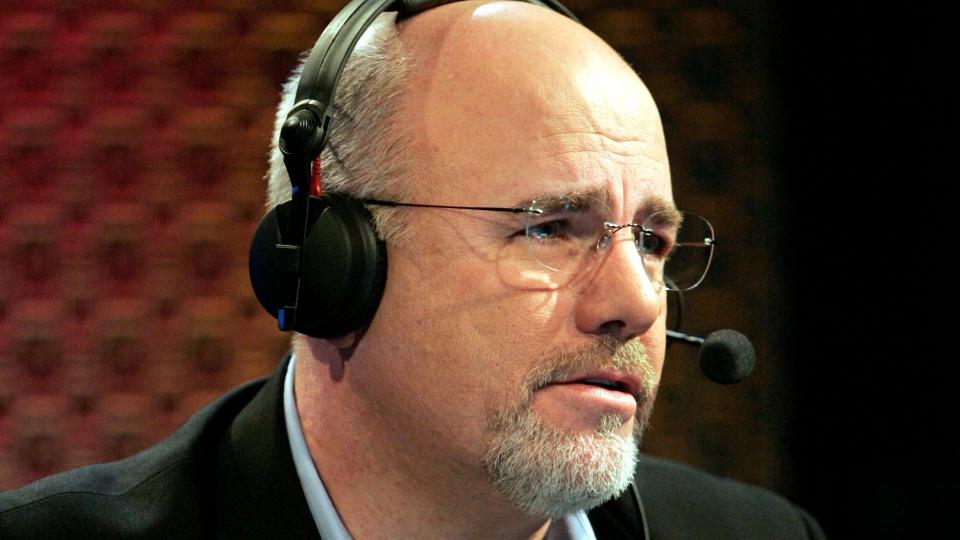

Dave Ramsey: This Is the Financial Lie Your Friends Tell Each Other

How much credit do you need to rent an apartment? According to a YouTube video by money expert Dave Ramsey from his call-in show, you don’t need credit at all.

Discover More: Dave Ramsey’s Best Passive Income Ideas for 2024 — 15 ‘Steady, Profitable’ Ways To Build Wealth Fast

Find Out: $10K or More in Debt? See If You Could Become Debt-Free (for Less Than You Owe)

Ramsey’s 23-year-old caller was surprised. Like many people, he’d heard you need a good credit history to get your place, so he was sure he needed to build up his credit.

The rest of the conversation is an essential lesson for anyone looking to build a credit history.

Busting the Credit Myth

Ramsey believes in doing his homework. He told his caller that he and his team had called multiple apartment complexes in a given area, pretending to be students without debt or credit and asking to rent.

According to Ramsey, nine out of 10 will say yes.

Renting Without Credit

Ramsey says that renters without credit histories may pay slightly higher security deposits, but that money is recoverable if you’re a responsible tenant.

Multiple reputable sources support Ramsey’s claim. According to the credit bureau Experian, tenants without credit can land leases with otherwise strong applications.

Most importantly, you need to earn enough to afford the rent easily. The industry standard is for rent to be at most 30% of your monthly income. Landlords may ask for more if you have no credit.

Sweetening the Deal

If a landlord seems hesitant and has some flexibility to negotiate, consider offering more upfront. You might offer to pay several months’ rent at move-in or increase your security deposit.

Another option for credit-free tenants is to have someone co-sign your lease. A co-signer agrees to pay your rent if you default. It’s a big ask, but it can make a difference with a hesitant landlord.

Trending Now: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

When You Might Need Credit

Ramsey is a tireless advocate for debt-free living. He refers to credit as a never-ending cycle of borrowing to improve your credit, only to borrow more and go deeper into debt.

Ramsey repeatedly tells consumers to avoid the trap of borrowing to buy things they don’t need and opt to buy things only when they can afford to pay cash. This is an appealing policy, but it’s not always feasible for everyone.

Auto and Personal Loans

Ramsey advises against financing a car. He encourages consumers to save up and buy a used car with cash. Theoretically, if you keep saving what you’d pay to a lender, you’d eventually have enough to upgrade.

But life happens, and the time may come when you need a car loan — or even a personal loan to cover emergencies. And if you have no credit history, lenders will charge you more interest because they believe you pose a higher risk.

Mortgages

Many people can save up for a low-end used car. However, with the median selling price of a home above $400,000, paying cash is out of reach for plenty of homebuyers.

There are other ways to buy a house without credit. The Federal Housing Administration offers options for mortgage applicants with “non-traditional credit histories” to submit other types of payment records, including rent and utility bills. Some private lenders also accept alternative proof.

Still, it’s easier and often less costly to get a mortgage with a strong credit history. The stronger, the better.

How To Use Credit Without Getting Trapped

Good credit can help you save money, but Ramsey has a point. You want to avoid putting yourself in an endless cycle of borrowing, repaying and borrowing more.

Borrow the Minimum

The key to building credit is following Ramsey’s advice and only buying what you can afford to pay for in cash. But instead of buying everything with cash or debit, you’ll make select purchases with a credit card. You’ll then pay that card off at the end of the month.

Getting a credit card will help your credit score in two major ways. First, it gives you “available credit” in the form of your card limit. Staying as far below that limit as possible when building credit is essential. Less credit use shows responsible borrowing.

Pay On Time

Using the minimum amount of credit also keeps your balance affordable so that you can pay it off at the end of the month. Any remaining amount will accrue interest if you don’t pay your entire balance by the due date.

Paying by the due date is essential. On-time payment is one of the most effective and simplest ways to boost your credit score — and in the age of automatic payments, there’s no excuse for paying late.

Choose the Right Card

If you’re new to the credit life, look for a beginner-friendly card option. Consider options that offer rewards like cash back so you can benefit in other ways besides a great credit score. Most importantly, keep paying on time and don’t carry a balance.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: This Is the Financial Lie Your Friends Tell Each Other