Don’t be blindsided by these 2 ETF risks

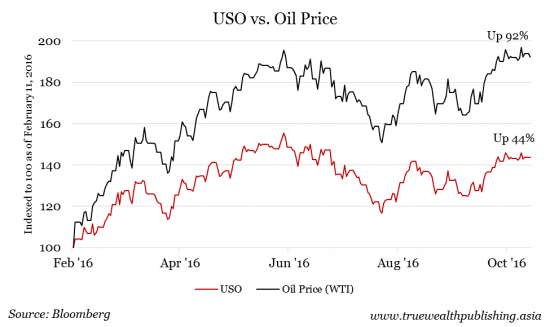

ETFs should be the centrepiece of a diversified investment portfolio. But ETFs also come with risks that can burn unwitting investors. Like any other investment, ETFs carry market risk – that is, the price of the fund can go up and down. We also recently discussed counterparty risk (especially as it relates to what's happening with Deutsche Bank). But ETF holders may be unknowingly exposing themselves to other, less obvious risks. And these risks can cause serious damage to their portfolios. Here are two hidden ETF risks (and how to avoid them): Beware derivatives and leverage in your ETFs As the exchange traded funds (or ETFs) market has grown, providers have developed increasingly exotic – and risky – structures to try to stand out in a very crowded field. (More than 450 new ETFs have been launched since early 2015 in the U.S. alone.) And leveraged and inverse ETFs in particular can be lethal to your portfolio. Leveraged ETFs seek to engineer gains that are 2 or 3 times that of the underlying index. An example is the UltraPro Short S&P 500 ETF (New York Stock Exchange; ticker: SPXU). It aims to earn 3 times the opposite of what the S&P 500 index returns on a given day. So, if the S&P 500 loses 1 percent in a day, SPXU would gain 3 percent that day. Inverse ETFs do the opposite of what the index it's linked to does. For example, the ProShares Short S&P 500 ETF (New York Stock Exchange; ticker: SH) is designed to go up if the S&P 500 index falls, and go down when the S&P 500 rises. So, if the S&P 500 falls 1 percent, SH rises 1 percent… and if the S&P 500 rises 1 percent, SH falls 1 percent. Leveraged and inverse ETFs use derivatives. These are instruments that "derive" their value from an underlying asset – like gold, an individual stock or a stock index. Derivatives allow ETF managers to simulate and/or multiply the returns of a target index. But beyond very short holding periods, inverse and leveraged ETFssignificantly underperform the indexes they're supposed to track. Why? They track daily returns. Hold them for any longer, and the tracking fades. And that can quickly kill your returns. Here's an example of how that could affect your portfolio: Let's say you buy a 2X leveraged ETF that tracks the return of ABC index. You buy 1 share of the ETF for $100, and the underlying index is at 10,000. If ABC jumps 10 percent the next day to 11,000, your 2X leveraged ETF would increase 20 percent, to $120. That's what should happen. But the next day, the index drops from 11,000 back down to 10,000. That's a 9.09 percent decline for the index. So your 2X leveraged ETF would go down twice this amount, or 18.18 percent. Losing 18.18 percent means the value of the leveraged ETF would drop from $120 to $98.40. So, over the two-day period the underlying ABC index is unchanged – it started at 10,000 and is back at 10,000. But the value of your 2X ETF is down 1.82 percent! Of course, indexes don't usually move 10 percent in a day. But a series of smaller moves over a longer period of time quickly eats into returns. Closely related to this is tracking error risk. This is the risk that the ETF will not accurately track the performance of the index, or asset price, it uses as a benchmark. For example… let's say that earlier this year, you decided that the price of oil had bottomed. On February 11, you invested in a popular ETF that tracks the price of WTI (for this example, the United States Oil Fund ETF, ticker USO), a kind of crude oil. If you had sold in mid-October, you'd have earned a return of 44 percent. That's a great return.

But the problem here – and the problem with ETFs like USO – is that over time, some ETFs do a terrible job at tracking the underlying price. As shown above, the price of WTI crude rose 92 percent over the same period. So, your return would have been less than half of the return of the underlying asset. In this case, at least you'd still have made a good return. But more often, by holding some ETFs too long, a correct market call can still be a losing investment.

Flash crashes can hurt ETFs more On August 24, 2015, U.S. stocks started to drop as soon as the stock market opened, in part due to a large drop in Asian stock markets overnight. ETFs that included many of these same stocks saw their prices fall as well. But it wasn't a normal day, something went seriously wrong: That morning, one out of every five U.S.-traded ETFs declined by 20 percent or more – some by more than 40 percent. In the "flash crash" that ensued, many ETFs fell far more than the stocks or indexes they tracked. For example, the SPDR S&P Dividend ETF (NYSE; ticker: SDY) traded down by as much as 38 percent. Meanwhile, the combined value of the stocks the ETF held only dropped 6 percent. How can an ETF fall more than the value of the shares it holds? There are two ways to value an ETF: The ETF's share price, and its net asset value (NAV). The share price is what investors are willing to pay to own the ETF. The NAV is the value of all the assets the ETF holds, minus expenses. Under normal circumstances, the share price and NAV are nearly identical. (This is one of the reasons why ETFs are – generally – a great investment vehicle.) That's because ETFs have "authorised participants" – large investors who are empowered to trade away discounts and premiums for their own profit. They do this by conducting "arbitrage" between the ETF share price and the prices of the individual stocks that make up the ETF. If an ETF price were to drop significantly below NAV, the authorised participant would sell or "short" the individual stocks and buy the undervalued ETF, locking in a profit. This is "free money" for sophisticated traders, as the spread between NAV and ETF price would be expected to quickly narrow. However, on this August morning, many authorised participants couldn't accurately calculate the ETFs' NAVs, because underlying share prices were in such disarray. So they stepped aside and allowed other investors to set the share price. When these other investors – mostly individuals who had even less insight on what was happening – saw the value of their ETFs plummeting, many panicked and sold… making the situation worse. Or, ETF share prices hit some investors' pre-set stop-loss limits (including large investment funds) and sold automatically. (We've talked about stop-loss orders here – and the dangers of telling your broker a level at which to sell, rather than keeping a mental stop-loss level.) All this selling further contributed to the selling frenzy. By that afternoon, the market had settled down and ETF share prices returned to "normal". But for some ETFs, the flash crash was even more extreme than it was for the underlying components of the ETF. An investor who panicked and sold into the morning's "flash crash" would have lost money. Or, if their stop-loss price was reached and the ETF sold automatically, they would have also lost money… even though prices climbed back up by the afternoon. How to avoid these risks ETFs are a great way to invest. But every investment carries risk, of course. And some ETFs carry unique risks. The good thing is that a savvy investor can minimise his exposure to these challenges, by following these steps:

Understand what you're getting into. If the ETF uses exotic derivatives, swaps or other structures that you don't understand, stay away.

If the ETF's share price is trading well below its NAV, like during a flash crash, don't panic and sell. An ETF trading below NAV is a great buying opportunity, not a reason to sell. And be sure not to leave a standing sell order with your broker that could be triggered at exactly the wrong time.

Stick to straightforward ETFs that track a well-known index. It's nearly impossible to outperform an index's performance over time, so stay with what works.

Kim Iskyan

Yahoo Finance

Yahoo Finance