Don't Overlook These 2 Finance Innovators It's Time to Buy

Some investors may be skeptical of the broader financial sector after the collapse of Silicon Valley Bank but there are some nice opportunities brewing.

Here are two fin-tech companies that are top-rated Zacks stocks at the moment as now looks like the time to buy.

Fiserv (FISV)

As a provider of financial technology services, Fiserv stock stands out at the moment sporting a Zacks Rank #2 (Buy). Fiserv’s Financial Transaction Services Industry is also in the top 28% of over 250 Zacks Industries.

Fiserv primarily offers account aggregation, business technology, and personal payment services to a diverse client base with its core focus areas being portfolio management, client relationship value enhancement, operational effectiveness, capital discipline, and innovation.

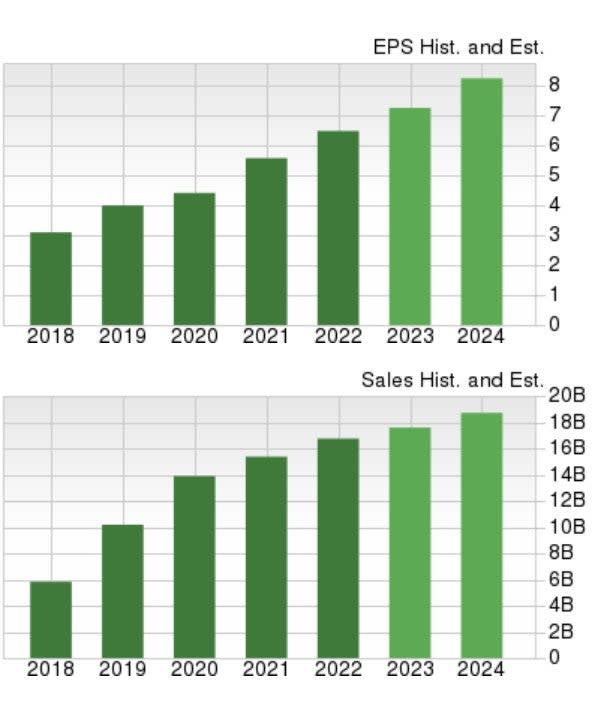

Fiserv is expected to see strong top and bottom-line growth over the next few years. Earnings are now projected to rise 13% this year and jump another 14% in FY24 at $8.37 per share. Earnings estimate revisions are slightly higher over the last quarter.

Image Source: Zacks Investment Research

Sales are forecasted to be up 6% in FY23 and rise another 8% in FY24 to $19.38 billion. More Impressive, fiscal 2024 would represent 90% growth from pre-pandemic sales of $10.18 billion in 2019.

Making Fiserv’s steady growth look more attractive is its price-to-earnings valuation which is very intriguing from a historical standpoint. Fiserv stock trades at $115 per share and 15.8X forward earnings which is 46% below its decade-long high of 29.4X while offering a 28% discount to the median of 22.1X. Fiserv stock also trades on par with its industry average and nicely beneath the S&P 500’s 19.2X.

Image Source: Zacks Investment Research

Interactive Brokers (IBKR)

Operating as an automated global electronic market maker and broker, Interactive Brokers stock is also starting to stand out with a Zacks Rank #2 (Buy).

Interactive Brokers specializes in routing orders, executing and processing trades in securities, futures, foreign exchange instruments, bonds, and mutual funds on more than 150 electronic exchanges and market centers worldwide.

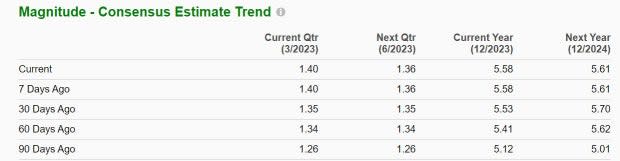

Notably, fiscal 2023 earnings estimates have risen 9% over the last 90 days with FY24 EPS estimates jumping 12%.

Image Source: Zacks Investment Research

Interactive Brokers’ earnings are now projected to climb 38% this year at $5.58 per share compared to EPS of $4.05 in 2022. Fiscal 2024 earnings are expected to slightly edge up at $5.61 per share.

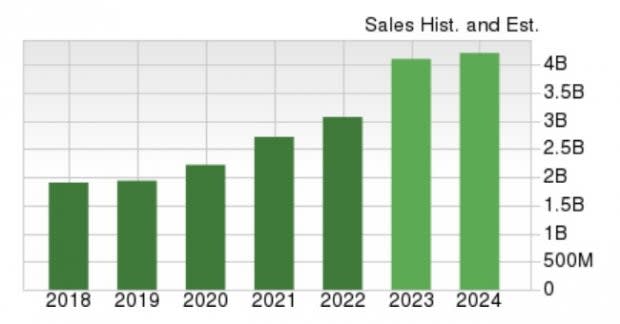

On the top line, sales are forecasted to soar 34% this year and rise another 1% in FY24 to $4.17 billion. Plus, fiscal 2024 would be a very impressive 116% increase from pre-pandemic sales of $1.93 billion in 2019.

Image Source: Zacks Investment Research

Even better, Interactive Broker’s P/E valuation is very attractive relative to its past. Trading at $83 per share and 14.7X forward earnings, shares of IBKR are 79% below their decade high of 66.2X and offer a 36% discount to the median of 22.9X. This is now closer to the Financial Investment Bank’s industry average of 12.4X and beneath the benchmark.

Image Source: Zacks Investment Research

Takeaway

Keeping in mind that Fiserv and Interactive Brokers stocks have both skyrocketed over +400% in the last decade makes their current prospects very intriguing. This has easily topped the S&P 500’s +163% with both companies continuing to expand and now trade far more attractively from a price-to-earnings perspective.

This certainly makes it more likely that Fiserv and Interactive Brokers’ strong performances could continue as we progress through the 2020s and investors shouldn't overlook these finance innovators.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance