DB, UOBKH: 3 Investment Themes For 2H17

Since the start of the year, STI has gained 12 percent with many heavyweight component stocks returning to their mid-cycle level valuations. 1Q17 had been driven largely by a return of confidence in the Singapore markets.

Many investors who were previously worried about the outlook for Singapore markets ditched their negative sentiments and adopted a ‘the worst is behind us’ mentality to drive the STI.

So how should investors invest in 2H17? Moving forward, delivering on raised growth expectations and the potential for earnings upgrades will be the focus. Deutsche Bank Research (DB) and UOB Kay Hian Research (UOBKH) recommend three investment themes to follow in 2H17.

1. Merger and acquisitions (M&A)

There has been a significant increase in M&A activities among SGX-listed companies in the past six months.

At the moment, there are seven companies with a total market cap of $26 billion that are currently either under strategic review and/or subjects of potential M&A.

DB opines that the rise in M&A activities is largely driven by strategic reviews to “maximise the value of shareholders’ stakes, family offices divesting non-core assets and value seekers acquiring assets below book value”.

Moving forward, DB believes that M&A will continue to be a key and active theme in the Singapore market.

There are three sub-themes that DB highlights for investment.

1. Real Estate

DB views the real estate sector as a key focus of M&A in the coming half of the year due to its significant valuation disparity between listed and private markets.

Moreover, with the increasing competition for land as companies fight to increase their land bank, real estate companies could merge or acquire peers to achieve more land bank.

2. Singapore Inc

Some of the government-linked companies (or Singapore Inc.) are suffering from a difficult business climate.

As such, DB sees opportunities of the potential restructuring of some of the existing Singapore Inc to create further scale and eliminate unnecessary internal competition.

3. Family Businesses

DB also sees opportunities for M&A where wealthy families could streamline their listed companies to “maximise returns from both capital markets and from an operational perspective”.

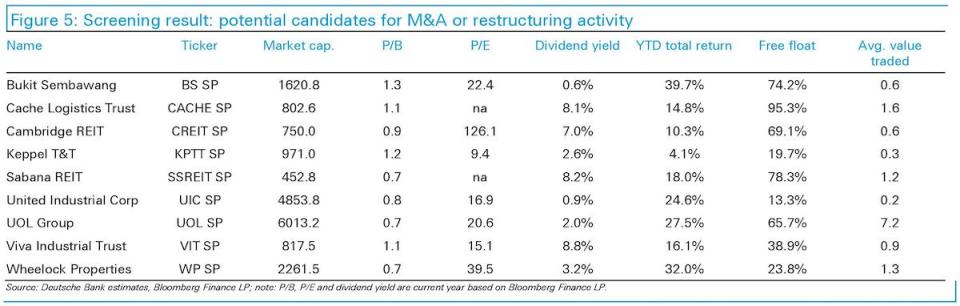

Some of the possible candidates for potential M&A or restructuring activity include:

2. Deep value & diversification strategy with REITs

While the oversupply in the REITs space is not yet digested, there are increasing signs of a supply-led recovery.

The improvement in fundamentals for business parks, hotel and residential has led to increasing interest from investors. For industrial parks, business and hi-tech segments could benefit from spillover office demand.

According to CBRE, this is attributed to the lack of pre-committed business park and hi-tech space supply from 2017. In the industrial space, UOBKH recommends A-REIT as the preferred pick.

Another sub-sector that UOBKH recommends is the hospitality sub-sector. The supply of hotel rooms in 2018 is expected to slow. As hotel room supply has historically exhibited a tendency of being deferred,

UOBKH believes that this could be an opportunity for investors to pick up hospitality REITs. Among the hospitality REITs, Frasers Hospitality Trust (SGX: ACV) is the preferred pick of UOBKH.

3. Opportunity for underperformers

The Singapore market is currently trading at 15x FY17E price-earnings ratio (P/E) and 1.2x FY17E price-book ratio (PB). Its current valuation is still slightly below the long-term average valuation.

DB believes that the slight discrepancy with long-term average valuation gives rise to an opportunity for some of the heavyweight stocks to do well in 2H17, given the rising expectations for these index heavyweights in recent months.

Among the index heavyweights, DB highlights Singapore Telecommunications Limited (SGX: Z74), Comfortdelgro Corporation Limited (SGX: C52) and CapitaLand Mall Trust (SGX: C38U) as the top three underperformers that are poised for better returns in the near term.

Yahoo Finance

Yahoo Finance