Deckers (DECK) Boasts Strong Brands, Omni-Channel Growth

Sports brands like Deckers Outdoor Corporation DECK are gaining from consumers’ return to outdoor activities, now that pandemic-led restrictions have been relaxed. Deckers is witnessing growth across its brands as well as direct-to-consumer channels. The company’s strategic endeavors to boost offerings, marketing and omni-channel capabilities have been yielding. Such upsides have contributed to the company’s first-quarter fiscal 2022 results.

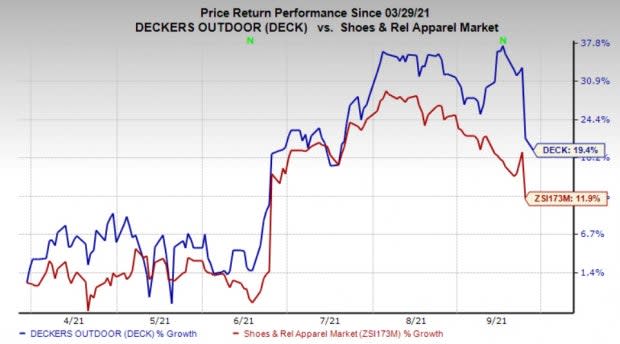

Shares of this well-known outdoor sports as well as other lifestyle-related footwear and accessories have rallied 19.4% in the past six months compared with the industry’s rise of 11.9%. Let’s take a closer look at the factors acting as aces for this Zacks Rank #2 (Buy) company.

Brand Strength is an Upside

Deckers is focusing on product and marketing strategies that are well aligned toward customers’ needs. The company has been expanding its brand lines and bringing more innovative products. Greater acceptance of the UGG brand across key markets and growth of the Teva brand are noteworthy. HOKA ONE ONE brand continues to build customer base through a combination of disruptive product innovation and disciplined marketing approach. The first quarter showcases the progress Deckers is making toward attaining long-term goals. The milestones include building HOKA ONE ONE into a $1-billion plus brand and elevating UGG as a global lifestyle brand with diverse product offerings. The company also expects the Teva and Koolaburra brands to keep growing. In terms of assortments, the company is focused on boosting casual shoes and boots, winter as well as seasonal boots.

Image Source: Zacks Investment Research

Online Wing Appears Sturdy

To cater to consumers’ growing preference for online shopping, Deckers has been constantly developing its e-commerce portal. The company has invested substantially to strengthen its online presence and improve shopping experience for its customers. It is focused on opening smaller concept omni-channel outlets. It is also striving to attract more online traffic through its direct-to-consumer channel.

Continued digital efforts are likely to keep favoring the company’s direct-to-consumer sales. During first-quarter fiscal 2022, direct-to-consumer net sales increased 14.7% to $160.4 million. The company aims to build a direct-to-consumer business that will represent 50% of total revenues.

More Notable Strategic Efforts

Deckers is targeting profitable and underpenetrated markets, by expanding assortment availability in online and across stores. The company is focused on store expansion across key markets. In order to capture incremental sales and margins, the company is selling directly to wholesale customers.

Wrapping up, Deckers’ well-chalked efforts have aided the company to stay strong in the sports apparel space. The company’s strong start to fiscal 2022 led management to provide an encouraging outlook for the year. It envisions net sales in the range of $3.010-$3.060 billion, suggesting an increase of 18-20% from $2.546 billion reported in fiscal 2021. Earnings are projected in the band of $14.45-$15.10 per share, calling for an increase from earnings of $13.47 reported in the last fiscal.

3 Shoes & Apparel Picks You Can’t Miss

Foot Locker, Inc. FL, sporting a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Crocs, Inc. CROX, flaunting a Zacks Rank #1, delivered an earnings surprise of 43.6% in the last four quarters, on average.

Steven Madden, Ltd. SHOO, with a Zacks Rank #2, delivered an earnings surprise of 56.2% in the last four quarters, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance