyx Pharmaceutical Inc. (RARE) : Free Stock Analysis Report

Blueprint Medicines Corporation (BPMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance