Crown Castle's (CCI) Q4 FFO and Revenue Surpass Estimates

Crown Castle International Corp.’s CCI fourth-quarter 2021 adjusted funds from operations (AFFO) per share of $1.77 surpassed the Zacks Consensus Estimate of $1.71. However, the figure was 26.6% lower than the year-ago quarter’s $2.33.

Net revenues of $1.65 billion improved 10.8% year over year in the fourth quarter. Further, the top line beat the Zacks Consensus Estimate of $1.63 billion.

Growth in site-rental revenues amid elevated tower space demand aided the top-line performance. Also declining operating expenses acts as tailwind.

For 2021, Crown Castle reported AFFO per share of $6.95, beating the Zacks Consensus Estimate of $6.89. Moreover, the figure increased 2.5% from the prior year’s $6.78. Net revenues of $6.34 billion improved 8.6% from the prior year’s $5.84 billion. Moreover, the reported figure beat the Zacks Consensus Estimate of $6.31 billion.

Per management, “We generated significant growth in 2021, including 14% AFFO per share growth and an 11% increase in our common stock dividend per share, as our customers began upgrading their existing cell sites as part of the first phase of the 5G build out in the U.S.”

Quarter in Detail

During the fourth quarter, site-rental revenues came in at $1.5 billion, up 9% year over year. The organic contribution of $79 million to the site rental revenues reflects 5.8% year-over-year growth. Further, services and other revenues rose 27.7% year over year to $180 million.

Quarterly operating expenses declined 3.7% year over year to $1.13 billion. The operating income descended 23.2% year over year to $522 million. The quarterly adjusted EBITDA of $984 million marked a 16.5% year-over-year decrease.

Crown Castle reported a capital expenditure of $337 million for the fourth quarter. This included $286 million of discretionary capital expenditure and $30 million of sustaining capital expenditure.

Balance Sheet

Crown Castle exited fourth-quarter 2021 with cash and cash equivalents of $292 million, up from $232 million reported at the end of Dec 31, 2020.

Also, debt and other long-term obligations aggregated $20.6 billion, up from the $19.1 billion witnessed at the end of 2020.

Guidance

CCI raised the outlook for 2022. For the full year, AFFO per share is anticipated to be $7.31-$7.41. The Zacks Consensus Estimate for the same is pegged at $7.37. Management estimates site-rental revenues of $6,202-$6,247 million. The adjusted EBITDA is projected at $4,249-$4,294 million.

Crown Castle currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

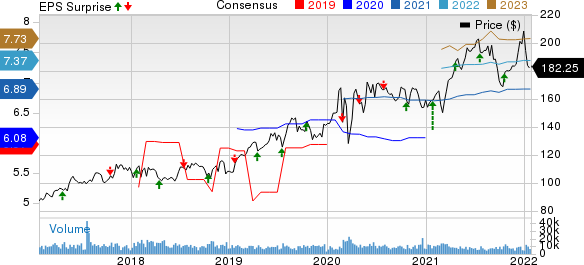

Crown Castle International Corporation Price, Consensus and EPS Surprise

Crown Castle International Corporation price-consensus-eps-surprise-chart | Crown Castle International Corporation Quote

It’s time to look forward to the earnings releases of REITs like Alexandria Real Estate Equities, Inc. ARE, Equity Residential EQR and Cousins Properties Incorporated CUZ .

Alexandria Real Estate is scheduled to report December-quarter earnings on Jan 31, while Equity Residential and Cousins Properties are slated to release fourth-quarter 2021 results on Feb 1 and Feb 3, respectively.

The Zacks Consensus Estimate for Alexandria Real Estate’s fourth-quarter 2021 FFO per share is pegged at $1.96, suggesting an increase of 6.5% from the year-ago quarter’s reported figure. ARE currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Equity Residential’s fourth-quarter 2021 FFO per share stands at 80 cents, indicating an increase of 5.3% from the prior-year period’s reported figure. EQR currently has a Zacks Rank #3 (Hold).

The Zacks Consensus Estimate for Cousins Properties’ fourth-quarter 2021 FFO per share is pegged at 69 cents, implying an increase of 1.5% from the year-earlier quarter’s reported figure. CUZ currently carries a Zacks Rank #4 (Sell).

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equity Residential (EQR) : Free Stock Analysis Report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance