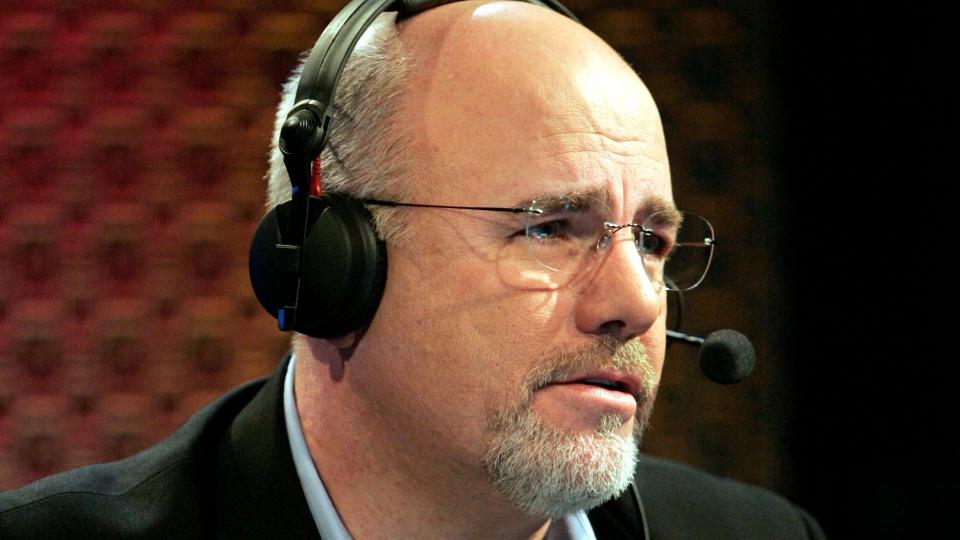

Dave Ramsey: Follow These 5 Rules That Lead to Wealth ‘100% of the Time’

Dave Ramsey, the well-known author, radio host and provider of financial advice, has been recognized by GOBankingRates as one of its Top 100 Money Experts. He is the host of the radio show “The Ramsey Show,” author of “The Total Money Makeover,” and founder of Ramsey Solutions, a service that helps customers learn to budget and reduce debt.

Learn More: 6 Things Minimalists Never Buy — and You Shouldn’t Either

Find Out: Owe Money to the IRS? Most People Don’t Realize They Should Do This One Thing

According to Ramsey, there are five main rules you need to follow to build wealth. “If you do these five things with money over a period of time, like 10 or 15 years, you will build a level of wealth 100% of the time,” he said. Here they are.

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

Get on a Written Budget

Ramsey advised to first make a written plan. This means writing a budget on paper every month to help you manage your money and use your income more effectively.

“You can decide today to be good at this or leave. You can decide to do a budget today. Get out a yellow pad or go to a free budget online, everydollar.com,” he said.

Get Out of Debt

According to Ramsey, your best wealth-building tool is your income and the main wealth destroyer is debt. He uses car payment debt as an example, citing data from the National Auto Dealers Association which found that the average car payment is $499.

“But if you take $500 a month and invest it from age 30 to age 70, in a decent growth stock mutual fund, you’ll have $5.6 million. That ‘s what a car payment costs you,” he said. “So who do you make rich? General Motors, Ford, Lexus, I don’t know, Toyota? You made somebody rich and it wasn’t you.”

Related Article: Dave Ramsey: 7 Vacation Splurges That Are a Waste of Money

Foster High-Quality Relationships

When you’re out of debt, Ramsey said that you need “to be careful to foster high-quality relationships.” According to him, there is a huge correlation between the people you surround yourself with and building wealth, “because you become who you hang around with.”

Ramsey added that studies have shown that over a 10-year period of time, your income will approximately land within 10% to 20% of the average of your 10 closest friends’ income because you will have the same habits they have.

Save and Invest

The fourth thing you need to do, according to Ramsey, is save and invest. This is something he has reiterated for years in his popular “Baby Steps” program. To start off, your goal should be to save $1,000 as fast as you can for an emergency fund, which will cover unexpected life events you can’t plan for.

“And there are plenty of them. You don’t want to dig a deeper hole while you’re trying to work your way out of debt,” he said.

Be Generous

Finally, the last rule you need to follow, according to Ramsey, is what he calls “cheerful generosity.”

“Generous people are more attractive. They smile; they’re not grouchy. It’s not all about them. They’re the ones that open the door. They’re the ones when the grocery bag has the bottom drop out and your groceries are rolling all over the parking lot, they’re the ones out there helping you pick it up.”

Ramsey believes generosity is a spirit that changes everything in your life. However, he conceded that it’s also difficult to give if you’re broke.

“If you’re in debt and you haven’t saved any money, and you don’t have a plan and you’re not hanging out with other people who are givers,” he said. “So change! You get to decide today. It’ll change your life, it’ll change your family tree.”

More From GOBankingRates

What Makes a Good Bank in 2024, According to a Banking Expert

I'm a Personal Finance Writer: These Are the Worst Money Mistakes I Made in 2023

This article originally appeared on GOBankingRates.com: Dave Ramsey: Follow These 5 Rules That Lead to Wealth ‘100% of the Time’