Decoding Cava Group Inc (CAVA): A Strategic SWOT Insight

CAVA reports a robust increase in revenue and net income for the sixteen weeks ended April 21, 2024.

Strategic expansion and operational efficiency drive CAVA's growth trajectory.

CAVA's focus on Mediterranean cuisine and health-conscious offerings positions it well in the fast-casual segment.

Challenges include managing supply chain complexities and navigating competitive pressures.

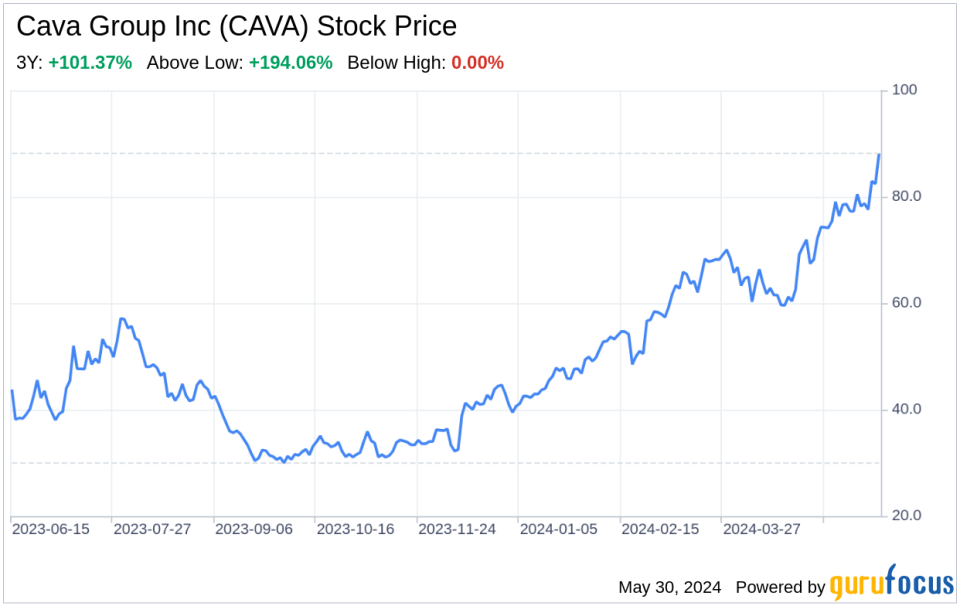

On May 29, 2024, Cava Group Inc (NYSE:CAVA), a leader in the Mediterranean fast-casual dining sector, filed its 10-Q report, revealing a comprehensive overview of its financial performance and strategic direction. The report highlights a significant year-over-year revenue increase from $203,083 thousand to $259,006 thousand and a remarkable turnaround in net income, swinging from a loss of $(2,141) thousand to a profit of $13,993 thousand. These figures underscore CAVA's successful execution of its growth strategy, operational improvements, and the appeal of its health-oriented menu to a broad customer base. As we delve into a SWOT analysis of Cava Group Inc, we aim to provide investors with a deeper understanding of the company's strengths, weaknesses, opportunities, and threats, informed by the latest financial data and market trends.

Strengths

Revenue Growth and Profitability: Cava Group Inc has demonstrated a strong financial performance, with a notable increase in revenue and a shift from a net loss to a net profit. This growth is a testament to the company's effective business model and operational excellence. The increase in revenue by over 27% from the same period last year, coupled with a net income of nearly $14 million, reflects the company's ability to scale successfully while maintaining profitability.

Brand and Menu Appeal: CAVA's focus on Mediterranean cuisine, known for its health benefits, positions the brand favorably in the fast-casual dining market. The company's ability to offer bold and satisfying flavors while promoting a healthful lifestyle resonates with the growing consumer demand for healthier dining options. This strength is reflected in the company's CAVA AUV (Average Unit Volume) and Same Restaurant Sales Growth, indicating strong brand loyalty and customer retention.

Weaknesses

Operating Expense Management: Despite the revenue growth, Cava Group Inc's operating expenses have also increased, particularly in areas such as labor, occupancy, and other operating expenses. The company must continue to manage these costs effectively to maintain its profitability. The increase in labor costs, partly due to higher average hourly wages, highlights the need for ongoing efficiency improvements and cost control measures.

Limited Diversification: CAVA's operations are heavily concentrated in the CAVA segment, with the majority of its revenue generated from this single brand. While the brand is strong, this concentration could expose the company to risks associated with market fluctuations and consumer preferences within the fast-casual Mediterranean niche. Diversifying revenue streams could help mitigate these risks.

Opportunities

Expansion Potential: CAVA has significant room for growth, with only 323 restaurants in operation as of April 21, 2024. The company's successful IPO and the subsequent financial resources provide an opportunity to accelerate its expansion strategy, both in existing markets and new geographic areas. This expansion can further increase brand presence and market share.

Digital and Delivery Channels: The rise of digital ordering and delivery services presents an opportunity for CAVA to enhance its digital revenue mix. By investing in its digital platforms and partnering with third-party delivery services, CAVA can cater to the convenience-driven segment of consumers, potentially driving sales and improving customer engagement.

Threats

Competitive Market: The fast-casual dining industry is highly competitive, with numerous players vying for market share. CAVA must continue to innovate and differentiate its offerings to maintain a competitive edge. The threat of new entrants and the aggressive expansion of existing competitors could pressure CAVA's market position and profitability.

Supply Chain Volatility: Fluctuations in the cost of ingredients and supply chain disruptions can impact CAVA's operations and margins. As the company grows, it will need to develop robust supply chain strategies to ensure consistent quality and availability of ingredients while managing costs effectively.

In conclusion, Cava Group Inc (NYSE:CAVA) exhibits a strong financial foundation and brand appeal, with significant growth opportunities in the fast-casual dining market. However, the company must navigate operational challenges and competitive pressures to sustain its momentum. By leveraging its strengths and addressing its weaknesses, CAVA can capitalize on market opportunities and mitigate potential threats. The company's strategic focus on expansion, digital innovation, and operational efficiency will be critical in shaping its future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.