Don't Ignore the Relative Strength of These 2 Defense Stocks

There have been several displays of relative strength within the market over the last several months, including a few stocks from the Zacks Aerospace sector.

Investors who target stocks displaying relative strength often find themselves in trends where buyers are in control, allowing them to ride bullish momentum.

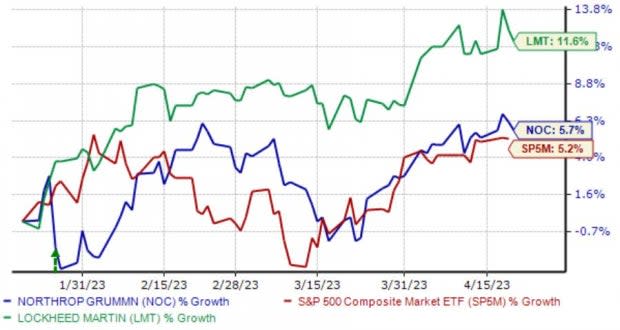

Two stocks from the Zacks Aerospace sector – Northrop Grumman NOC and Lockheed Martin LMT – have outperformed the general market over the last three months, as illustrated in the chart below.

Image Source: Zacks Investment Research

In addition, both sport favorable Zacks Ranks, indicting bullish sentiment from analysts. Can their recent outperformance continue? Let’s take a closer look.

Lockheed Martin

Lockheed Martin is the largest defense contractor in the world. The company focuses on defense, space, intelligence, homeland security, information technology, and cyber security. The stock is presently a Zacks Rank #2 (Buy).

The company has posted better-than-expected results as of late, exceeding both earnings and revenue estimates in back-to-back quarters. Just in its latest release on April 18th, the defense titan posted a 6% EPS surprise and reported revenue 2% above expectations, with growth in the company’s Space segment providing a nice boost.

Shares saw buying pressure post-earnings but have since modestly cooled. The market has regularly had positive reactions to the company’s quarterly prints, as we can see by the arrows circled below.

Image Source: Zacks Investment Research

In addition, Lockheed Martin is shareholder-friendly; LMT returned roughly $1.3 billion of cash to shareholders via dividends and share repurchases throughout the quarter. Impressively, the company’s dividend payout has grown by 7% just over the last year.

Image Source: Zacks Investment Research

Northrop Grumman

Northrop Grumman supplies various products and services to the U.S. Department of Defense (DoD), including electronic systems, information technology, aircraft, space technology, and systems integration services. The stock is currently a Zacks Rank #2 (Buy).

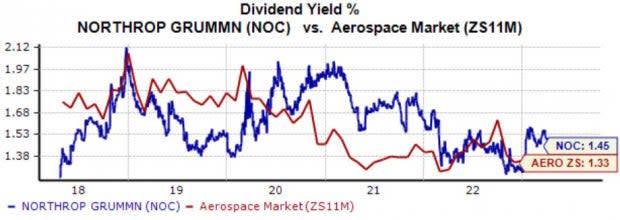

Like LMT, Northrop Grumman boasts a shareholder-friendly nature, upping its dividend payout by 10% over the last year. The company’s dividend currently yields 1.5% annually, nicely above the Zacks Aerospace sector average.

Image Source: Zacks Investment Research

The company’s shares may not be attractive to value-focused investors, with the current 21.6X forward earnings multiple sitting above the 15.8X five-year median and highs of 22.4X in 2022.

Image Source: Zacks Investment Research

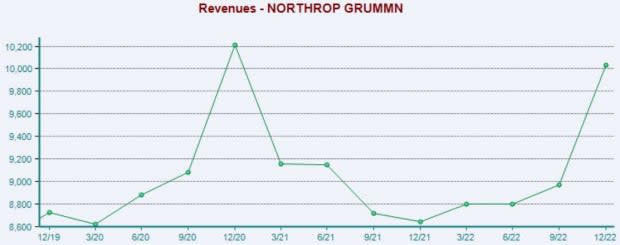

Northrop is scheduled to report next on April 27th before the market open. Currently, the Zacks Consensus EPS Estimate of $5.20 indicates a pullback in earnings year-over-year.

Top line growth is there, with our $9.2 billion quarterly revenue estimate suggesting a 4.5% Y/Y climb in sales.

Image Source: Zacks Investment Research

Bottom Line

Targeting stocks displaying relative strength is a great way for investors to insert themselves in favorable trends where buyers are in control.

And both stocks above – Northrop Grumman NOC and Lockheed Martin LMT – have displayed relative strength over the last three months, outperforming the general market.

In addition, both stocks sport a favorable Zacks Rank, indicating optimistic near-term outlooks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance