CRISPR Therapeutics (CRSP) Q1 Earnings and Revenues Beat

CRISPR Therapeutics AG CRSP reported a net loss per share of 67 cents in the first quarter of 2023, narrower than the Zacks Consensus Estimate and our estimate of a loss of $1.67 and $2.49, respectively. The company had posted a loss of $2.32 per share in the year-ago period.

CRISPR Therapeutics' total revenues, comprising collaboration revenues, were $100 million in the first quarter, primarily attributed to an upfront payment from Vertex Pharmaceuticals VRTX.

In March, CRSP and VRTX entered a new non-exclusive licensing agreement to accelerate the development of the latter’s hypoimmune cell therapies for type I diabetes using the former’s gene-editing technology.

Revenues substantially beat the Zacks Consensus Estimate and our estimate of $38 million and $1 million, respectively. In the year-ago quarter, revenues were less than $1 million.

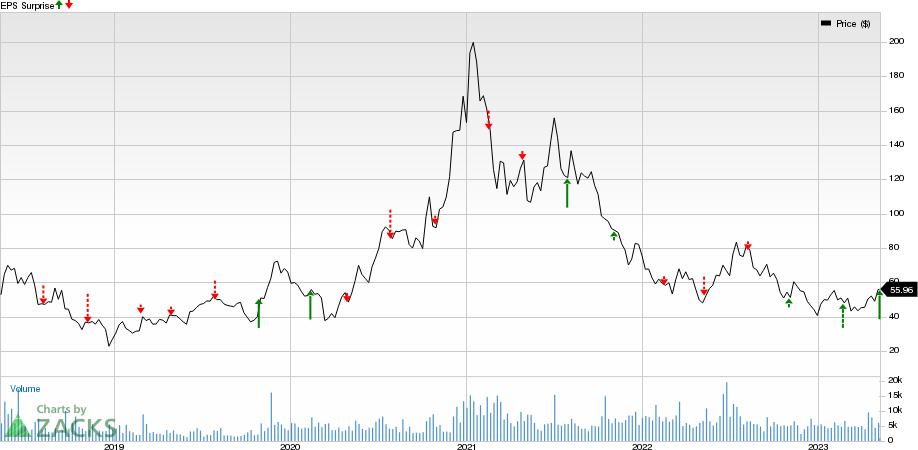

Post the announcement of the first-quarter results, CRISPR Therapeutics’ shares rose in after-market trading on May 8. The stock has gained 37.6% in the year-to-date period compared with the industry’s fall of 4.9%.

Image Source: Zacks Investment Research

Quarter in Detail

For the reported quarter, research and development expenses fell 15% year over year to $99.9 million, driven by reduced variable external research and manufacturing costs.

Also, general and administrative expenses dipped 20% to $22.4 million due to a decline in external professional costs.

Collaboration expenses for the first quarter reached $42.2 million, up 38% year over year. This significant gain was attributed to a rise in the company’s manufacturing and pre-commercial costs on the exa-cel program (being developed in collaboration with Vertex Pharmaceuticals).

As of Mar 31, 2023, CRISPR Therapeutics had cash, cash equivalents and marketable securities of $1.88 billion compared with $1.87 billion as of Dec 31, 2022.

Pipeline Update

CRISPR Therapeutics has developed exa-cel — an investigational ex-vivo CRISPR gene-edited therapy for treating sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT) — in partnership with Vertex Pharmaceuticals.

In April, with partner Vertex, CRISPR Therapeutics completed the rolling biologics licensing application (BLA) submission with the FDA, seeking approval for exa-cel in SCD and TDT indications. The companies started the BLA submission in November 2022.

The companies also filed similar regulatory applications on exa-cel in European Union and the U.K. in December 2022, which were validated by the European Medicines Agency, and the Medicines and Healthcare products Regulatory Agency in January 2023.

Apart from exa-cel, CRISPR Therapeutics is developing two chimeric antigen receptor T cell (CAR-T) therapy candidates — CTX110 and CTX130 — for hematological and solid-tumor cancers.

The company has been enrolling patients in the phase II study evaluating CTX110 in relapsed/refractory B-cell malignancies. CRISPR Therapeutics is also enrolling patients in the ongoing phase I COBALT-LYM study evaluating CTX130 targeting CD70 for the treatment of T cell lymphomas.

The company is advancing several next-generation CAR-T product candidates, namely CTX112 targeting CD19 antigen and CTX131 targeting CD70 antigen. These candidates have been designed to enhance CAR-T potency. The company has initiated clinical studies on both candidates, following the clearance of their investigational new drug application by the FDA in February 2023.

CRISPR Therapeutics also announced plans to advance its lead in the vivo program, CTX310, into clinical development later this year. The candidate has been designed to target angiopoietin-related protein 3 (ANGPTL3), which is responsible for the development of atherosclerotic cardiovascular disease.

CRISPR Therapeutics AG Price and EPS Surprise

CRISPR Therapeutics AG price-eps-surprise | CRISPR Therapeutics AG Quote

Zacks Rank & Stocks to Consider

CRISPR Therapeutics currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the same sector are Ocuphire Pharma OCUP and Allogene Therapeutics ALLO. Ocuphire Pharma sports a Zacks Rank #1 (Strong Buy) and Allogene Therapeutics carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss per share estimates for Ocuphire Pharma have narrowed from 29 cents to 24 cents for 2023 and from 86 cents to 81 cents for 2024 in the past 60 days.

The company’s shares have surged 64.6% in the year-to-date period. Ocuphire’s earnings beat estimates in three of the last four quarters and missed the mark once, the average surprise being 23.85%.

Loss per share estimates for Allogene have narrowed from $2.56 to $2.32 for 2023 and from $2.53 to $2.22 for 2024 in the past 60 days. Shares of ALLO have gained 0.5% in the year-to-date period.

Allogene’s earnings beat estimates in three of the last four quarters and missed the mark once, the average surprise being 5.08%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Ocuphire Pharma, Inc. (OCUP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance