Drug/Biotech Stocks Q4 Earnings Due on Feb 2: GILD, MRK & Others

The fourth-quarter 2022 reporting cycle of the Medical sector picked up pace this week. The sector mainly comprises pharma/biotech and medical device companies.

The earnings season for the Medical sector kicked off last week when bellwether Johnson & Johnson reported mixed first-quarter results, with its bottom line beating estimates but the top line missing the mark. Its Pharmaceuticals unit, which is also its biggest division, was the poorest performer in the quarter. Earlier this week, Pfizer also reported fourth-quarter results. Though Pfizer beat estimates on both counts, it expects a steep decline in sales of its COVID-19 in 2023.

The Earnings Trends report indicates that as of Jan 25, 8.9% of the companies in the Medical sector — representing 28.4% of the sector’s market capitalization — reported quarterly earnings. While 80% of participants beat on earnings, only 20% outperformed on revenues. Earnings and revenues increased 5% and 7% year over year, respectively. Overall, fourth-quarter earnings of the Medical sector are expected to decline by 10.9% while sales are expected to rise by 2.9%, each from the year-ago quarter’s respective reported figures.

Gilead Sciences GILD, Bristol Myers BMY, Merck MRK and Eli Lilly LLY are scheduled to release Q4 earnings on Feb 2.

Let’s analyze the performance of the biotech/pharma companies mentioned above.

Gilead Sciences

Gilead, with a decent earnings track record so far, is scheduled to report quarterly results after the closing bell.

Gilead beat earnings estimates in three of the last four quarters while missing the mark on one occasion, delivering an average earnings surprise of 0.36%. In the last reported quarter, GILD beat earnings estimates by 31.94%.

Our proven model indicates that the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

For the quarter to be reported, Gilead has an Earnings ESP of +1.71% and a Zacks Rank #3, implying a likely earnings surprise. The Zacks Consensus Estimate and our model estimate for earnings are pegged at $1.50 and $1.40 per share, respectively. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our previous article showed that Gilead did not have the favorable combination to beat earnings in the soon-to-be-reported quarter. However, estimates changed thereafter and we are more certain of a beat now.

Sales of HIV drugs, Biktarvy and Descovy, are likely to have provided support to Gilead’s top line, backed by strong demand trends in the to-be-reported quarter

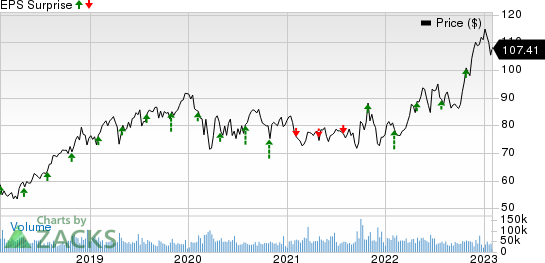

Gilead Sciences, Inc. Price and EPS Surprise

Gilead Sciences, Inc. price-eps-surprise | Gilead Sciences, Inc. Quote

Bristol Myers

Bristol Myers, which boasts a decent earnings track record so far, is scheduled to report quarterly results before the opening bell.

Bristol Myers beat earnings estimates in three of the last four quarters while meeting the mark on one occasion, delivering an average earnings surprise of 4.66%. In the last reported quarter, BMY beat earnings estimates by 8.74%.

For the quarter to be reported, Bristol Myers has an Earnings ESP of -1.22% and a Zacks Rank #3. The Zacks Consensus Estimate and our model estimate for earnings are pegged at $1.71 and $1.66 per share, respectively.

Bristol-Myers’ immuno-oncology drug Opdivo and blood thinner drug Eliquis are likely to have been key top-line drivers backed by strong demand trends in the to-be-reported quarter.

Bristol Myers Squibb Company Price and EPS Surprise

Bristol Myers Squibb Company price-eps-surprise | Bristol Myers Squibb Company Quote

Merck

Merck, which has an encouraging earnings track record to date, is scheduled to report quarterly results before market opens.

Merck beat earnings estimates in each of the last four quarters, delivering an average earnings surprise of 16.07%. In the last reported quarter, MRK beat earnings estimates by 10.78%.

For the quarter to be reported, Merck has an Earnings ESP of -0.80% and a Zacks Rank #3 (Hold). The Zacks Consensus Estimate and our model estimate for earnings are pegged at $1.56 and $1.50 per share, respectively.

Strong global underlying demand across Merck’s business, particularly for cancer drug Keytruda and HPV vaccine, Gardasil, is likely to have boosted sales growth in the fourth quarter.

Merck & Co., Inc. Price and EPS Surprise

Merck & Co., Inc. price-eps-surprise | Merck & Co., Inc. Quote

Eli Lilly

Lilly, which has a mixed earnings track record so far, is scheduled to report quarterly results, before the opening bell.

Eli Lilly, which has a mixed earnings track record so far. LLY’s earnings beat estimates in two of the trailing four quarters while missing the mark on other two occasions, delivering an average negative surprise of 4.48%. In the last reported quarter, Lilly’s earnings beat estimates by 0.51%.

For the quarter to be reported, Lilly has an Earnings ESP of -1.56% and a Zacks Rank #4 (Sell). The Zacks Consensus Estimate and our model estimate for earnings are pegged at $1.83 and $1.90 per share, respectively.

In the fourth quarter, higher demand and volume growth for its key drugs, including Trulicity, Taltz, Verzenio, Jardiance, Olumiant and Emgality, are likely to have provided top-line support. Newer products like Retevmo and Mounjaro (tirzepatide) are also likely to have contributed to sales growth.

Eli Lilly and Company Price and EPS Surprise

Eli Lilly and Company price-eps-surprise | Eli Lilly and Company Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance