Dominion Energy (D) Gets Nod to Produce 800 MW Clean Energy

Dominion Energy Inc. D recently received approval from the Virginia State Corporation Commission to develop two dozen new solar and energy storage projects. These developments are expected to help the company meet the growing needs of its customers.

Once the projects come online, they will produce more than 800 megawatts (MW) of carbon-free electricity, which, at full capacity, would be able to serve nearly 200,000 homes in Virginia. During the first 10 years of operation, the projects are expected to save more than $250 million in fuel costs for consumers.

Renewable Energy

Per a U.S. Energy Information Administration (EIA) report, coal usage for electricity generation is expected to decline going forward. It also projects an increase in renewable energy sources from 22% in 2022 to 26% in 2024.

EIA expects the utility operators to add nearly 54.5 gigawatts (GW) of new utility-scale electric-generating capacity to the United States in 2023. It also projects that approximately 29.1 GW out of the total energy capacity will be based on solar power. This clearly indicates the rising usage of solar energy in the production of clean electricity in the United States.

The Inflation Reduction Act (IRA) will support and accelerate the Utilities’ transition toward clean-energy sources. The Act has removed uncertainties related to federal incentives for the usage of renewable sources. It also entails an opportunity for a wide range of low-cost clean energy solutions in a predictable way and is expected to create earnings visibility.

Utilities Focus on Clean Energy

Along with Dominion Energy, some other electric power industry companies like AVANGRID, Inc. AGR, Ameren Corporation AEE, and NextEra Energy, Inc. NEE are adopting measures to meet clean-energy targets.

AVANGRID plans to create a clean generation portfolio — coal-free and 91% renewables — and achieve Scope 1 and Scope 2 carbon neutrality goals by 2035. In the Renewables segment, nearly 400 MW of new capacity were placed into operation, including its first large-scale solar project and advancing construction of nearly 1.4 gigawatts.

AGR’s long-term (three- to five-year) earnings growth is pegged at 4.83%. It delivered an average earnings surprise of 11.17% in the last four quarters.

Ameren plans to supply electricity produced from cleaner and more diverse sources of energy generation, including solar, wind, natural gas, hydro and nuclear power. To this end, AEE aims to expand its portfolio by 2,800 MW of renewable generation by the end of 2030, and a total of 4,700 MW of renewable generation and 800 MW of battery storage by 2040.

Ameren’s long-term earnings growth is pegged at 6.97%. The Zacks Consensus Estimate for 2023 EPS is $4.35, implying a year-over-year increase of 5.1%.

NextEra Energy aims to reduce total carbon emissions by 67% within 2025 from 2005 base line. It continues to work on its strategy of long-term investment in clean-energy assets. NEE expects to add 33-42 gigawatts of new renewables to the generation portfolio during 2023-2026 via clean-energy investments.

The company’s long-term earnings growth rate is pegged at 9.04%. The Zacks Consensus Estimate for 2023 EPS is pegged at $3.12, implying a year-over-year increase of 7.6%.

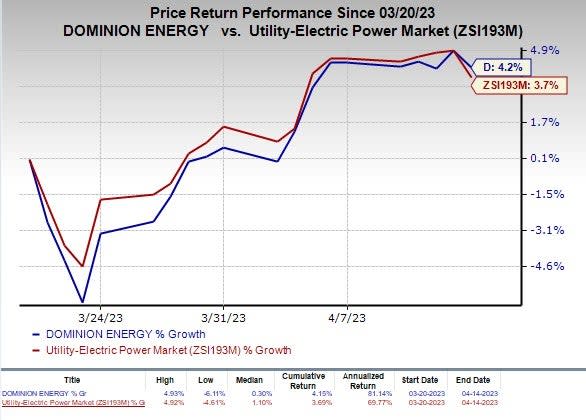

Price Performance

In the past month, shares of Dominion Energy have gained 4.2% compared with the industry’s 3.7% growth.

Image Source: Zacks Investment Research

Zacks Rank

Dominion Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Avangrid, Inc. (AGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance