Dr Tee: Top 10 Global Blue Chip Stocks – Dream Team Portfolio

There are over 40,000 stocks in the world, a smart investor has to carefully choose Top 10 global blue chip stocks aligned with own unique personality as investment portfolio to grow the wealth.

A smart investor should form a dream team portfolio with global Top 10 stocks for both passive incomes and capital gains. Let’s learn step-by-step with a portfolio of 10 global blue chip stocks with strong fundamentals in 8 growing sectors (Bank, Property, REIT, F&B, Casino, Consumer, Oil & Gas, ETF), applying Ein55 Optimism as investment clock, waiting patiently to buy low in global financial crisis and sell high in bullish stock market for tremendous potential return. These Top 10 stocks are diversified over 4 countries: 4 from Singapore, 3 from the USA, 2 from Hong Kong, 1 from Malaysia. Strength and opportunities for each stock and suggested strategies will be explained.

Stock investment is not just what to buy, the mastery of investment clock is crucial, knowing when to buy and sell to maximize the profit. In general, Buy when Optimism <25%, Hold or Wait when Optimism 25-75%, Sell when Optimism >75% (see sample Ein55 Optimism in Figure below).

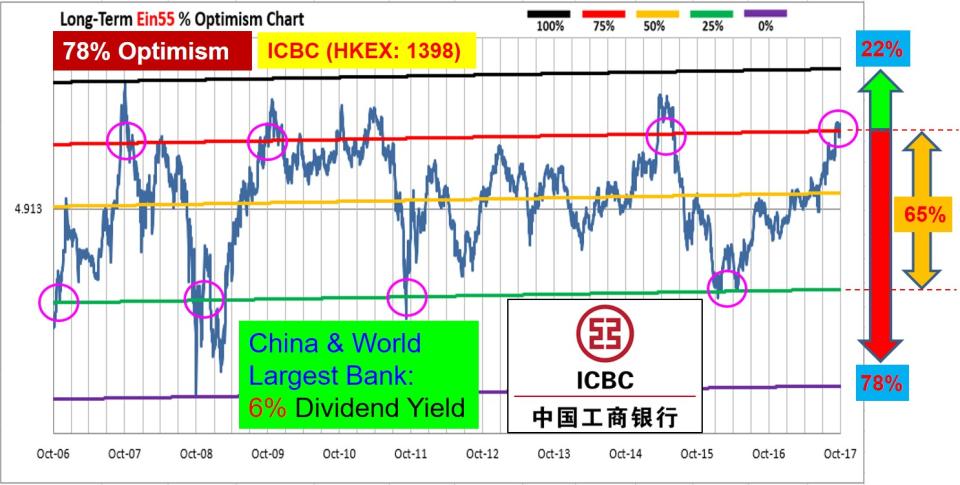

(#1) ICBC (Hong Kong, HKEx: 1398), Industrial and Commercial Bank of China

Defender / Midfielder Strategies: For long term investing, collect stable dividend payment as passive income with China and Temasek protection. Maximize dividend yield when buying stock at low optimism. For medium term trading, apply Ein55 Optimism to buy low sell high every few years for quicker capital gains.

ICBC is the largest bank in China and also the whole world (based on current share price and valuation). The business with stable growing fundamental is supported by the strong economy in China with a large population. Temasek is a major shareholder, providing stability to the share prices, an additional shield of defence for investors. With increasing US and global central bank interest rates, the outlook for banking and finance stocks are positive as the net interest margin (NIM) will help the global banks to grow in earnings until the next global financial crisis.

Current Ein55 Optimism of ICBC is high at 78% (see Figure above), in addition, to hold for stable 6% dividend yield, an investor also has an option to sell the stock first, buying back when the share price drops to below 25% Optimism in future, aiming to maximize the dividend yield. Since the global stock market is at high optimism, an investor has to take note of the signals of global financial crisis which would affect the global banking and finance stocks significantly. A crisis presents an opportunity if an investor knows when to buy a strong fundamental stock at price with low Ein55 Optimism.

ICBC is a bank stock, cyclic in nature due to volatile China / Hong Kong stock market and economic cycles. Therefore, besides being a “Defender” stock (dividends only), it may also be considered as a “Striker” (capital gains only) or “Midfielder” (capital gains and dividends) for trading in medium term, following trends to long or short, gaining from average 65% profit from medium-term volatility of share prices with cyclic investing every 2-3 years.

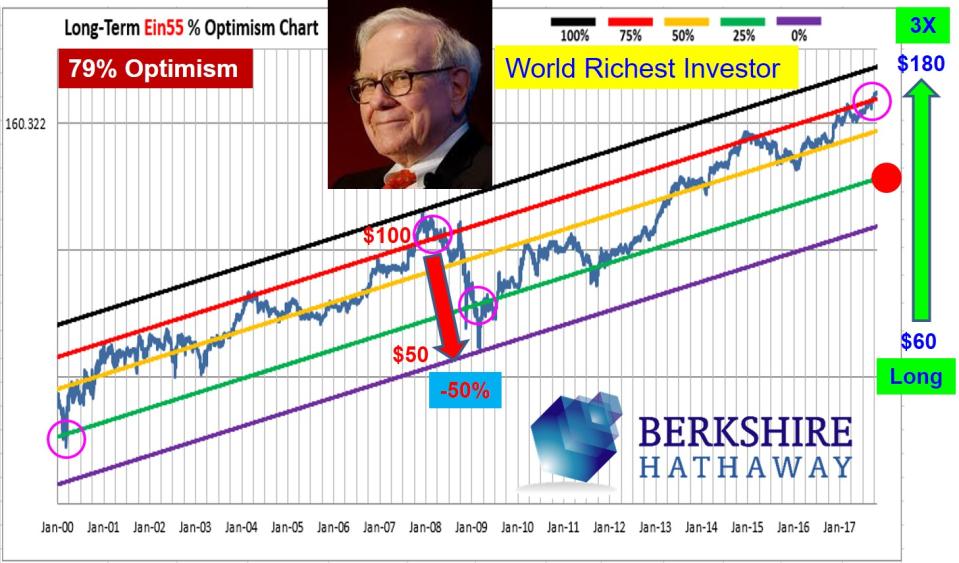

(#2) Berkshire Hathaway Class-B (US, NYSE: BRK.B)

Midfielder Strategy: High-growth fund for capital gains with Warren Buffett wisdom when buying at low optimism

Warren Buffett is the richest investor in the world. Berkshire Hathaway represents an average performance of Buffett’s investment portfolio. Berkshire Class-A stock is very expensive, approaching $300,000 for 1 share, mainly suitable for high net worth individuals or big funds with long-term investment strategies as the stock did not pay dividend, there was no change in number of shares, all the retained earnings for decades are accumulated and reflected in its growing share prices. Berkshire Class-B stock is a more affordable option for retail investors, pro-rated at 1/1500 price of the Class-A stock, below $200 / share currently.

Berkshire Class-B allows an easy way for retail investors to diversify with a portfolio of strong fundamental stocks owned by Warren Buffett. Despite Berkshire is a growth giant stock, it is still susceptible to systematic risks of the economic cycle. During the global financial crisis in 2008-2009, Berkshire share price was halved due to excessive market fear. An investor who follows Ein55 Optimism to buy below 25% Optimism, the current share price has gone up by 3 times, currently at a high optimism of 79% (see Figure above).

As an investor, one has 3 possible options for investing in Berkshire stock. Firstly, assuming a buy & hold long-term strategy, one may continue to hold the stock despite at high optimism but using the strong fundamental to overcome the next global financial crisis. This option is only suitable for those who have strong investor mindset, bought the share at low optimism price last time. Secondly, an investor may adopt a cyclical investing approach, selling Berkshire stock first, buying back at <25% Optimism in future. This option is suitable for those investors who know how to integrate trading and economy cycle investing into the overall strategy. Finally, a smart investor has the choice of buying better stocks than Warren Buffett, i.e. focusing on a few best component stocks of Berkshire to achieve higher growth than Berkshire but still enjoying the protection by Warren Buffett as a major shareholder of these few stocks.

The remaining 8 of the Top 10 blue chip stocks in dream team portfolio with a key summary of strategies and Ein55 Optimism Investment Clock can be found here (30 pages eBook). Click to Download FREE eBook #1 by Dr Tee: “Global Top 10 Stocks – Dream Team Portfolio” (latest version of eBook with a complete guide of What to Buy, When to Buy, When to Sell).

In the same eBook Download link, readers will get another FREE eBook #2 by Dr Tee: “Global Market Outlook 2018” covers comprehensive investment topics: Stock, Property, Commodity, Forex, Bond and Political Economy. Past readers have benefited from the analysis. Learn to position for each market crisis and opportunity with Ein55 Optimism Strategies.

Table of Contents (eBook: Global Stock Market Outlook 2018)

Mass Market Sentiment Survey

Review of Global Stock Markets

US Market Outlook (Economy, Stock, Property, Commodity, Bond, USD)

Regional Market Outlook (Europe, China, Hong Kong)

Singapore Market Outlook (Stock & Property)

Conclusions and Recommendations

The key to stock trading and investing is to match our goals with our personalities, there are at least 10 different strategies to choose. When Ein55 Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful when one is able to take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with own personality.

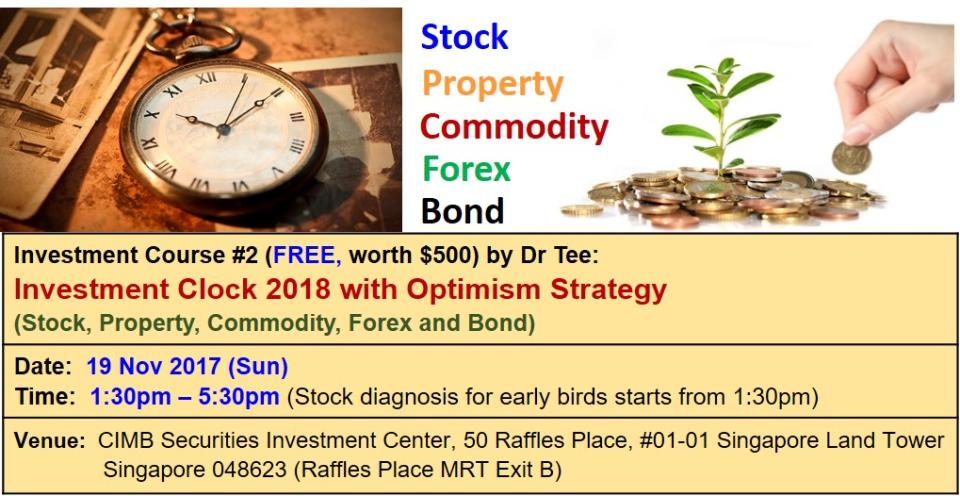

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc) to buy safely, when to buy, when to sell, including the option of long-term holding. So far over 10,000 people have benefited from Dr Tee high-quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Bonus #1 for Readers: FREE Investment Courses by Dr Tee

Bonus #2 for Readers: Dr Tee Investment Forum with over 4000 members (Private Group)

(Please click “JOIN” with link above and wait for Admin approval of membership)

Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

Optimism/ Fundamental / Technical / Personal Analyses

Investment risks & opportunities

Dr Tee graduates events and activities updates

Yahoo Finance

Yahoo Finance