Disney (DIS) Benefits From Hamilton's Launch on Disney+

Disney’s DIS video streaming service –– Disney+ –– reportedly witnessed a surge in downloads after the launch of Broadway musical Hamilton on the platform.

Per data analytics firm Apptopia, the Disney+ app was downloaded around 752K times globally and 458K times in the United States over the Jul 4 holiday weekend following Hamilton’s release on Jul 3. The global download numbers indicate growth of 46.6% over the average of the prior four weeks in June, while growth in the United States was 74%.

Moreover, the global numbers don’t include India and Japan as Disney+ is delivered though pre-existing apps in those countries (Hotstar and NTT DoCoMo, respectively).

The Hamilton movie, which is a live recording of the original musical, was initially supposed to debut in movie theatres in October 2021. However, the shutting down of theatres due to coronavirus-induced lockdowns forced Disney to release the movie on its streaming service.

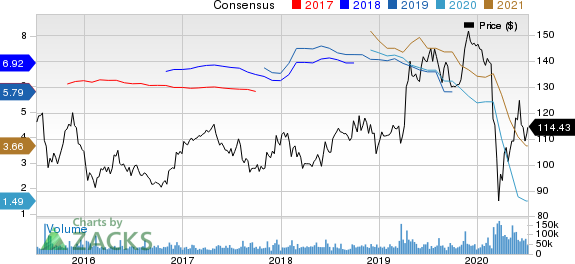

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Strong Content Portfolio to Aid Disney+ Growth

Hamilton’s release is in line with Disney’s strategy of strengthening the Disney+ portfolio by releasing movies that were scheduled for a theatrical release directly on its streaming service.

Notably, the adaptation of popular fiction Artemis Fowl that was supposed to hit theatres on May 29 started streaming on Disney+ from Jun 12. In India, the company announced the launch of Disney+ Hotstar Multiplex that will see the direct release of Bollywood movies on the OTT platform that were originally slated for a theatrical release.

Further, Pixar’s Onward was added to the Disney+ library within a few weeks of its release after the movie’s theatrical run was dampened by the closing down of theatres.

These endeavors are expected to help the streaming service acquire subscribers amid the pandemic as fans will able to watch their favorite movies without leaving their homes. Markedly, Disney+ had 54.5 million subscribers as of May 4, up from 33.5 million as of Mar 28.

Additionally, the service’s robust portfolio makes it well poised to counter competition from the likes of Netflix NFLX, AT&T’s T HBO MAX and Amazon’s AMZN prime video in the video streaming space. Per Grand View Research data, the video streaming space is expected to witness a CAGR of 20.4% between 2020 and 2027.

Persistent Risks

However, huge investments in developing and acquiring content for its streaming service are expected to hurt profitability of this Zacks Rank #5 (Strong Sell) company.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Moreover, Disney’s businesses have been affected by the coronavirus outbreak, which is expected to hurt its top line as well as profitability in the near term. Additionally, a leveraged balance sheet is a significant headwind.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATT Inc. (T) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance