Credit Suisse: 3 Things To Know About the TDSR Changes in the Singapore Property Market

Source: Singapore Non-Oil Domestic Exports, Trading Economics

The slowdown in Singapore’s economy continues as the non-oil domestic export (NODX) contracts for the second consecutive month. Meanwhile, the property market in Singapore faces strong headwinds too. However, to combat the economic slowdown, the government can make policy adjustments, such as property cooling measures.

Recently, the government has made the first change to the total debt servicing ratio (TDSR) framework that was first introduced in June 2013 as a property cooling measure.

1. What Are the Changes to TDSR?

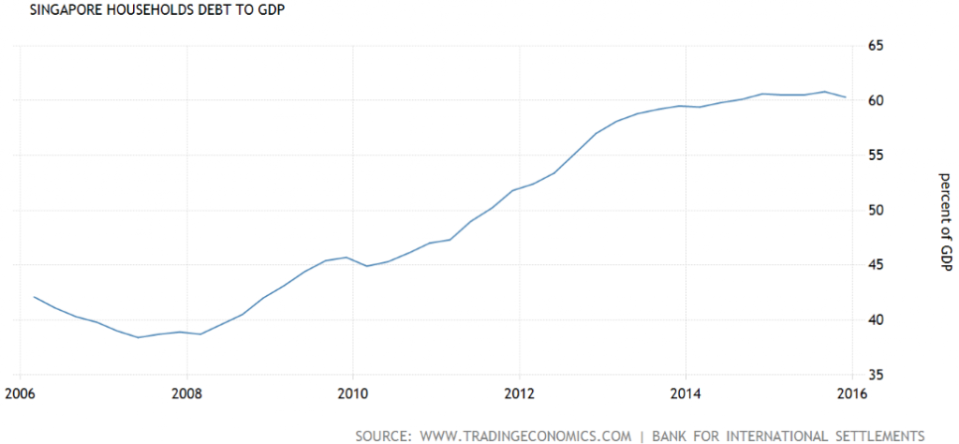

Source: Household Debt to GDP, Trading Economics

Based on the TDSR framework that was introduced in 2013, 60 percent of the borrower’s income may be used to service their debt obligations. However, the new framework states that this will no longer apply to the refinancing of debt on all current owner-occupied residential properties.

According to Mr David Baey, MoneySmart head of mortgage, a person with a loan tenure of 20 years and a $500,000 loan could save about $332 a month after refinancing.

For investment property borrowers, they may take advantage of the current low interest rate environment and refinance their mortgage if they fulfil the following requirements: Firstly, they need to meet the credit assessment from their financial institutions and secondly, they need to be able to commit to a debt reduction plan that repay at least three percent of their outstanding balance over a period of less than three years.

2. It’s Supposed to Support Owners Who are Occupying the Properties

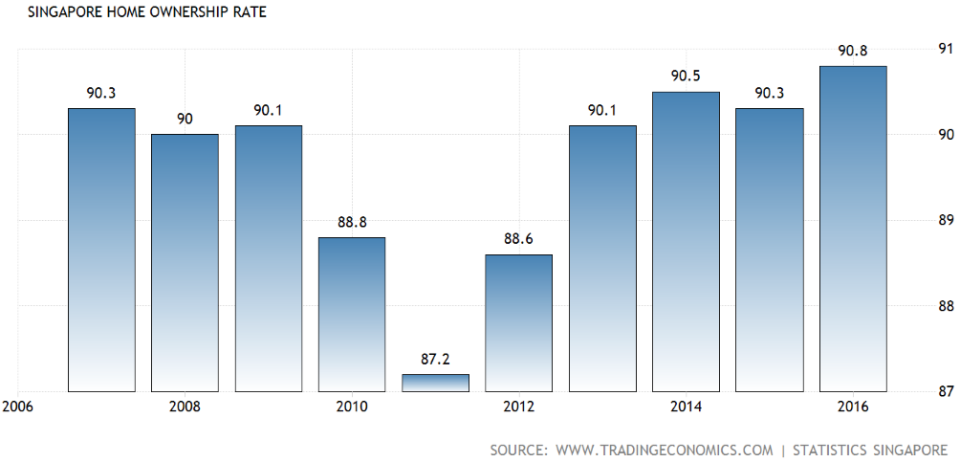

Source: Home Ownership Rate, Trading Economics

This tweak in policy is meant to help owners who are currently occupying their residential properties to manage their loans. In this case, the government is trying to help in the real need for housing rather than fuelling a bubble driven my unsustainable investments.

Based on the Financial Stability Report published late last year, 73 percent of outstanding housing loans are for owner-occupied properties as of 3Q2015. These owners will be able to benefit from the current low interest rate environment.

3. Is The Liberation for Singapore Property Market Coming?

The Monetary Authority of Singapore (MAS) expressed that the loosening of the TDSR does not represent an easing of property cooling measures. However, the lifting of the cooling measures will be beneficial to the growth of the economy.

MAS’s main reason for not lifting the property cooling measures is having it as an option to keep the property market controllable and without any surprises. This will reiterate the government’s key focus of driving the property market by demand for housing rather than investment which might lead to a bubble. An example is seen from China’s lifting of their property cooling measures which led to a 200 percent surge in property prices in some cities.

Though property cooling measures are not expected to be lifted at any time soon, this is definitely a first step towards it.

Investors’ Takeaway

Source: City Developments, Bloomberg

Analysts from Credit Suisse Research felt that City Developments Ltd (CIT) is the best proxy to Singapore’s property market. They gave a long-term “Buy” call with a target price of $11.70. You may view the article on Credit Suisse Research’s long term calls here. Investors may also look out for Nouvel 18 as a near term catalyst due to the asset monetisation opportunity.

Yahoo Finance

Yahoo Finance