Disney (DIS) Brings Back Bob Iger as the CEO, Shares Surge

Disney DIS recently announced the appointment of Robert A. Iger, popularly known as Bob Iger, as CEO, effective immediately.

Bob Iger replaces Bob Chapek, following the latter’s two-year stint. The reappointment of Bob Iger as the CEO has bought a spree of excitement among investors as share prices have been surging ever since the news broke out on Nov 20 Shares jumped 6.3% to close at $97.58 on Nov 21.

The lingering impact of the COVID, raging inflation and rising interest rates do not bode well for Disney’s consumer-oriented businesses. Shares have declined more than 37% year-to-date.

Disney has been struggling in its streaming division with the increased cost of production and delayed releases lately.

However, with Bob Iger taking charge once again, investors are expected to gain back their lost confidence in the company’s prospects.

Bob Iger had actively been involved in launching the launch of Disney+ in 2019. His expertise and experience of more than four decades are likely to help the company create an efficient and cost-effective structure for the streaming platform.

Where is Disney’s Streaming Division Heading To?

Disney has been heavily investing in its streaming services to launch new movies and shows to gain traction. This has aided subscriber growth as Disney+ added more than 12 million global subscribers in the fourth quarter of fiscal 2022.

However, Disney’s direct-to-consumer division reported an operating loss of nearly $1.5 billion in the fourth-quarter fiscal 2022, that doubled year-over-year. This has been attributed to macroeconomic factors like inflation, which have spiked up the cost of production for the company, as well as adverse foreign exchange impact that decreased Disney+’s ARPU by 5%.

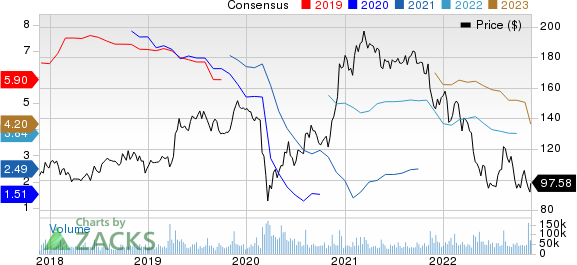

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Disney+ also faces significant competition from Netflix NFLX, which has a strong pipeline of content and has reached 223 million subscribers worldwide to date. A saturated streaming market with the presence of services from the likes of Apple AAPL and Comcast CMCSA is creating headwind for Disney+.

Streaming market leader, Netflix, reported better-than-expected third-quarter 2022 subscriber numbers. The streaming giant gained 2.41 million paid subscribers globally, higher than its estimate of gaining one million users. Netflix added 4.38 million paid subscribers in the year-ago quarter.

Apple’s streaming service, Apple TV+, continues to gain recognition with its critically acclaimed and popular shows like Ted Lasso.

Comcast’s Peacock had more than 15 million paid subscribers in the United States at the end of third-quarter 2022. Moreover, Peacock had approximately 14 million bundled and free users, totaling around 30 million monthly active accounts.

Nevertheless, Disney is focusing on the realignment of cost, including meaningful rationalization of marketing spending and optimization of content slate and distribution approach to deliver a steady state of high-impact releases that efficiently drive engagement.

The company expects Disney+ to reach profitability by 2024. It is also counting on releases such as Black Panther: Wakanda Forever, and Avatar: The Way of Water to fuel its subscriber acquisition.

The Zacks Rank #3 (Hold) company is also about to launch a cheaper, ad-supported subscription offering for Disney+ to attract even more viewers and diversify its revenue stream. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The ad-supported version will launch on Dec 8 for $7.99 a month, while its basic ad-free subscription jumps to $10.99.

ESPN+, the sports streaming platform of Disney, has also been taking steps to boost its top line.

It renewed the Major League Baseball sports rights deal through 2028 and entered a long-term partnership with the National Football League, where it has agreed on a five-year rights deal with the NFL to broadcast the league’s Monday night Wild Card playoff game through the 2025 season.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance