Credit Card Annual Fees: Annual Fee Cost & How to Get Annual Fee Waivers

If you’re using credit cards the right way, you should be getting more money out of the bank than they’ll ever get from you.

That means paying all your bills in full and on time, using the cards strategically to maximise your cashback, rewards and air miles, and remembering to call the bank every year to ask for an annual fee waiver.

Thanks to credit card annual fees, I’ve had intimate chats with customer service officers at almost every bank in Singapore in which they asked private questions about my mother’s middle name. Some of them finally relented and waived my credit card’s annual fee, while other conversations ended with me unceremoniously cancelling my credit card.

Contents

1. How much are credit card annual fees in Singapore?

What is a credit card annual fee, and why do banks charge them? Banks often charge credit card annual fees so that the cardholder can enjoy “membership” perks, privileges, and promotions. Generally, annual fees cover the bank’s administrative work that goes into maintaining your credit card account.

Credit card annual fees are not cheap. In most cases, it costs more than all the benefits you could receive from the credit card’s promotions and other perks.

How much do credit card annual fees cost in Singapore? Here’s a look at some of the annual fees being charged:

Credit Card | Annual fee | Fee waiver |

$194.40 | 1 year | |

$194.40 | First 2 years. Waived from the third year onwards if you spend more than $12,500 with it per year. | |

$194.40 | 1 year | |

$194.40 | 2 years (Fee automatically waived if you spend at least $10,000 in 1 year, starting from the month in which your card was issued) | |

$194.40 | 1 year | |

$194.40 | 1 year | |

$194.40 | 1 year | |

$172.80 | 1 year |

Luckily, almost all credit cards can be used for 1 year before they start charging you fees, with some offering 2 fee-free years.

So, you can sign up for the card when you’re sure you’ll be able to max out the benefits, and then ask for a fee waiver at the end of the year.

2. Why do credit cards have annual fees?

When you pay for credit card annual fee, you’re paying for the convenience of using the credit card to make your purchases. Having a credit card means you don’t have to fumble with small change, or feel embarrassed if you open your wallet at the store and find yourself without cash.

You’re also paying for the administrative costs of maintaining your credit card account. You often get a free credit card replacement if your card is lost or stolen, or if it’s damaged and you need a new one. All these costs add up and your annual fee is what goes into paying for them.

3. Should I pay my credit card annual fee?

It’s rarely worth it to pay the annual fee. Even if the card’s perks are great, you still save money by cancelling and reapplying.

Some credit card providers do at least give you something in return for paying the annual fee. Certain air miles credit cards, for example, give you bonus miles when you pay your annual fee, which is tantamount to you purchasing those miles. You should do the math (i.e. work out the cost per mile) to figure out if it’ll be worthwhile to just pay the fee.

With some credit cards, like certain American Express cards, there are generally no annual fee waivers. Most of their cardholders feel that the top-notch customer care and worldwide assistance that they provide is often reason enough to keep paying each year.

Generally speaking though, you would want to get your annual fee waived.

There is one special case. You might want to pay the annual fee if it’s your oldest credit card, or your ONLY credit card.

A long-term credit history, especially if it’s free from partial payments and late payments do go a long way in giving you a good credit score. If you’re thinking of taking out a major loan, like a home loan, education loan or car loan, it might be worth paying the annual fee to make sure you don’t destroy whatever good credit history you have built up.

4. DBS Annual Fee Waiver

Some banks are so sick of fielding annual fee waiver requests that they now maintain an automated system that lets you send yours without speaking to a real human being. DBS and POSB is one such bank.

To ask for a credit card fee waiver from DBS or POSB, you have 2 options. The first is to use the DBS digibot, which is honestly easier than talking to a real person on the phone. Go to the DBS website, click the red chat logo on the bottom right of the screen to launch the digibot. Then, type “fee waiver” into the chatbox and follow the onscreen prompts.

If you want to do things the old-fashioned way (read: the more troublesome way), call DBS at 1800 111 1111 (from Singapore) or (+65) 6327 2265 (from overseas).

5. Citibank Annual Fee Waiver

To ask for a fee waiver on a Citibank credit card, you only have 1 option. And it’s the old-fashioned one: Call their 24-hour hotline at (65) 6225 5225 and then enter your NRIC or credit card number when prompted.

Next, press 0 to speak to a Citibank customer service officer to request for annual fee waiver.

6. UOB Annual Fee Waiver

To ask for a fee waiver on a UOB credit card, call the 24-hour UOB customer service hotline at 1800 222 2121 or, if you’re overseas, +65 6222 2121.

After choosing your language, continue to hold until asked to enter your NRIC or credit card number. Then select option 1 for credit card services, including requesting an annual fee waiver.

7. AMEX Annual Fee Waiver

To cancel an American Express credit card, you can either make a request via chat on the AMEX app, or call in to speak with their customer service. If you want to phone in, you have to dial a different contact number for each card. You can find the number on the back of your card.

Here’s the list of AMEX credit card contact numbers for Singapore and overseas:

AMEX Platinum Card: 1800 392 1177 for Singapore, +65 6392 1177 from overseas

American Express Platinum Credit Card: 1800 396 6000 for Singapore, +65 6396 6000 from overseas

American Express Platinum Reserve Credit Card: 1800 392 1181 for Singapore, +65 6392 1181 from overseas

American Express True Cashback Card: 1800 295 0500 for Singapore, +65 6295 0500 from overseas

American Express Singapore Airlines KrisFlyer Credit Card: 1800 392 2000 for Singapore, +65 6392 2000 from overseas

American Express Singapore Airlines KrisFlyer Ascend Credit Card: 1800 392 2000 for Singapore, +65 6392 2000 from overseas

American Express Singapore Airlines PPS Club Credit Card: 1800 396 6888 from Singapore, +65 6396 6888 from overseas

American Express Singapore Airlines Solitaire PPS Credit Card: 1800 396 6888 from Singapore, +65 6396 6888 from overseas

American Express CapitaCard: 1800 723 1339 from Singapore, +65 6880 1343 from overseas

American Express Rewards Card: 1800 296 0220 from Singapore, +65 6296 0220 from overseas

American Express Gold Card: 1800 733 0833 for Singapore, +65 6733 0833 from overseas

American Express Personal Card: 1800 732 2244 for Singapore, +65 6732 2244 from overseas

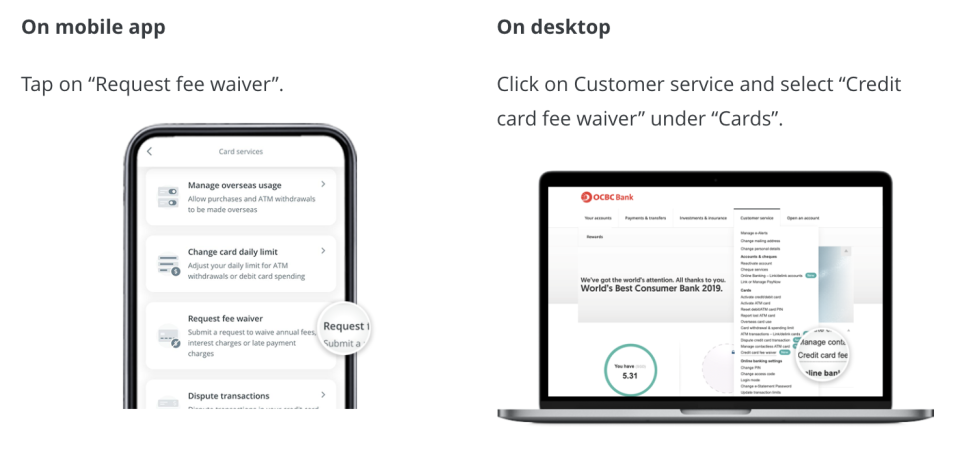

8. OCBC Annual Fee Waiver

You can quite easily get your OCBC credit card annual fee waived online via the OCBC mobile app or desktop. Then, go to the menu bar and select Card Services > Request fee waiver. Select the credit card which fee you want waived, then submit your request.

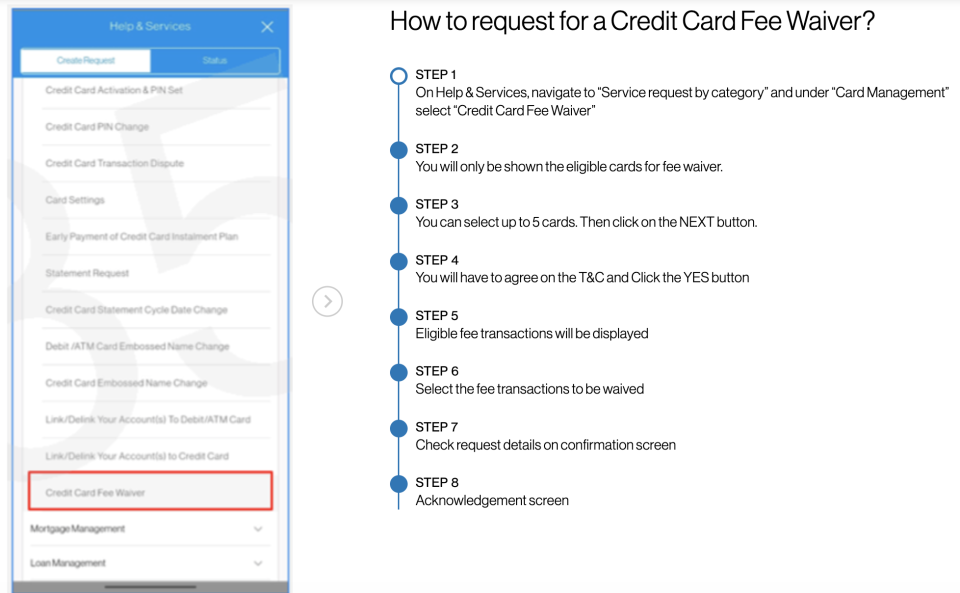

9. Standard Chartered Annual Fee Waiver

Standard Chartered offers an online credit card fee waiver system so you can do it all without speaking to an actual human being. Hooray!

You can request an annual fee waiver for a Standard Chartered credit card through online banking or the SC Mobile app. On the Standard Chartered mobile app, select:

Help & Services

Service request by category

Card Management

Credit Card Fee Waiver

Next, select the credit card you wish to request a fee waiver for, agree to the terms and conditions and submit your request.

10. Maybank Annual Fee Waiver

To get your Maybank credit card annual fee waiver, you will need to call Maybank’s customer service hotline at 1800 484 2088 or +65 6484 2088 if you’re overseas.

11. HSBC Annual Fee Waiver

You will need to call the HSBC customer service hotline at 1800 4722 669 (that’s 1800-HSBC-NOW) to get an annual fee waiver for your HSBC credit card. The hotline is open 24/7.

12. How can I get my annual fee waived?

It really depends. Some banks use mind-boggling formulae to determine if it’s worth giving you a fee waiver, while others will say okay to almost anyone who asks.

Generally, the more often you use your card, the more you spend on it and paying your bills in full and on time can positively influence their decision.

Some banks have a certain spending threshold for their credit cards.

For example, spend about $500 on the card in the past three months and they can waive your annual fee.

Of course, no customer service officer who wants to keep their job will tell you what the exact amount is, but some may be kind enough to suggest how much more you need to spend in order to hit that waiver requirement. If you’ve already spent $400 on the card, then it might be worth to charge another $100 to the card, instead of paying the annual fee.

If you can’t find out what that spending threshold is, you can appeal to the higher-ups at the bank to have your credit card waived. Make sure your appeal comes with valid reasons, of course.

By the way, customer service officers may have some discretion to decide whether you deserve a fee waiver, so be nice and they’ll be more inclined to do their best to help you.

13. My annual fee waiver request was rejected! Now what?

So, the customer service officer is using their most apologetic voice to tell you that unfortunately they cannot waive the annual fee. Your next step is to check with them if there is a way to appeal the decision. If your appeal gets rejected as well, the decision is final and there is no point in trying your luck again.

At this point, you can choose to burst into tears and cancel the card, or grit your teeth and pay the annual fee.

For the majority of cards, the most worthwhile option is simply to cancel it on the spot before the annual fee is due. You can always reapply for the card if you really like it.

Note that you’ll lose all rewards points and air miles that you haven’t transferred out when you cancel your card. So, make sure you redeem all rewards points and air miles before you make that fateful call.

Cash rebates, if credited directly to your account every month, are considered your money and cannot be withheld by the bank. The cash is usually used to offset your final bill or repaid to you after you close your account.

Also, make sure that you don’t have any standing instructions to pay recurring bills like utilities, telco, insurance premiums and so on. You should set up new recurring payment arrangements before making the call.

14. Credit cards with no annual fees

Not keen on wasting time with the annual ritual of asking for fee waivers? Here are some credit cards that don’t ever charge annual fees:

Standard Chartered Smart Credit Card: This card gives you rewards points equivalent to 6% cashback on everyday spending like bus and train rides, Netflix, Spotify, McDonald’s, Toast Box and Yakun. It also offers fee-free 0% 3-month instalments.

MoneySmart Exclusive

Earn up to 6% Cashback

Standard Chartered Smart Credit Card

MoneySmart Exclusive:

Get S$250 Cash via PayNow or an Apple AirPods 3rd Generation (worth $261.40) or a Nintendo Switch Lite (worth S$309) when you apply and spend a min. of S$250 in Eligible Transactions. T&Cs apply.

Valid until 30 Nov 2023

More Details

Key Features

0% interest 3-month EasyPay on all eligible expenditure with 100% cashback on fees. Earn Rewards Points on your instalments.

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life benefits program

6% cashback on your everyday spend at your favourite merchants across fast food dining, coffee and toast, digital subscriptions and on your daily commute (Bus/MRT). No minimum spend requirement.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

CIMB World MasterCard: Get 2% unlimited cashback on eating/drinking out, online food delivery, movies and digital entertainment, taxis and ride hailing and luxury goods when you spend at least $1,000 in a month.

MoneySmart Exclusive

Unlimited 2% cashback

CIMB World Mastercard

MoneySmart Exclusive:

Get S$350 Cash via PayNow OR $400 Amazon SG Gift Card OR a Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$575) when you apply and spend a min of S$988. T&Cs apply.

Valid until 15 Nov 2023

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods.

1%* Cashback on all other spends.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

HSBC Revolution Credit Card: This card offers card members 10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments. Not only does it have no annual fee—it also has no minimum spend.

MoneySmart Exclusive

Enjoy Instant Approval* | MoneySmart LUCKY DRAW

HSBC Revolution Credit Card

MoneySmart Exclusive:

[MONEYSMART LUCKY DRAW | REFERRAL]

Stand a chance to win an Apple Watch Series 9 (GPS), 41mm (worth S$599) when you successfully apply for an eligible HSBC Credit Card through MoneySmart.

Refer friends and family to boost your lucky draw odds. The more you refer, the better your chances! T&Cs apply.

Plus get a Samsonite ZELTUS 69cm Spinner Luggage (worth S$680) or S$150 Cashback from HSBC when you meet the min. spends of S$1,000 upon card approval required and provide marketing consent. T&Cs apply.

Valid until 15 Dec 2023

Get a Samsonite ZELTUS 69cm Spinner Exp Luggage with built-in scale (worth S$680) or S$150 cashback for new HSBC credit cardholders. Existing HSBC credit cardholders receive $50 cashback. Min. spends of S$1,000 upon card approval required and marketing consent provided upon applying. T&Cs apply.

*Plus Instantly Activate Your Virtual Card for Google Pay and Apple Pay Shopping! T&Cs apply.

Valid until 31 Dec 2023

More Details

Key Features

10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments.

1X Reward point for all other types of spending.

No min. spend required.

No annual fee

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 1-for-1 deals on dining, lifestyle and travel worldwide.

Cap of 10,000 rewards points per calendar month on eligible purchases. Other terms apply.

Found this article useful? Share it with those who need to declutter their wallets.

The post Credit Card Annual Fees: Annual Fee Cost & How to Get Annual Fee Waivers appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Credit Card Annual Fees: Annual Fee Cost & How to Get Annual Fee Waivers appeared first on MoneySmart Blog.

Original article: Credit Card Annual Fees: Annual Fee Cost & How to Get Annual Fee Waivers.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance