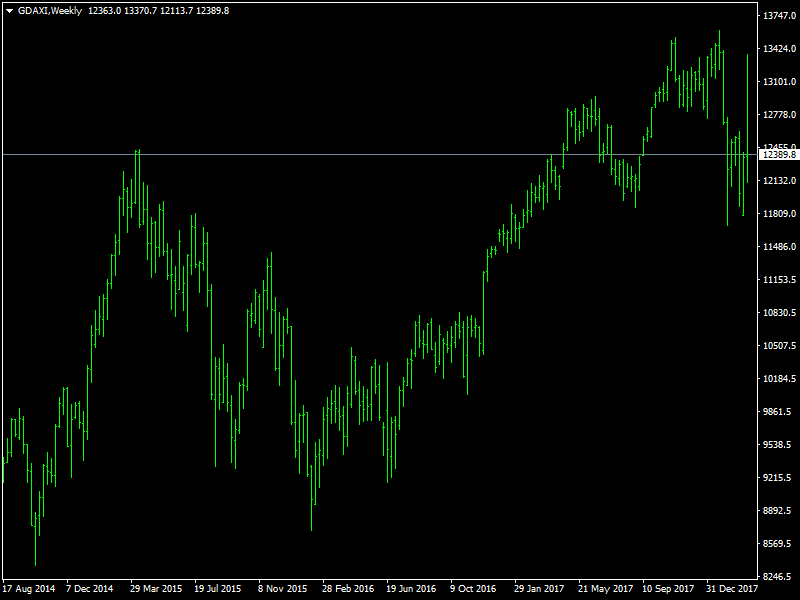

DAX Index Fundamental Analysis – week of March 19, 2018

The DAX index continues to trade within the larger range, despite some volatility within the range over the last week. This has been the case with the index over the past few weeks where the investors have been reluctant to push the index in either direction as they are still uncertain how the various political tensions and developments and the global economy is going to pan out.

DAX Stays In Range

There have been treats and fears of a global trade war breaking out and this has affected the risk sentiment around the globe. The US administration under Trump continues to pursue the policy of nationalism over globalism and it is only a different form of that as we saw them impose a new tariff plan. Though the plan was subsequently watered down, the risk continues to remain with new reports of tariffs being mulled against some of the Chinese goods as well. This is likely to continue to keep the pressure on the markets though the US stock indices seem to be taking it very well as the focus on domestic strength is likely to benefit them.

Also, the DAX has been under pressure over the last few weeks due to the eventuality of the QE being tapered and being wound down during the course of the year. This is likely to happen and good data is only going to accelerate this process even further. That is why, we are seeing the index being under pressure and continuing to find it difficult to break higher despite some strong data from Germany and the Eurozone as a whole.

In the coming week, there is not much by way of data or news from the Eurozone or Germany but we are likely to see some volatility as we have the G20 meetings scheduled for the first half of the week while we have the FOMC meeting and announcement later in the week where the Fed is expected to announce their first rate hike for the year. These are unlikely to directly impact the DAX though, and hence we believe that we are likely to see more of the consolidation as the index continues to remain volatile within the larger range.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance