Darden (DRI) Earnings Surpass Estimates in Q1, Sales Miss

Darden Restaurants, Inc. DRI reported first-quarter fiscal 2020 results, wherein earnings surpassed the Zacks Consensus Estimate but sales lagged the same. With this, the company delivered third-straight quarter of bottom-line beat, whereas the top line missed the consensus mark for the second straight quarter.

Following the quarterly results, shares of Darden Restaurants decreased nearly 3% in the pre-market trading session. However, the stock has gained 27.3% so far this year compared with the industry’s 27.1% rally.

In the quarter under review, adjusted earnings came in at $1.38 per share, which outpaced the Zacks Consensus Estimate of $1.36. The bottom line also increased 3% year over year on higher sales. Results were aided by the company’s relentless efforts to improve the basic operating factors of the business — food, service and ambiance.

Total sales of $2,133.9 million lagged the consensus mark of $2,137 million. However, sales increased 3.5% from the prior-year quarter. The upside was driven by the addition of 40 net restaurants and a 0.9% increase in blended comps.

Sales by Segments

Darden reports business under four segments — Olive Garden, LongHorn Steakhouse, Fine Dining that includes The Capital Grille and Eddie V's, and Other Business.

Sales at Olive Garden increased 3.6% year over year to $1,090.2 million. Comps grew 2.2% at the segment, lower than the prior-quarter’s comp growth of 2.4%. Traffic declined 0.8%. Pricing improved 2.2% and menu-mix increased 0.8%.

Sales at Fine Dining improved 4.8% to $136.1 million. Comps at The Capital Grille rose 1.5% compared with 2.9% growth recorded in fourth-quarter fiscal 2019. Further, Eddie V's posted comps growth of 1.2%, lower than 2% improvement recorded in the prior quarter.

Sales at Other Business grew 1.8% year over year to $457.4 million. However, comps at Seasons 52 fell 4.2% in the reported quarter compared with a comps decline of 1.5% in fourth-quarter fiscal 2019. Comps at Yard House inched down 1.9% compared with 1.4% decrease in the prior quarter. Meanwhile, comps slipped 4.2% at Bahama Breeze compared with a decline of 1.9% in the preceding quarter.

At LongHorn Steakhouse, sales rose 4.6% to $450.2 million. Comps at the segment increased 2.6%, down from comps growth of 3.3% in the fiscal fourth quarter. Traffic increased 0.3%. Also, pricing and menu mix grew 1.7% and 0.6%, respectively.

In the reported quarter, comps at Cheddar's decreased 5.4% compared with a 3.4% decline in fourth-quarter fiscal 2019.

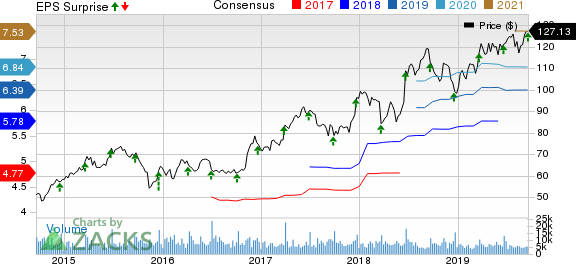

Darden Restaurants, Inc. Price, Consensus and EPS Surprise

Darden Restaurants, Inc. price-consensus-eps-surprise-chart | Darden Restaurants, Inc. Quote

Operating Highlights & Net Income

In the fiscal first quarter, total operating costs and expenses increased 3.2% year over year to $1,932.4 million. The rise was due to an overall increase in food and beverage costs, restaurant expenses, and labor costs.

Net earnings in the first quarter totaled $170.6 million, up 2.6% from the year-ago level.

Balance Sheet

Cash and cash equivalents as of Aug 25, 2019, totaled $350.8 million, up from $457.3 million as of May 23, 2019.

Inventories summed $199 million at the end of the reported quarter. Long-term debt as of Aug 25, 2019, was $928 million, up from $927.7 million as of May 26, 2019.

During the fiscal first quarter, Darden repurchased approximately 0.8 million shares of its common stock for roughly $95 million. The company also authorized a fresh share repurchase program of $500 million.

Fiscal 2020 Outlook

Darden reiterated its fiscal 2020 outlook. The company continues to expect total revenue growth of 5.3-6.3% during the fiscal year. This will include the 2% positive synergy from the 53rd week. Comps are projected to increase 1-2%. Darden’s earnings per share are anticipated to be $6.30-$6.45.

Meanwhile, the company expects inflation to be up 2.5% in 2020. With an effective tax rate of 10-11%, total capital spending is expected to be $450-$500 million. Darden plans to open 50 gross and 44 net new restaurants in 2020.

Zacks Rank & Key Picks

Darden has a Zacks Rank #3 (Hold). Better-ranked stocks worth considering in the same space include Yum China Holdings, Inc. YUMC, Starbucks Corporation SBUX and Shake Shack Inc. SHAK, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Yum China, Starbucks and Shake Shack have an impressive long-term earnings growth rate of 9.4%, 13% and 22.5%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Yum China Holdings Inc. (YUMC) : Free Stock Analysis Report

Shake Shack, Inc. (SHAK) : Free Stock Analysis Report

Starbucks Corporation (SBUX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance