Disney+, Apple TV+ and Netflix can coexist—for now

Disney+ launches on Tuesday with extremely high expectations. The service was first announced along with ESPN+ on an earnings call in August 2017 (but not publicly named until 2018), an announcement that CEO Bob Iger, in his new book, says “marked the beginning of the reinvention of the Walt Disney Company... In essence, we were now hastening the disruption of our own businesses, and the short-term losses were going to be significant.”

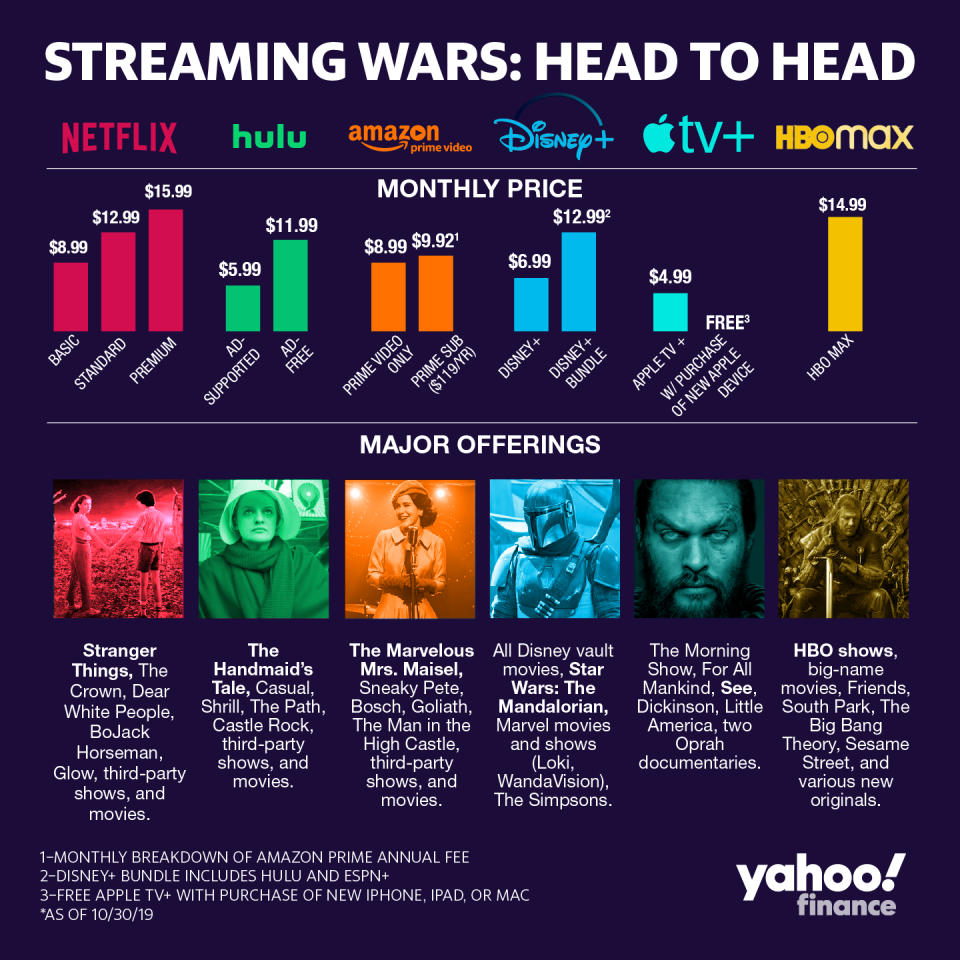

Many of the headlines since then have pitted Disney+, Apple TV+, and Netflix in a dramatic three-way streaming fight.

But most analysts and surveys say that the success of Disney+ and Apple TV+ are not mutually exclusive, and that all three big-name services can do well—at least for a time.

For starters, all three streaming apps have very different content strategies.

Small array of originals vs. kitchen sink

Disney+ and Apple TV+ launched in the same month, but that’s about all they have in common. Apple TV+ launched with just seven shows, all of them originals, including “The Morning Show,” “See” and “Dickinson.” It’s a premium approach: a handful of expensive shows (“The Morning Show” budget was reportedly $15 million per episode) with big names, and Apple (AAPL) wisely priced it super-cheap ($4.99 a month) to make it practically an impulse purchase if you’re interested in one or two of the shows. Wedbush analyst Dan Ives called the $4.99 price tag a “shocker” that “we loudly applaud.” Wall Street had initially been expecting a price in the $7.99 to $9.99 range.

In contrast, Disney+ and Netflix (NFLX) both have kitchen-sink approaches to content, but even those differ from each other because all of Disney’s (DIS) content is Disney-owned, while a lot of what is on Netflix is licensed content that Netflix pays to host. (Netflix originals reportedly contribute less than 30% of viewing time on Netflix.)

The vast library of content on Disney+ is staggering—from Disney Animation to Pixar to Marvel to Lucasfilm to National Geographic, including old classic Disney movies and brand new original shows and movies—but it is all family-friendly, which fits Disney’s brand. Marvel’s last couple “Avengers” movies are about as adult as the Disney+ content gets. (Separately, Disney plans to move all FX shows to Hulu, which brands Hulu as Disney’s more adult streaming app, and sufficiently differentiated from Disney+.) Disney+ is priced at $6.99 a month, which puts it between Apple TV+ ($4.99) and Netflix ($12.99). Disney as of June was aiming for 30 million subscribers for Disney+ by 2024, and has since hiked that way up to a range of 60 million to 90 million subs by 2024.

Like Apple, Disney is also spending big on originals: $25 million per episode on some of the original Marvel shows, according to The Hollywood Reporter. Due to its direct-to-consumer investments, Disney’s profit in Q4 2019 of $1.07 per share was down 28% from the year before. It will take years for Apple TV+ and Disney+ to be profitable.

Adding more subs before the cutting comes

Both Apple TV+ and Disney+ are giving their service away to some consumers as a way to boost total subscribers right at launch. Apple is offering one year of Apple TV+ to anyone who purchases a new Apple device (iPhone, iPad, iPod, Mac or Apple TV), and Disney signed a pact with Verizon (Yahoo’s parent company) to give one year of Disney+ to all Verizon Wireless Unlimited customers. Thanks to Apple’s install base and Verizon’s customer base, both services can scale quickly.

And then there’s Netflix. Despite all that is on Disney+ it cannot yet match Netflix for sheer volume of content on the platform. Instead, Disney+ is a quality play. (So is Apple TV+, though its shows have received very mixed reviews so far.) Netflix has had some U.S. subscriber attrition recently, but it is still the established streaming king with 150 million global subscribers.

“With an installed base of ~900 million active iPhones worldwide, we believe Apple has an opportunity to gain 100 million consumers on the streaming front in the next 3-4 years,” writes Wedbush analyst Ives. “Disney on the other hand has a whole other strategy, as the company has a content library that is unmatched, with loyal built within the installed base globally.”

In other words, both Apple TV+ and Disney+ can grow without being mutually exclusive, and also without necessarily hurting Netflix—though of the two, Disney+ is certainly the bigger threat to Netflix.

Because the content on each app is so different, and because the pricing arguably fits the volume of content each has, these three apps are unlikely to cannibalize each other—for now.

Recent surveys suggest that Americans are still not at “peak” streaming, the point where they begin cutting OTT subscriptions. For the time being, they are willing to add more to their plate. Deloitte projects that by the end of 2020, half of adults in developed countries will pay for at least four digital subscriptions, and 20% of adults will be paying for 10.

Wedbush agrees: “In a nutshell, we believe there is room for consumers to add 1-2 more streaming services onto their entertainment monthly budgets as the cord cutting theme further takes hold into 2020 with both Apple and Disney in a strong position,” Ives writes.

That’s encouraging not just for Apple, Disney, and Netflix, but for some of the many, many other streaming apps already out there and launching soon: Disney’s Hulu; NBC’s Peacock; HBO Max; Sinclair’s STIRR; and Discovery’s forthcoming offering, to name just a few.

—

Daniel Roberts is a senior writer and show host at Yahoo Finance and closely covers Disney. Follow him on Twitter at @readDanwrite.

Read more:

Disney reveals what it will do with Hulu

Disney’s next Marvel movie phase should scare box-office competitors

Sinclair buys 21 former Fox regional sports networks from Disney

Disney+ has a secret weapon: millennial nostalgia

Yahoo Finance

Yahoo Finance