A domino effect from the bond market could lead to a correction in stocks, JPMorgan says

U.S. Treasury yields are hovering near one-month lows and a significant move lower may trigger a correction in equities, analysts at JPMorgan said.

Technical analyst Jason Hunter said in a note Thursday "the technical case for a continued bear market in Treasuries this year has weakened further" given the 10-year note yield's recent fall, adding that some of the equity plays associated with the "U.S. reflation trade" have been largely correlated with Treasury yields.

The reflation trade centers around stocks that benefit from higher inflation and yields, including financials. Investors and traders have been betting that inflation will rise under Donald Trump 's presidency as he moves to enact an agenda that includes lower corporate taxes and infrastructure spending.

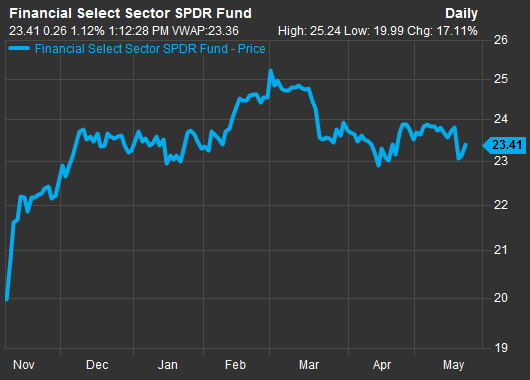

The Financials Select Sector SPDR Fund ETF (XLF) , which tracks the S&P financials sector, has been a stalwart since Trump's victory, rising more than 17 percent since Nov. 8.

XLF since US election

Source: FactSet

But the reflation trade has been under siege lately because of the decline in rates. The benchmark 10-year note yield has fallen from about 2.41 percent to 2.24 percent since May 10 and hit a one-month low on Wednesday. Financials, meanwhile, suffered their worst day since June 24 earlier this week on the back of the U.S. stock market's worst session of 2017.

Stocks fell sharply on Wednesday on news that former FBI Director James Comey put together a memo outlining a conversation in which Trump asked him to halt an investigation into Michael Flynn's ties with Russian officials. Flynn is Trump's former national security adviser.

Hunter noted that if yields fall, sectors like financials could be threatened, adding the best-performing groups of the year, technology and consumer discretionary, "will top out at some point, and leave the broader S&P 500 Index vulnerable to a more material correction later this year."

"We will adopt a much more defensive bias if the market internals do not improve in the weeks ahead, the leadership groups start to form bearish momentum divergence patterns, and

the S&P 500 Index carves out a multi-week/multi-month distribution pattern within the 2,392-2,486 target zone this summer."

Watch: Market by the numbers

Yahoo Finance

Yahoo Finance