Crude Oil Price: Two-Month Down Trend Broken

DailyFX.com -

Talking Points:

Crude Oil Gains Most in Six Years, Breaks 2-Month Down Trend

Upside Correction May Be Sizable But Trend Still Firmly Bearish

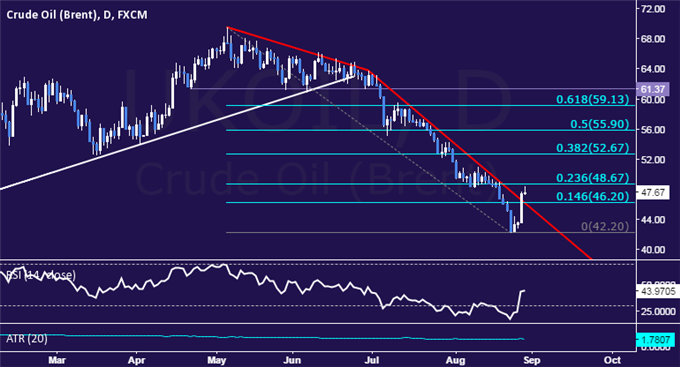

Crude oil prices launched a sharp recovery having found support above the $42/barrel figure, producing their largest daily advance in over six years. The move overturned a two-month down trend, opening the door for the possibility of a larger recovery in the cards ahead.

From here, the next key level of resistance comes in at 48.67, the 23.6% Fibonacci retracement, with a break above that on a daily closing basis exposing the 38.2% threshold at 52.67. Alternatively, a turn back below the intersection of falling trend line resistance-turned-support and the 14.6% Fib at 46.20 clears the way for another challenge of the August 24 low at 42.20.

On balance, crude oil’s dominant trend has favored the downside since mid-June 2014, when a long period of congestion lasting since April 2011 gave way to an aggressive selloff that carried on for seven consecutive months. An upside correction began in mid-January and delivered a rebound of over 55 percent before prices turned lower anew. Looking over the past decade, counter-trend reversals have tended to be similarly sizable, suggesting the current move higher may have significant follow-through ahead. Still, the overall trajectory continues to point firmly lower.

KEY UPCOMING EVENT RISK:

28 AUG 2015, 12:30 GMT – US Core PCE (YoY) (JUL) – Expected: 1.3%, Prev: 1.3%

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance