Dometic Group And Two Other Stocks Estimated To Trade Below Their Value On The Swedish Exchange

Amidst a landscape of fluctuating global markets, Sweden's exchange presents unique opportunities for investors seeking value. As various indices show mixed signals, identifying stocks that trade below their intrinsic value could offer potential advantages in the current economic environment. In this context, companies like Dometic Group stand out as potentially undervalued assets worth considering.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

RVRC Holding (OM:RVRC) | SEK45.14 | SEK87.70 | 48.5% |

Truecaller (OM:TRUE B) | SEK35.60 | SEK70.98 | 49.8% |

Nordic Waterproofing Holding (OM:NWG) | SEK161.00 | SEK308.52 | 47.8% |

Lindab International (OM:LIAB) | SEK228.20 | SEK426.51 | 46.5% |

Stille (OM:STIL) | SEK202.00 | SEK395.43 | 48.9% |

Biotage (OM:BIOT) | SEK167.60 | SEK319.03 | 47.5% |

Flexion Mobile (OM:FLEXM) | SEK8.12 | SEK16.01 | 49.3% |

Hexatronic Group (OM:HTRO) | SEK54.24 | SEK106.25 | 49% |

Nordisk Bergteknik (OM:NORB B) | SEK17.02 | SEK32.12 | 47% |

Image Systems (OM:IS) | SEK1.52 | SEK2.86 | 46.8% |

Underneath we present a selection of stocks filtered out by our screen

Dometic Group

Overview: Dometic Group AB specializes in mobile living solutions, including food and beverage storage, climate control systems, and power solutions, with a market capitalization of approximately SEK 22.06 billion.

Operations: Dometic's revenue is generated from various geographical segments, with Europe, Middle East and Africa (EMEA) contributing SEK 8.14 billion, Marine SEK 6.56 billion, Americas SEK 5.05 billion, Asia Pacific (APAC) SEK 4.70 billion, and Global operations SEK 5.92 billion.

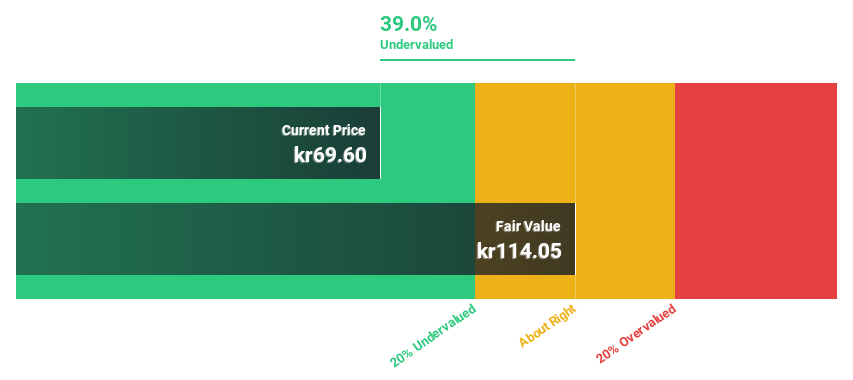

Estimated Discount To Fair Value: 40.5%

Dometic Group, with its recent sales drop to SEK 6.53 billion from SEK 7.29 billion, still shows promise as an undervalued stock based on cash flows. Currently trading at SEK 69.05, significantly below the estimated fair value of SEK 116.06, it presents a substantial undervaluation opportunity despite a high debt level and unstable dividend history. The company's earnings are expected to grow by 21.78% annually, outpacing the Swedish market forecast of 14.4%, indicating potential for appreciable financial improvement over the next three years.

Lindab International

Overview: Lindab International AB, a company based in Europe, specializes in manufacturing and selling products and solutions for ventilation systems, with a market capitalization of approximately SEK 17.54 billion.

Operations: The company generates revenue primarily through two segments: Profile Systems, which brought in SEK 3.30 billion, and Ventilation Systems, accounting for SEK 9.78 billion.

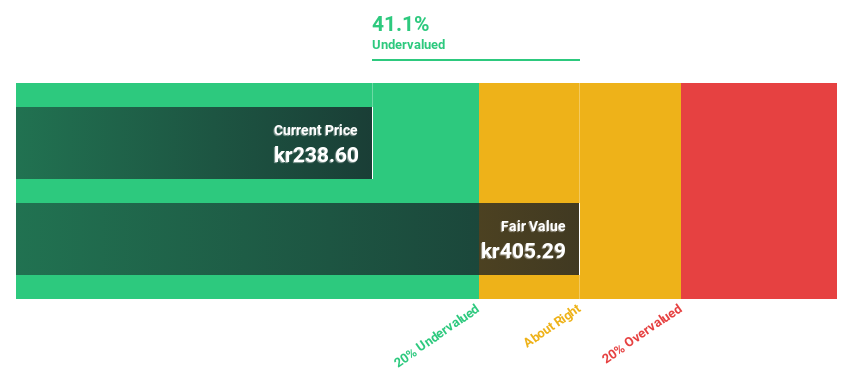

Estimated Discount To Fair Value: 46.5%

Lindab International, currently priced at SEK 228.2, is trading significantly below its assessed fair value of SEK 426.51, reflecting a substantial undervaluation based on discounted cash flows. Despite a recent dip in quarterly net income from SEK 180 million to SEK 117 million and unstable dividends, the company's earnings are expected to surge by over 20% annually over the next three years, outperforming the Swedish market's average growth rate. This robust profit growth projection alongside a moderate revenue increase suggests potential for valuation correction.

RVRC Holding

Overview: RVRC Holding AB (publ) specializes in active lifestyle clothing, operating in Sweden, Germany, Finland, and other international markets with a market capitalization of SEK 5.08 billion.

Operations: The company generates revenue primarily through its online retail segment, amounting to SEK 1.80 billion.

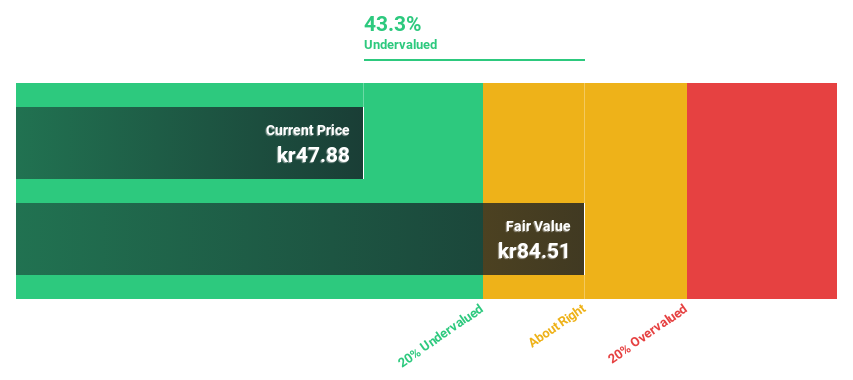

Estimated Discount To Fair Value: 48.5%

RVRC Holding, priced at SEK 45.14, is considered highly undervalued with a fair value estimate of SEK 87.7, trading at a 48.5% discount. Despite an unstable dividend track record and revenue growth forecasts below significant levels (16.6% per year), earnings are expected to grow by 16.19% annually, outpacing the Swedish market's average (14.4%). Recent executive changes and share sale plans could influence its market dynamics but reflect ongoing strategic adjustments within the company.

Taking Advantage

Click here to access our complete index of 45 Undervalued Swedish Stocks Based On Cash Flows.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:DOM OM:LIAB and OM:RVRC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com