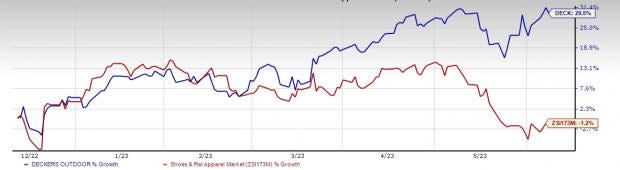

Deckers (DECK) Stock Rallies 29.5% in Six Months: Here's Why

Deckers Outdoor Corporation DECK stock has been doing well, owing to its efforts related to product innovations, store expansion and the enhancement of e-commerce capabilities. DECK’s focus on expanding its brand assortments, bringing a more innovative line of products and optimizing omnichannel distribution, bodes well.

Buoyed by the aforesaid tailwinds, this major footwear and accessories designer shares have appreciated 29.5% against the industry’s 1.2% dip. An impressive long-term projected growth rate of 18.4% further highlights the strength of this current Zacks Rank #3 (Hold) stock.

Analysts seem optimistic about the stock. The Zacks Consensus Estimate for Deckers’ fiscal 2024 sales and earnings per share (EPS) is pegged at $4 billion and $21.56, respectively. These estimates suggest growth of 9% and 11.3%, respectively, from the year-ago fiscal quarter’s corresponding figures. The consensus estimate for next fiscal year’s sales and EPS of $4.3 billion and $25, respectively reflects a corresponding increase of 8.6% and 15.8% year over year.

Let’s Delve Deep

Deckers is targeting profitable and underpenetrated markets to boost overall sales. In addition, the HOKA ONE ONE brand is also performing impressively. The brand continues to build its customer base through a combination of robust product innovation and a disciplined marketing approach. Deckers is progressing toward building HOKA ONE ONE into a major multibillion-dollar player, elevating the UGG brand as a global lifestyle brand with diverse product offerings and enhancing the direct-to-consumer (DTC) business.

Image Source: Zacks Investment Research

Management has also been constantly developing its e-commerce portal to efficiently resonate with the evolving trends. The company is focused on opening smaller concept omnichannel outlets and expanding programs such as Retail Inventory Online, Infinite UGG, Buy Online, Return In Store and Click and Collect to enrich customers’ shopping experience. Markedly, DTC revenues grew 19.5% during the fourth quarter of fiscal 2023.

Furthermore, Deckers is focused on product and marketing strategies that are more skewed toward customers. The company has also been focusing on expanding its product categories per the customer purchasing trends that differ with the weather. Its brand strength also bodes well. We believe that management’s focus on ramping up inventory, optimizing channel mix to fulfill consumer demand, scaling production to support the growth of brands and implementing targeted price increases should position Deckers well for growth.

Deckers envisions fiscal 2024 net sales of about $3.950 billion. This suggests an increase of about 9% from the $3.627 billion reported in fiscal 2023. This growth is likely to be driven by the HOKA brand as it continues to outpace expectations in DTC and expand market share across global wholesale access points. The HOKA brand is likely to rise by 20% for fiscal 2024, implying over $280 million of incremental revenues compared to the prior year. Also, management forecasts experiencing sturdy DTC demand and growth as it focuses on driving consumer acquisitions and retention, margin improvement and marketplace management. Management expects UGG’s revenues to increase in the low single digits, supported by international expansion and a flat U.S. marketplace, as the company focuses on maintaining the brand’s pull model.

Eye These Solid Picks

Some better-ranked companies are Royal Caribbean RCL, Crocs CROX and lululemon athletica LULU.

Royal Caribbean sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 26.4%, on average.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates increases of 47.9% and 158.3%, respectively, from the year-ago period’s reported levels.

Crocs, which offers casual lifestyle footwear and accessories, presently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 15%.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and EPS suggests growth of 13.1% and 2.8% from the year-ago period’s reported figure. CROX has a trailing four-quarter earnings surprise of 21.8%, on average.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 16.7% and 18%, respectively, from the year-ago reported figures. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance