Don't Get Greedy with Freeport-McMoRan, Inc. Stock

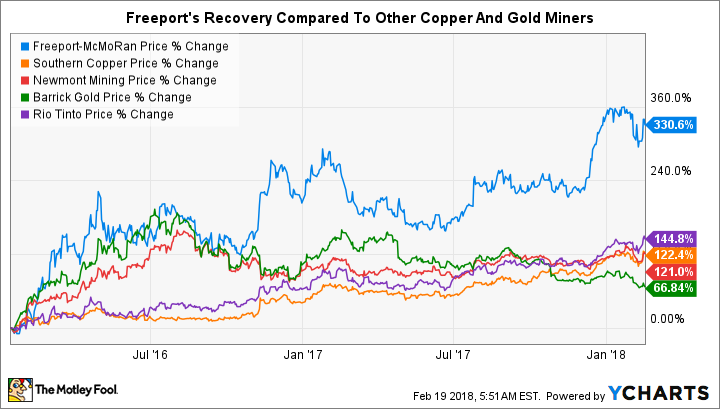

Shares of copper and gold miner Freeport-McMoRan, Inc. (NYSE: FCX) have rocketed over 330% since commodity prices started to turn higher in early 2016. Peer Southern Copper, meanwhile, is only up around 120%. However, although Freeport has made material progress on key goals, now is not the time to get greedy with this stock. Here's why a little caution is still warranted.

Getting back on track

One of the biggest positives from 2017 was Freeport's trimming its debt load by around 18% over the year. Total debt now sits at around $13.1 billion, down from a peak of around $20 billion at the start of 2016. The only problem here is that debt was only around $3.5 billion at the start of 2013 before the miner bought two oil and natural gas companies in an attempt to diversify its business.

Image source: Getty Images

That plan didn't work out as well as hoped after oil prices started to tumble in mid-2014. Losses and write offs followed, with Freeport eventually deciding to get out of the energy business and refocus on copper and gold assets. It's largely done with that process, but it is still dealing with the debt overhang left behind. To put it politely, the balance sheet just isn't the same as it once was, even though the miner has largely extracted itself from what in hindsight were ill-advised oil efforts.

Still some troubles

If this were the only uncertainty Freeport was facing you could understand why rising copper and gold prices had pushed the shares up over 300%. After all, higher commodity prices will make it a lot easier for management to keep reducing debt. The problem is that the miner is also dealing with a huge question mark surrounding its investment in the giant Grasberg mine in Indonesia.

This single mine holds roughly 30% of Freeport's copper reserves, and accounted for about 25% of its 2017 production. If that weren't bad enough, Grasberg contains virtually all of the miner's gold reserves, making up slightly more than 99% of its gold production last year. This is, to put it bluntly, an important asset.

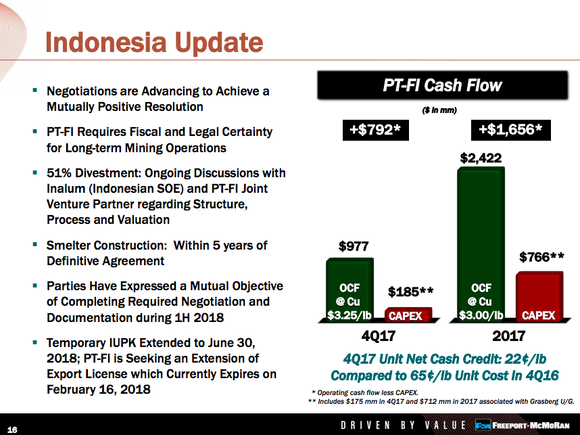

The problem is that Indonesia would like to get more financial benefit from the mine, and is working to change its ownership stake in the massive project. This will reduce Freeport's ownership position at the mine. The two sides have come to a broad agreement about making this happen, but have yet to come to final terms. The fine details have been harder to agree upon and the deal could still fall apart, which would push the two into a contentious dispute resolution process.

The most recent Grasberg update... progress is slow. Image source: Freeport-McMoRan Inc.

Something will likely be worked out over time here, but there's really no way to tell how good or bad it's going to turn out for Freeport just yet. And since Grasberg is such a large and important asset, investors should really be treading cautiously right now, not jumping in with both feet.

Too much recovery

At one point Freeport held material recovery potential, and rightly so since it was working back from its massive overreach in the oil space. That's basically done, even though the company still has a huge slug of the related debt sitting on its balance sheet. So the giant price rally since commodities turned higher in early 2016 makes some sense -- things are much better than they were.

However, after an over-300% price advance, Freeport would need to see more positive news at this point to keep this rocket ship going. The only positive catalyst on the horizon is a resolution with Indonesia over Grasberg. But that's not going as quickly or smoothly as hoped, and it's really hard to handicap the outcome of a largely political dispute with an asset in a foreign country. Freeport has done a great job repairing its business and balance sheet, but now is not the time to be greedy here.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance