Domo (DOMO) Q3 Loss Narrower Than Expected, Revenues Rise Y/Y

Domo DOMO reported third-quarter fiscal 2020 non-GAAP loss of 85 cents per share, narrower than the year-ago quarter’s loss of $1.06 and the Zacks Consensus Estimate of a loss of $1.02.

Revenues of $44.8 million increased 21.5% on a year-over-year basis, primarily driven by customer addition. The figure also beat the consensus mark of $42 million.

International revenues represented 24% of total revenues in the reported quarter. The growth was primarily driven by strong performance in North American regions.

Billings increased 15% year over year to $44.4 million.

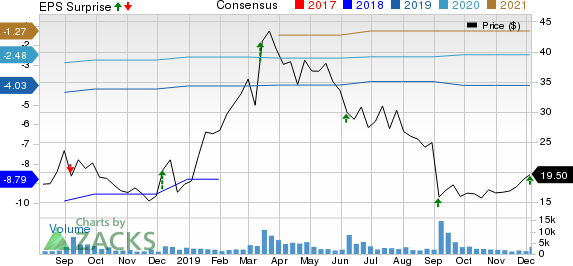

Domo, Inc. Price, Consensus and EPS Surprise

Domo, Inc. price-consensus-eps-surprise-chart | Domo, Inc. Quote

Customer Growth & Retention

Domo stated that 52% of the customers were on multi-year contracts at the end of third-quarter fiscal 2020 compared with 39% at the end of the year-ago quarter. Gross retention rate was 90%.

Notable customer additions during the reported quarter included TaylorMade, a leading manufacturer of high-performance golf equipment.

Additionally, Domo signed new logo deals of over $500,000 in annual recurring revenues (ARR) with two aftermarket auto-parts companies. These companies used Domo to monitor the real-time performance of the retail operations, measuring against daily, weekly and monthly objectives for sales and service.

Moreover, Swire Coca-Cola also chose Domo’s services to drive more value from business data across the organization. Swire Coca-Cola produces, sells and distributes Coca-Cola and other beverages to 60,000 retailers, and communities in 13 states across western America.

Further, Sony Bank Ltd. selected Domo’s enterprise-grade scale and security to use its cross-departmental data to power a more proactive and agile business.

DOMO signed key expansion deals with notable customers, including consumer packaged goods (CPG) giant, L'Oreal, and UnitedHealth Group, a Fortune 10 diversified healthcare company.

Domo also inked a partnership with Snowflake, a data warehouse built for the cloud that combines the power of data warehousing, the flexibility of big data platforms and the elasticity of the cloud at a fraction of the cost of traditional solutions.

Quarter Details

Subscription revenues (84.5% of total revenues) were $37.8 million, up 24.5% year over year. Professional services and other revenues (15.5%) increased 7.4% to $6.9 million.

During the quarter, Domo announced Domo for Square, a new application that helps merchants with multiple Square accounts to easily unlock business insights and value from all Square data in real time.

In third-quarter fiscal 2020, gross profit rose 26.7% year over year to $30.3 million. Gross margin expanded 280 basis points (bps) to 67.7%.

Notably, non-GAAP subscription gross margin was 76.1% in the reported quarter compared with 73% in the year-earlier quarter.

GAAP sales & marketing (S&M) expenses increased 6.2% year over year to $29.8 million GAAP general & administrative (G&A) expenses increased 35.9% to $9.6 million. GAAP research & development (R&D) expenses declined 6.5% to $17.6 million.

Total non-GAAP operating expenses increased 4.9% year over year to $51.8 million in the reported quarter on increased marketing and G&A costs.

Non-GAAP operating loss of $21.2 million was narrower than the year-ago quarter’s loss of $25.3 million.

Balance Sheet & Cash Flow

As of Oct 31, 2019, Domo had cash, cash equivalents and short-term investments of $115.9 million compared with $133.9 million reported in the previous quarter.

Moreover, adjusted net cash used in operations was $16.2 million, an improvement of 47% year over year.

Guidance

For fourth-quarter fiscal 2020, revenues are anticipated between $45 million and $46 million. Non-GAAP net loss per share is expected between 94 cents and 98 cents.

Billings are expected to total $57 million. Domo expects operating expenses to increase in the fourth quarter.

Adjusted cash used in operations is expected at around $16 million.

For fiscal 2020, revenues are anticipated between $172.2 million and $173.2 million. Non-GAAP net loss per share is expected between $3.88 and $3.92.

Billings are expected to be around $181 million. Adjusted cash used in operations is expected be around $73 million.

Zacks Rank & Stocks to Consider

Currently, Domo has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Marchex, Inc. MCHX, Fortinet, Inc. FTNT and Baidu, Inc. BIDU. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Marchex, Fortinet and Baidu is currently pegged at 15%, 14% and 2.3%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Marchex, Inc. (MCHX) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Domo, Inc. (DOMO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance