Deciphera (DCPH) Down Despite Narrower-Than-Expected Q1 Loss

Deciphera Pharmaceuticals, Inc. DCPH reported first-quarter 2022 loss of 80 cents per share, narrower than the Zacks Consensus Estimate of a loss of 84 cents. In the year-ago quarter, the company had reported a loss of $1.06.

Total net revenues were $29.2 million in the quarter, which surpassed the Zacks Consensus Estimate of $27 million. Revenues rose 15.8% year over year.

Shares of Deciphera were down 1.5% on May 5 despite the better-than-expected earnings result. The stock has rallied 8.8% in the year so far against the industry’s decline of 20.1%.

Image Source: Zacks Investment Research

In May 2020, the FDA approved Deciphera’s sole marketed drug, Qinlock (ripretinib), to treat adult patients with advanced gastrointestinal stromal tumors (“GIST”) who have received prior treatment with three or more kinase inhibitors, including Novartis’ NVS Gleevec (imatinib).

NVS has lost the patent protection for Gleevec, which faces increasing generic competition in major markets.

Quarter in Detail

Apart from Qinlock, there is no other marketable drug in the company’s portfolio. Total revenues comprised net product revenues and collaboration revenues. Net product revenues were $28.8 million, reflecting a sequential increase of 21.5%. Qinlock generated $23.4 million in sales in the United States and $5.4 million in sales in ex-U.S. markets.

Collaboration revenues of $0.4 million comprised commercial supply and royalty revenues under the company’s license agreement with Zai Lab.

Research and development expenses were $47.4 million, down 14.9% year over year, owing to lower costs related to clinical studies on Qinlock.

Selling, general and administrative expenses were $28.3 million, down 7.8% year over year, owing to a decrease in professional and consultant fees.

Deciphera had cash, cash equivalents and investments worth $275.4 million as of Mar 31, 2022, down from $327.6 million as of Dec 31, 2021.

Other Updates

In November 2021, the European Commission approved Qinlock for treating adult patients with advanced GIST who have received prior treatment with three or more kinase inhibitors, including Novartis’ Gleevec. The nod in Europe should boost sales in 2022 and beyond.

Deciphera is evaluating vimseltinib in the phase III MOTION study for the treatment of tenosynovial giant-cell tumor.

The company is also planning to initiate three phase Ib studies on DCC-3116 in combination with FDA-approved MEK inhibitor, trametinib, and binimetinib as well assotorasib, an FDA- approved KRASG12C inhibitor, for treating patients with advanced or metastatic solid tumors.

In November 2021, Deciphera announced a corporate restructuring plan to prioritize the development of select clinical programs, streamline commercial operations, reduce expenses and extend its cash runway. The company reduced its current workforce by approximately 35% or almost 140 positions.

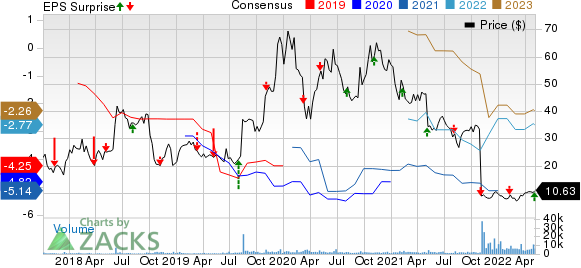

Deciphera Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Deciphera Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Deciphera Pharmaceuticals, Inc. Quote

Zacks Rank & Other Stocks to Consider

Deciphera currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector are Vertex Pharmaceuticals Incorporated VRTX and Applied Therapeutics, Inc. APLT, both carrying the same Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vertex’s earnings estimates have been revised 0.3% upward for 2022 and 0.1% upward for 2023 over the past 60 days. The VRTX stock has rallied 21.3% year to date.

Earnings of Vertex have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Applied Therapeutics’ loss per share estimates have improved 34.1% for 2022 and 20.2% for 2023 over the past 60 days.

Earnings of Applied Therapeutics surpassed estimates in two of the trailing four quarters, met the same once and missed the same on the other occasion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Deciphera Pharmaceuticals, Inc. (DCPH) : Free Stock Analysis Report

Applied Therapeutics Inc. (APLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance