Why the Dow's best week in 82 years is no reason to get bullish

After stocks were pretty much in free-fall the first there weeks of March, the Dow staged its best week in more than 80 years as Congress passed its historic coronavirus relief package in hopes to bolster an economy crushed by COVID-19.

This past week, the Dow Jones Industrial Average (^DJI) ended up 12.8%, its best weekly gain since 1938, while the S&P 500 (^GSPC) climbed 10.3% for its best week since 2009.

However, Wall Street experts are cautioning that this might not be a sustained rally and warning investors to prepare for what could be a bumpy road ahead.

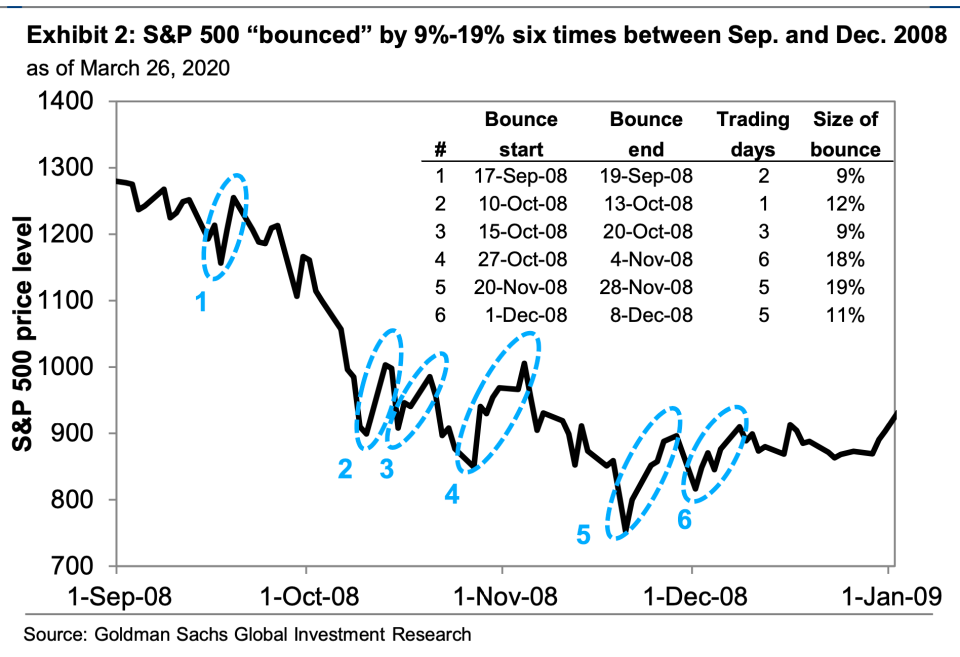

In a March 27 note to clients, Goldman Sachs’ U.S. chief equity strategist David Kostin wrote that “bear markets are often punctuated by sharp bounces before resuming their downward trajectory.”

Looking back, Kostin pointed to six distinct bounces of 9% or more between September 2008 and December 2008.

“Most bounces involved optimism around monetary or fiscal policy support. However, the market low did not occur until March 2009, when the pace of economic contraction began to slow,” Kostin added.

RBC Capital Markets head of U.S. equity strategy Lori Calvasina also highlighted this to her clients on March 26, describing “big down days, as well as big up days” as a “hallmark” of that period “just as they’ve been today.”

“This analysis continues to keep us concerned that the U.S. equity market hasn’t found a bottom yet. It also reminds us that after the most severe equity market drawdowns, durable bottoms have taken time to form – something we think will be the case this time around as well. We are growing increasingly skeptical about the V-shaped recovery thesis in stocks. In particular, we are concerned that there has been too little discussion about the longer-term collateral damage from the public health crisis,” Calvasina wrote.

It’s also along the lines of what Jefferies chief market strategist David Zervos pointed this out in a client note sent on March 22 about what happened in the months following the passage of TARP.

“[Even] after a fiscal bailout was agreed in early October 2008, it wasn’t until about 6 months later that the risk asset markets finally bottomed. And to be sure those 6 months felt like an eternity!! I would thus not yet get too excited, too quickly, about a sharp sentiment reverse, even in more positive news begins to flow on a fiscal package. Maybe this time will be different, but right now I have my doubts,” Zervos wrote.

In an op-ed on Sunday, Mohamed El-Erian wrote that the optimists see a bottom starting to form, while the pessimists see a “dead cat bounce” similar to what happened between September 2008 and March 2009.

“It’s hard to make the definitive case for either of these. There is simply too much uncertainty about the severity and duration of the underlying disruptor — the spread of the coronavirus — the extent of damage already done to economies and markets, and the smoothness of the eventual process to restart the economy,” El-Erian wrote in Bloomberg.

El-Erian’s outlook at the moment is “for high stock market volatility around a still-downward trend.”

“As such, it is more of an ‘up in quality’ repositioning opportunity within a strict overall risk-mitigation approach than an all-clear signal for investors,” he wrote.

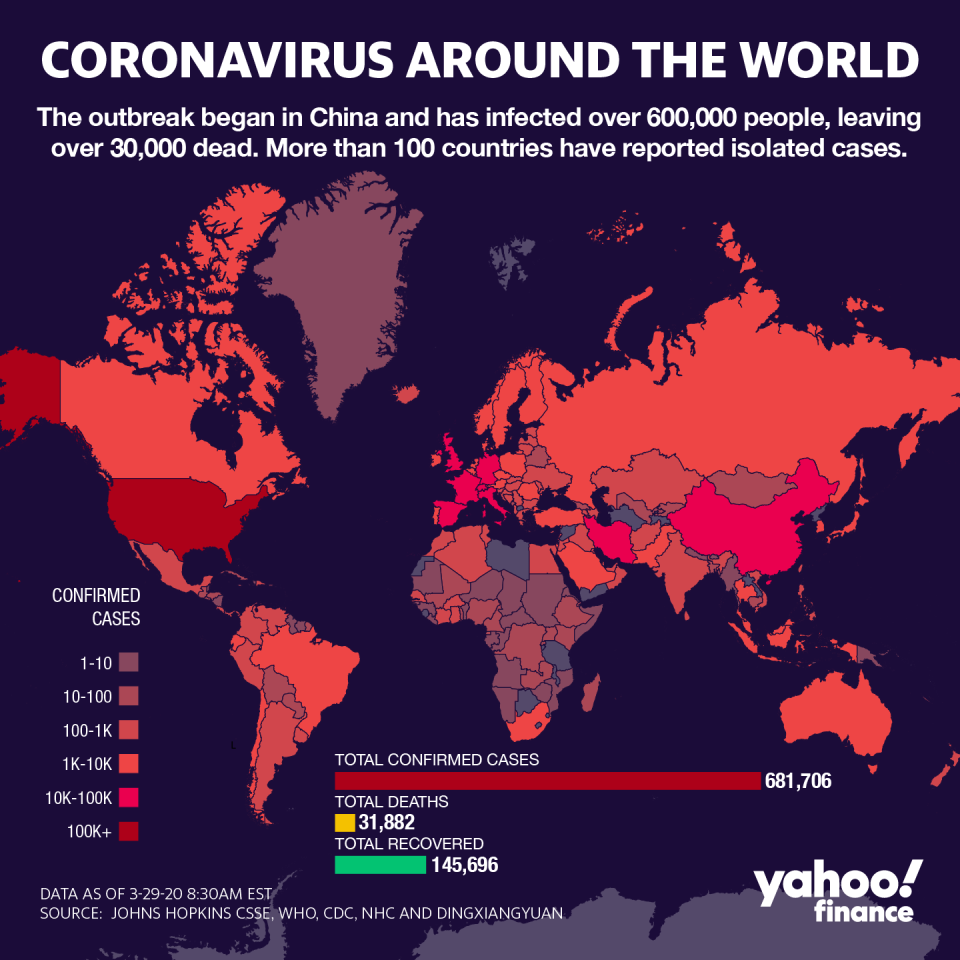

In searching for a stock market bottom, famed economist Nouriel Roubini, who nailed the narrative of the 2008 crisis, asserted on Twitter that the market “can’t truly find a bottom” until the virus peaks and the rate of new cases is “sharply down.”

The NYU Stern professor of economics cautioned for what he calls bear market “head fake” rallies.

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.

Yahoo Finance

Yahoo Finance