Danaher's (DHR) Aldevron Buyout to Aid Genomic Medicine

Danaher Corporation DHR yesterday announced that it agreed to acquire Fargo, ND-based Aldevron. The purchase transaction has been valued at $9.6 billion and will help the company expand its medicine business.

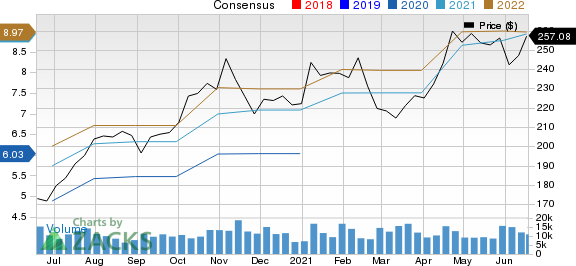

The news of the buyout seems to have boosted investors’ sentiments, resulting in a 5% increase in Danaher’s stock price yesterday. The trading session closed at $257.08.

Aldevron specializes in manufacturing mRNA, proteins and plasmid DNA. The products are mainly used by pharmaceutical and biotechnology customers for commercial, research and clinical purposes. This privately-held company has founded in 1998 and employees 600 people.

Inside the Headlines

As noted, Danaher intends on paying the purchase price of $9.6 billion with cash on hand and funds raised through commercial paper.

The completion of the transaction is subject to the receipt of regulatory approvals and satisfaction of other customary closing conditions. When accomplished, Aldevron will be integrated with Danaher’s Life Sciences segment. It will work as an operating company (stand-alone).

Notably, the Life Sciences segment offers a broad range of research tools used for analysis in areas — including genes, proteins, metabolites and cells. The segment serves various industries — including biopharmaceutical, food and beverage, medical, aerospace, microelectronics, and general industrial. Revenues generated in the first quarter totaled $3,546 million, reflecting growth of 114.9% from the year-ago quarter. It represented 51.7% of the company’s total revenues in the first quarter.

Danaher anticipates the buyout to strengthen its foothold in the genomic medicine field. Through Aldevron, introducing vaccines and life-saving therapies will be a lot easier for Danaher’s customers.

Danaher’s Other Acquisitions

We believe that the above-mentioned transaction is consistent with the company’s policy of acquiring businesses to gain access to new customers, regions and product lines. In the first quarter of 2021, buyouts boosted Danaher’s sales by 34.5%.

In first-quarter 2021, Danaher’s Cytiva acquired Canada-based Vanrx Pharmasystems and IDT bought Swift Biosciences. It is worth noting here that Cytiva is the name of the operating company that was formed after Danaher acquired General Electric Company’s GE BioPharma business in March 2020. The acquired BioPharma business was added to Danaher’s Life Sciences segment.

Zacks Rank, Price Performance and Estimate Trend

With a market capitalization of $174.6 billion, Danaher currently carries a Zacks Rank #2 (Buy). The company is poised to benefit from solid product offerings, the pandemic-induced demand, shareholder-friendly policies and inorganic initiatives.

In the past three months, the company’s shares have gained 16.3% as compared with the 5.4% growth recorded by the industry.

Image Source: Zacks Investment Research

In the past 60 days, the Zacks Consensus Estimate for its earnings has been increased by 19.5% to $8.93 for 2021 and 11.6% to $8.97 for 2022. Notably, there were eight upward revisions in estimates for 2021 and seven for 2022 in the past couple of months.

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

Also, earnings estimates for the second quarter are pegged at $2.04, reflecting an increase of 15.9% from the 60-day-ago figure.

Other Stocks to Consider

Two other top-ranked stocks in the industry are Carlisle Companies Incorporated CSL and Crane Co. CR. While Carlisle currently sports a Zacks Rank #1 (Strong Buy), Crane carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for the stocks have improved for the current year. Further, earnings surprise for the last reported quarter was 116.18% for Carlisle and 26.72% for Crane.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Crane Co. (CR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance