Digital Multi-Currency Accounts & Cards For Travel Spending: BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip

With travel opening up again (despite the fear mongering behind the new COVID-19 variant, Omicron), Singaporeans are looking for ways to save a wee bit of cash. This is where the digital multi-currency accounts come in.

Instarem’s Amaze card used to be lauded for its lucrative 1% cashback on top of your linked credit card, but it’s since replaced this with a loyalty points-based system. At the same time, it’s also slapped on some top-up fees.

Meanwhile, YouTrip has finally added Google Pay compatibility—you can now add your YouTrip card to your Google Wallet and make seamless and secure payments.

With the world of digital multi-currency accounts constantly changing, how do we know which is the best? Here’s the lowdown on offerings from YouTrip, Instarem, BigPay, Revolut, and Wise (formerly TransferWise). Let’s review and compare.

BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip: Which is the best multi-currency account?

| BigPay | Instarem Amaze | Revolut | Wise (Formerly TransferWise) | YouTrip |

Mechanics | E-wallet top-up | Link with Mastercard/Google Pay OR top up Amaze Wallet using any card | E-wallet top up Up to 1.5% cashback at metal tier | E-wallet top-up | E-wallet top-up |

Able to remit money | Yes | Yes | Yes | Yes | No |

Currency exchange rates | |||||

No. of supported currencies | N.A. | 10 | 28 | 50+ | 10 |

Card available for payment | Visa or Mastercard | Mastercard | Visa or Mastercard | Visa or Mastercard | Visa or Mastercard |

Overseas withdrawal | Free for first withdrawal, 2% thereafter | 2% fee, limit of SGD 1,000 per day | Free up to S$350, 2% afterwards | Free up to 2 withdrawals under S$350, S$1.50 per withdrawal afterwards | Free up to S$400, 2% afterwards |

Min. top-up | S$20 | S$20 (Amaze Wallet) | S$20 | No minimum top-up | S$1 (PayNow) / S$20 (Credit/debit card) |

Electronic payments | N.A. | Google Pay | Apple Pay, Google Pay | Apple Pay, Google Pay | Apple Pay, Google Pay |

Swipe left to see the full table.

Best all-round digital multi-currency card: Instarem Amaze Card

The Instarem Amaze Card’s winning factor is the fact that you can earn Instarem rewards on top of your own credit or debit card cashback or rewards. All you have to do is link your credit or debit card (up to 5 cards) to your Amaze card or top up your Amaze wallet and spend away. This alone introduces a very enticing incentive for people to use the Instarem Amaze card while still spending on their existing cards.

How does the cashback work for the Instarem Amaze card?

The Amaze card used to give you 1% cashback, but has now switched to a loyalty points system with InstaPoints. When spending overseas on your Amaze card, you earn up to 1 InstaPoint for every 1 SGD-equivalent in foreign currency. There’s a minimum spend of 10 SGD (the equivalent in foreign currency) per transaction for you to earn InstaPoints on that transaction.

You’ll notice we said up to 1 InstaPoint. I dug through the Amaze Card T&Cs and found out that how many InstaPoints you earn depends on your payment method. Per SGD1 spent in foreign currency on your Amaze Card, you’ll earn

0.5 InstaPoints if your Amaze Card is linked to a credit or debit card.

1 InstaPoint if you’re topping up your Amaze Wallet on your Amaze Card.

Their website doesn’t spell out this distinction, it just says “T&Cs apply”. Sneaky, but we’re sneakier.

There’s also a cap of 500 InstaPoints you can earn per foreign currency transaction, and InstaPoints expire after 12 months. Do note that there are also certain categories excluded from Amaze Rewards, including healthcare, utilities, education, tolls, and postal services.

To redeem InstaPoints as cashback, do so directly on your Instarem App. Every 2,000 InstaPoints gets you SGD 20 cashback.

Pros—What we like about the Instarem Amaze Card:

1% cashback per quarter on top of your credit or debit card rewards.

Googly Pay compatibility: Android users can add their Amaze card on Google Pay.

No foreign currency conversion fees

No annual, processing, or application fees

The Instarem app automatically categorises your transactions into categories like “Food and Dining” and “Travel”. These days, we need all the help we can get staying organised.

Since you can link up to 5 cards, the app also combines your cards into 1 and lets you track your spending across all of them regardless of the credit card provider.

Cons—What we don’t like about the Instarem Amaze Card:

You can only link your Amaze Card to a Mastercard credit/debit card or to Google Pay. For other card associations like Visa or Amex, you have to top up your Amaze Wallet instead—which doesn’t let you earn rewards on the card you use for top-ups.

At the same time, you only earn 1 InstaPoint per 1 SGD spend in foreign currency if you use the Amaze Wallet. If you link a card or use Google Pay, you earn half of that—0.5 InstaPoints per 1 SGD instead.

You’ll incur a 1.5% fee when topping up your wallet using Visa cards. Top-ups using Mastercard and PayNow are free.

Instarem charges you a fee of 2% (minimum S$0.50) for SGD transactions involving GrabPay, prepaid cards and other e-wallet top-ups. This applies to both using your Amaze card with your linked bank card as well as to Amaze wallet transactions. The saving grace is that this doesn’t apply to foreign currency transactions.

However, to note, there’s a $100 cap on the cashback and a minimum spend requirement of $500per quarter.

We found the linking service a bit wonky. Users have reported random declines or duplicate charges, including myself. To elaborate, I made a skincare haul on Guardian Singapore, had my S$238 charge reversed, and then recharged again.

There is also no integration with Apple Pay, which is a shame.

Runner-up for the best digital multi-currency card: Revolut

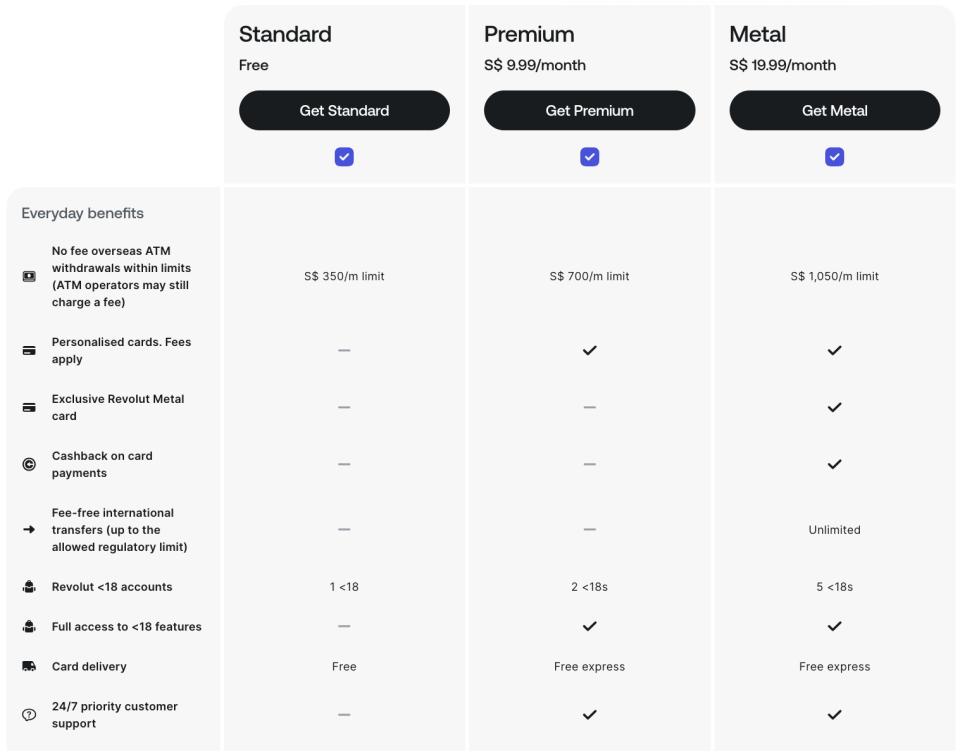

I like no-commitment cards. Revolut gives us that option with 3 plans, the most basic of which is free. Here’s a quick comparison of the everyday benefits of all 3 cards:

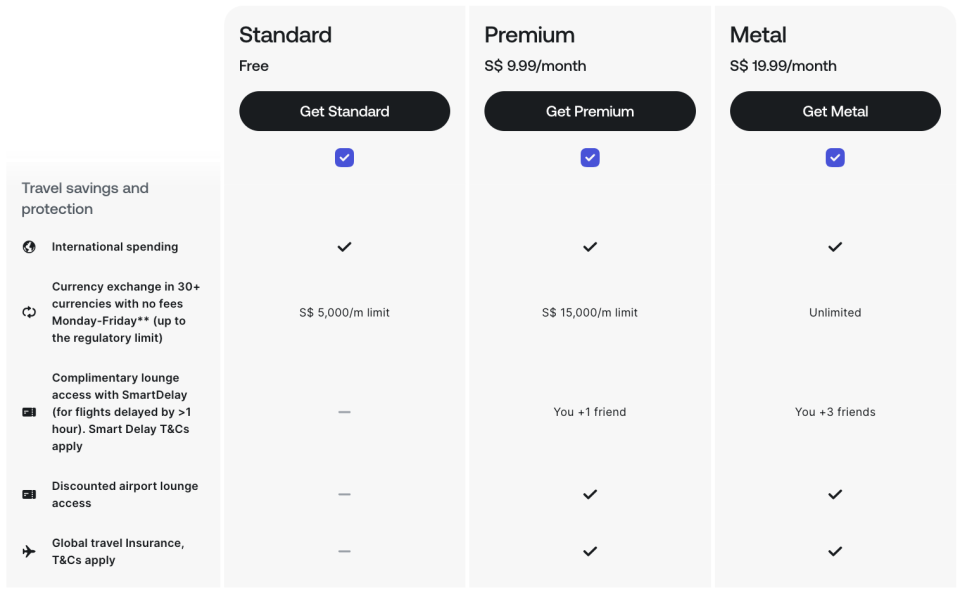

And here’s a summary of their travel benefits:

For a noob traveller like me who doesn’t often leave Singapore’s sunny shores, I like the Standard plan. First of all, it’s completely free to get. Even the card delivery to your doorstep is free (assuming it’s your first Revolut card). Secondly, it provides one of the most essential service I’d be interested in during overseas trips—currency exchange (fee-free on weekdays), overseas spending, and overseas cash withdrawal.

The limit for cash withdrawal is $350 per month under the Standard plan. Admittedly, that’s not a very high limit. It’ll do if you’re strapped for cash overseas, but you can’t depend on this card for cash during long haul trips, like if you’re backpacking across Asia for a month. So at the other end of the spectrum, Revolut offers their $19.99/month Metal plan. This card lets you withdraw $1,050 per month overseas for free, on top of unlimited fee-free currency exchange on weekdays, unlimited fee-free international transfers (up to the allowed regulatory limit) and up to 1.5% cashback.

The Revolut Metal card costs S$19.99 a month or S$199 a year. You get a discount if you pay upfront—it’s S$199 as opposed to S$239.98 if you were to pay monthly.

How does the Revolut card work?

Unlike the Instarem Amaze card, you can’t just link your credit card to your Revolut card and call it a day. The Revolut card works more like the Amaze Wallet—top up money, spend it later overseas directly using your card or by withdrawing cash from an ATM.

Unfortunately, there are charges for pumping money into your Revolut account—yes, even their free Standard plan has these fees:

Card Type | Surcharge Rate |

Mastercard debit card (Singapore issued, consumer card) | 0.51% |

Mastercard credit card (Singapore issued, consumer card) | 0.62% |

Visa debit card (Singapore issued, consumer card) | 0.30% |

Visa credit card (Singapore issued, consumer card) | 1.97% |

International consumer debit & credit cards | 2.08% |

Commercial debit & credit cards | 1.12% |

The first top-up is free.

Comparing apple to apple, top-ups to the Amaze Wallet are free for Mastercard credit cards (0.62% for Revolut) and 1.5% for Visa (1.97% for Revolut). So as far as top-ups go, Amaze wins. But if you’re paying in cash, factor in Instarem’s 2% ATM withdrawal fee and Revolut’s 0.62% Mastercard top-up fee suddenly looks way more enticing.

Pros—What we like about the Revolut Card:

Slickest UI

Best integration with current phone payment methods, most notably Apple Pay and Google Pay.

Free ATM withdrawals (up to $350, $700, or $1050 depending on your plan)

Choice of 3 plans, including a basic Standard plan with no fees

Premium and Metal plans come with other perks like airport lounge access and travel insurance coverage

Fee-free currency exchange on weekdays. This is unlimited for Metal plan users, but capped at $5,000/month and $15,000/month for Standard and Premium plan users respectively. If you exceed this limist, Standard will be charged a 1% fee, while Premium customers will be charged a 0.5% fee.

Up to 1.5% cashback on Revolut Metal card, capped at the monthly subscription fee of S$19.99.

Cons—What we don’t like about the Revolut Card:

Surcharges to top up your Revolut account range from 0.30% to 2.08% depending on the card type.

1% currency exchange fee on weekends.

Best free digital multi-currency card with rewards for those who don’t want sign up for more credit cards: BigPay

BigPay is completely free to sign up and comes with no annual fees. Does Big sound familiar? It’s the subsidiary of low-cost Malaysian carrier, AirAsia, and that means you can use it to redeem discounted flights, meals from AirAsia food, travel insurance and even investments. For example, from now till 31 Dec, use BIGPAY5 to get 5% off AirAsia flights.

It’s quite useful too if you already have an AirAsia account—simply link them up to reap even more benefits with your BigPay card.

The kicker is that you will need to spend at least S$5 on any transaction to earn 1 BIG point, and there’s a limit of S$300 daily on Visa PayWave payments. Do note that chip + pin transactions are subject to the MAS yearly limit of S$30,000.

Pros—What we like about BigPay

Free—no joining fee, annual fee, or account service fee

First overseas ATM withdrawal is free

AirAsia benefits

Cons—What we don’t like about BigPay

Essentially, its fees:

Overseas ATM withdrawal fee: 2% after first withdrawal

Currency conversion fee: Up to 1% + network charges

Cross-border transaction fee: 0.5% + network charges

Debit and credit card top-up fees:

Mastercard Debit: 0.6% (Domestic) / 3.05% (International)

Mastercard Credit: 0.7% (Domestic) /3.30% (International)

Visa Debit: 1.25% (Domestic) /2.5% (International)

Visa Credit: 2.3% (Domestic) / 3% (International)

What about Wise (formerly TransferWise)?

Wise (formerly TransferWise)’s strength lies more in its ability to remit and hold multiple types of currencies as opposed to spending money through its e-wallet. This is shown by the fact that, out of all the digital multi currency account providers, it supports the most number of currencies to store and send, at over 50. The next highest is Revolut, which stands at a decent 36.

There is something I like about Wise that’s specific to my bad travel habits. I often underestimate the cash I need overseas and end up looking for a money exchanger or ATM. If you’re like me and don’t want to pay ATM withdrawal fees, Wise lets you withdraw up to $350 for free each month.

Less than 350 SGD per month | More than 350 SGD per month | |

2 or less withdrawals per month | Free | 1.75% of the amount over 350 SGD |

3 or more withdrawals per month | 1.5 SGD per withdrawal | 1.5 SGD + 1.75% of amount over 350 SGD |

If you’re looking for loyalty points (like the Instarem Amaze card) or travel perks (like BigPay), Wise may disappoint you. The multi-currency card provides no special benefit to everyday consumers other than the ability to spend from the wallet. You’re better off using Wise to send money to your loved ones overseas, but it depends on the region that you’re sending to as well. Find out what I mean in this article about the best remittance services.

Pros—What we like about Wise

Free overseas ATM withdrawals—Up to 2 withdrawals (less than $350) per month.

No joining fee

Highest number of currencies: 40+ different currencies in more than 175 countries.

Transparent currency conversion fees that you can easily check online.

Supports Apple Pay and Google Pay.

Cons—What we don’t like about Wise

No cashback or reward benefits

Is YouTrip a good multi-currency card?

Yes, and no. Let’s talk about the “yes” parts first.

I think YouTrip’s biggest win is that it has no overseas transaction fees or currency exchange fees. Additionally, top-ups are free for Mastercard credit and debit cards as well as Visa debit cards. Recall that these will incur a 0.5-2% fee with Revolut. Instarem doesn’t charge a fee for Mastercard, but does charge 1.5% for Visa top-ups.

YouTrip’s withdrawal fees are also competitive. Your first S$400 for the month is free—slightly higher than that for Wise. After this, YouTrip will charge you a 2% withdrawal fee.

So, what’s not so good about YouTrip? For one thing, you can only store up to 10 currencies in its e-wallet.

Its rewards system is also a bit troublesome—you have to dig out your YouTrip card for its Y-number when you want to redeem something from its YouTrip Perks page. Granted, the mobile app does it for you, I find shopping on your desktop is a more comfortable experience because you can multitask, and compare prices between two tabs.

Better deals can also be had within the app, but it’s on a limited-time basis and not built into the functionality of the card unlike the above mentioned providers. Also, some users have reported that some of the promotions don’t work, like how this anonymous user has sent us a screen recording of a Shopee cashback deal leading to an error page, saying that the “Budget has been exhausted”.

However, if you already have a YouTrip card sitting in your wallet, make use of the 0% foreign transaction fee to buy stuff online in other currencies or link it to foreign mobile apps such as WeChat or Taobao.

Pros—What we like about YouTrip

No overseas transaction fees

No currency exchange fees

Free top ups for Mastercard credit/debit cards and Visa debit cards

First $400/month free ATM withdrawal

Supports Apple Pay and Google Pay.

Cons—What we don’t like about YouTrip

Limited to only 10 currencies

Desktop experience is cumbersome

No cashback benefits

Between mid-market rates, wholesale rates, and real-time exchange rates: what’s the difference?

As a consumer, this is not something that you should base your decision on. Essentially what those above mentioned terms are talking about is the constantly changing rates of foreign currencies, and you can check it through the tools provided by Visa, Mastercard and Reuters. The difference will mostly boil down to the nearest cent, as illustrated in the Instarem Amaze card review.

Does that mean I don’t have to exchange foreign currencies ever again?

For short trips and urban cities, you may be able to get away with not having the local currency in cash, and just rely on debit. In most cases though, I reckon you’d still want to make a trip to Change Alley or Mustafa Centre to prepare some cash on hand.

This is because many countries are still very dependent on cash and the limit of S$350 for Wise (formerly TransferWise) and S$1,050 for Revolut (with Metal Plan, S$350 otherwise) without fees may not be sufficient for long trips.

Don’t forget that you’d have to hunt down the right ATM terminal overseas to get fee-free withdrawals. Otherwise, admin/processing fees may apply.

Is using a digital multi currency account better than a bank’s?

Electronic multi-currency account (e.g. BigPay, Instarem, Revolut, Wise, YouTrip) | Banks’ multi-currency savings accounts (e.g. DBS Multiplier, HSBC Everyday Global) |

Better conversion rates, transparent fees | Worse conversion rate with some markup, opaque fees |

Able to withdraw overseas (up to $350). Not able to withdraw SGD in Singapore. | Able to withdraw in Singapore and overseas (sometimes with no fee). |

No need to maintain a minimum balance | Usually has a minimum balance requirement |

Loose cents can be spent overseas or converted | May end up with loose cents that can’t be converted in various balances |

Banks rely on legacy structures that are still in place, which can mean unfavourable exchange rates and high fees.

However, borderless multi-currency accounts like Instarem, Revolut and Wise (formerly TransferWise) are not tied to legacy structures like the SWIFT network and multiple bank partnerships. Therefore, they can provide much lower fees, up to 6 times cheaper for currency conversion and remittance.

Example: SGD to THB on 6 Dec 2023

| S$1 | S$1,000 |

DBS Multiplier account | THB 25.77 | THB 25,765 |

Airport money changer | THB 25.85 | THB 25,853 |

Wise | THB 25.95 | THB 26,060 |

XE live rate | THB 26.22 | THB 26,217 |

*Before fees are applied.

As you can see, Wise’s rate is the closest to XE’s live rate. Factoring in Wise’s transfer fees of approximately 0.58%, converting S$1,000 costs $5.77, yielding a net of THB 26,060. Overall, that still yields the most.

A digital multi-currency account may be more convenient to apply for as well. Opening a bank account comes with requirements, one of which is to maintain a minimum balance. You don’t have to do that for electronic multi-currency accounts.

An irritating thing about using a multi-currency savings account is that you’d retain cents in various currencies that can’t be converted back after your travels.

With a digital multi-currency account like Wise, you can spend with your borderless Mastercard or Visa card and have the system choose the best existing currency to convert from. This gives you a chance to spend loose cents that you can’t convert back to Singapore Dollars.

That said, using a local multiplier savings account is convenient as you can use it to pay and withdraw money in Singapore seamlessly. You can also earn interest rates on certain foreign currencies.

In contrast, you can only withdraw up to $350 per month with no card fees overseas. This is with an electronic multi-currency account, and you can’t withdraw local currency in Singapore when the Payment Services Act was enforced in 2019.

That being said, the world is a lot different from what it used to be 3 years ago. Digital multi currency card accounts have caught up to the level of banks in terms of rewards and cashback promotions, whilst being on the bleeding edge of financial technology. Don’t miss out!

Know anyone who’s making travel plans? Share this article with them!

The post Digital Multi-Currency Accounts & Cards For Travel Spending: BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Digital Multi-Currency Accounts & Cards For Travel Spending: BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip appeared first on MoneySmart Blog.

Original article: Digital Multi-Currency Accounts & Cards For Travel Spending: BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance