DocuSign Earnings: What to Watch

Since going public last year, DocuSign (NASDAQ: DOCU) has consistently posted strong revenue growth as the e-signature and cloud-based document company strengthens its ecosystem with new partners and features and grows its customer base. When DocuSign reports its fiscal first-quarter results on Jun. 6, investors will be looking for more of the same.

Ahead of DocuSign's upcoming earnings release, here's a look at some key items for investors to check on.

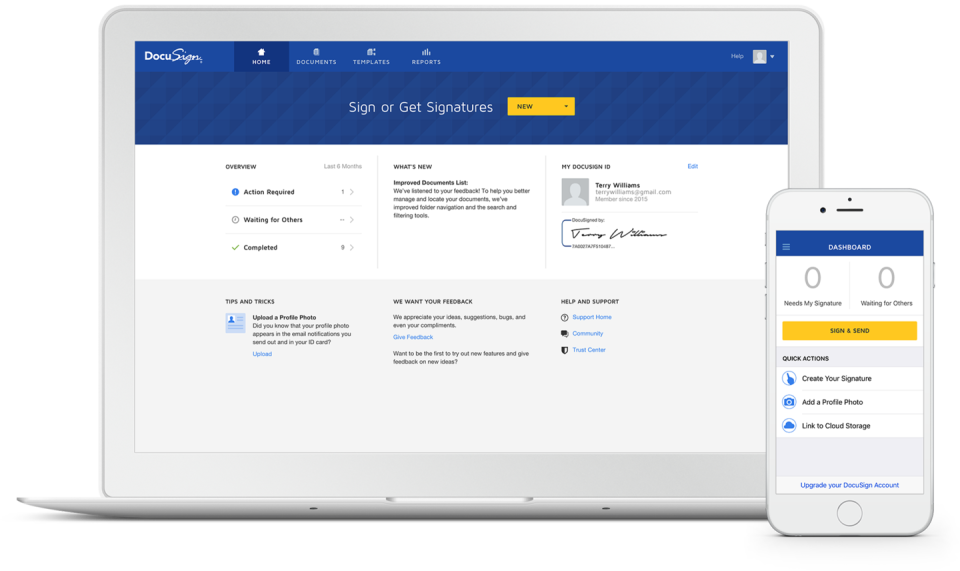

Image source: DocuSign.

Revenue growth

In DocuSign's fourth quarter of fiscal 2019, revenue rose 34% year over year, to $199.7 million. Though this was strong growth, it was notably down from 38% growth in fiscal Q3.

This trend of decelerating growth is expected to continue in the company's first quarter of fiscal 2020. Management guided for fiscal first-quarter revenue between $205 million and $210 million. The midpoint of this guidance range represents 33% revenue growth. Analysts, however, forecast DocuSign's fiscal first-quarter revenue to come in at $208.2 million.

Subscription revenue

Importantly, DocuSign's subscription revenue hasn't been decelerating meaningfully in the way as its total revenue has been doing. DocuSign's subscription revenue increased 37% in fiscal Q4, down from 38% growth in fiscal Q3.

Importantly, this fast-growing revenue represents 94% of total revenue, highlighting its importance to the company's long-term growth potential. Investors should consider the segment's lucrative and widening gross profit margin. For the full year of fiscal 2019, DocuSign's subscription gross margin was 86%, up from 84% in fiscal 2018.

Investors should look for growth in DocuSign's fiscal first-quarter subscription revenue to be similar to the growth rate seen in fiscal Q4.

Customer additions

DocuSign has been adding new customers at a rapid clip recently, with 25,000 new customers in fiscal Q3 and 23,000 in fiscal Q4. Viewed another way, DocuSign added over 100,000 customers between the fourth quarter of fiscal 2018 and the fourth quarter of fiscal 2019.

Investors should look for new customers of 20,000 or more in fiscal Q1.

Of course, investors should keep in mind that there are two other ways DocuSign is driving growth: expanding existing customers' volume and use cases. Look for optimistic updates from management on these growth drivers, as well.

DocuSign is scheduled to report its fiscal first-quarter earnings after market close on Thursday, Jun. 6. The company will host a live conference call with analysts on the same day at 4:30 p.m. EDT.

More From The Motley Fool

Daniel Sparks has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends DocuSign. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance