Crude Oil Prices Recover with Risk Appetite on Brexit News Lull

DailyFX.com -

Talking Points:

Crude oil prices rebound after testing range support

Gold prices in consolidation mode above $1300/oz

Lull in Brexit news keeps markets in digestion mode

Commodities prices have settled into uneasy consolidation of Brexit-inspired volatility. Crude oil prices recovered for a second consecutive day, rising along stock prices. Risk appetite improved amid a lull in fresh news-flow advancing the post-referendum UK narrative, allowing markets to transition into digestion mode (as expected). An unexpectedly large weekly inventory drawdown (-4.05m bbl vs. -2.5m bbl forecast) may have bolstered support for the WTI contract.

Gold prices are treading water. The post-Brexit correction across the asset spectrum has helped engineer a modest improvement in the US monetary policy outlook (as priced into Fed Funds futures) – undermining the appeal of anti-fiat assets – but lingering uncertainty looks to have contained outright selling pressure. Indeed, the latest positioning data from the CFTC suggests net-long gold futures exposure is at the highest since at least 1993.

Looking ahead, central bank commentary is likely to be in focus. St. Louis Fed President James Bullard and Bank of England Governor Mark Carney are scheduled to speak. The latter may help offer greater detail on how the post-Brexit reaction thus far fit into the BOE’s scenario analysis and hint at what the near-term policy response could look like. The former may help illuminate the thinking on the FOMC about knock-on effects from the UK’s decision to leave the EU on the path of interest rate hikes.

In both instances, the probability that truly trend-defining commentary emerges seems decidedly low. Central banks operate with a medium term view and officials at the Fed and the BOE have almost certainly agreed to opt for a wait-and-see approach, waiting to assess the referendum’s impact on progress toward their policy objectives. With that in mind, sentiment trends may retain control over price action. Absent fresh fodder for the Brexit narrative, a broadly consolidative tone is likely to persist.

Most FXCM traders are short crude oil. Find out here what this may hint about the price trend!

GOLD TECHNICAL ANALYSIS – Gold prices paused to consolidate above the $1300/oz, as suspected. From here, a daily close below the 50% Fibonacci expansion 1308.12 exposes the 38.2% level at 1294.44. Alternatively, a breach of resistance at 1321.79, the 61.8% Fib, targets the 76.4% expansionat 1338.72.

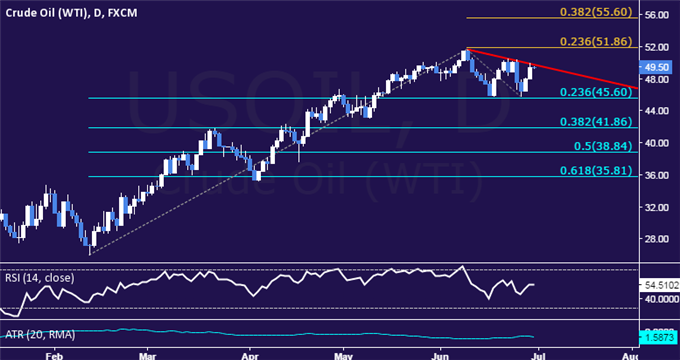

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices have settled into digestion mode having found resistance below the $52/bbl figure. A daily close below the 23.6% Fibonacci retracement 45.60 targets the 38.2% level at 41.86. Alternatively, a push above falling trend line resistance – now at 49.73 – exposes the 23.6% Fib expansionat 51.86.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance