CPF Withdrawal Limits and How to Retrieve Your Account Statement

When I applied for my HDB BTO flat, I was so “happy like bird” that I didn’t really do my sums — and most importantly, I didn’t even know that there was such a thing as a Central Provident Fund (CPF) withdrawal limit.

Thankfully, things worked out for me. But if you’re planning to buy a home or you’ve already gotten one but want to refinance your home loan, do note the CPF withdrawal limits and find out how to retrieve your CPF account statement before you continue.

Don’t be all happy-happy, but BOOM, realise you need to pay extra cash out of your own pocket because you exceeded the CPF withdrawal limit. And no, not all housing types have the same withdrawal limit. We’ll talk more about it in a section below.

Using CPF for property

Did you know that on 10 May 2019, rules for using your CPF and getting HDB housing loans were updated?

In a nutshell:

Before 10 May 2019 | From 10 May 2019 (Now) | |

Property’s remaining lease is at least 20 years | Can’t use CPF at all (minimum duration was 30 years) | CPF can now be used (prorated based on the extent that the remaining lease can cover the youngest buyer to the age of 95) |

Property with less than 60 years (but at least 20 years) left on its lease | Can use CPF if buyer’s age plus the remaining lease is at least 80 years; CPF usage throttled to a maximum of 80% of the valuation limit | CPF usage no longer throttled against valuation limit if the remaining lease can cover the youngest buyer till age 95; otherwise will be prorated |

Buyer is over 55 years old | Can withdraw CPF savings above the Basic Retirement Sum (BRS) if they own a property with a remaining lease of at least 30 years | Needs to have a property with a remaining lease that can cover them until at least age 95; otherwise they cannot withdraw CPF savings above the Basic Retirement Sum |

As you can see, a lot of the new CPF and HDB housing loan rules are centred around this magic number, 95, to ensure that we have a roof over our heads, for life.

We’ve written about this in detail here: Buying a HDB? Here’s What Changed in The CPF Usage and HDB Loan Update.

But even if you can use your CPF to pay off your home loan, should you really? I mean, it does seem like the most sensible thing to do — it’s money you can’t withdraw until you hit retirement age, and what better way to use it than to buy a home? Especially if that means you don’t need to pay any actual cash at all.

However, some will argue that using this money has an opportunity cost. While you’re servicing your home loan, you lose out on the guaranteed 2.5% per annum interest rate that your CPF Ordinary Account offers. That’s higher than any savings account right now. And if you have the habit of transferring your OA monies into your CPF Special Account, you might be missing out on an interest rate of up to 5% per annum.

By the power of compound interest, $100,000 with a return rate of 2.5% per annum after 25 years (the typical length of a HDB loan) would be $185,394.41 — where the interest earned is over $85,000.

There’s more to it, which we’ve covered in our article: Should You Use CPF to Pay Off Your Home Loan?

CPF Housing Withdrawal Limits

Let’s say you’re still choosing to use your CPF monies to help finance your monthly mortgage repayment. That’s fine, because myself and many other Singaporeans have taken this route.

You might need to take note of two key things:

Valuation Limit (VL)

This is the value of the property at the time of purchase (or the purchase price), whichever is lower. For example, your property might cost $400,000 for you to purchase, but it is valued at $390,000. So your VL is $390,000.

Withdrawal Limit (WL)

This is the maximum amount of CPF monies you can use to pay for your mortgage, usually applicable for bank loans; currently capped at 120% of your property’s VL. From the example above, for a VL of $390,000, your WL would be $468,000.

Let’s look at some scenarios where VL and WL come into play for first-time property buyers:

Type of property | Type of loan | What is your CPF Withdrawal Limit? |

BTO flat | HDB loan | No limit imposed, can use full CPF OA |

BTO flat | Bank loan | WL = VL x 1.2 |

HDB resale flat | HDB loan | WL = VL (unless your CPF BRS is met) |

HDB resale flat | Bank loan | WL = VL x 1.2 |

Executive condominium (not eligible for HDB loan) | Bank loan | WL = VL x 1.2 |

Private | Bank loan | WL = VL x 1.2 |

If you’re looking at buying your second property, you can use your excess CPF OA after you’ve set aside the BRS. The WL is capped at 100% of the VL.

Other conditions may apply, such as the remaining lease left on a resale property, age of youngest buyer and so on. Use the CPF Housing Usage Calculator to determine your actual CPF WL.

Do note that once you hit your CPF WL (and you will, as the final amount payable will be the purchase price of the property AND the interest accrued on your home loan), you will need to service the rest of the loan in cash. This means that for a 25-year home loan, you might hit the CPF WL midway through and will need to service the remaining years of monthly mortgage payments in cash instead of CPF.

Remember how I mentioned earlier that when I bought my HDB BTO flat, I didn’t check up on (let alone know about) my CPF Withdrawal Limit? Luckily for me, as a first-time property buyer of an HDB BTO flat who was choosing to service my mortgage with an HDB loan, there is no limit imposed on my CPF WL so I can use my CPF OA monies freely. Phew!

How to retrieve my CPF withdrawal account statement

To backtrack a bit: Why would you even need to retrieve your CPF withdrawal statement?

Well, you’ll need it if you want to refinance your home loan. Yes, even if you’re not using CPF to service your existing home loan.

And it’s also useful to check if you’re going to reach your CPF WL (so you don’t get a shock when one fine day you’ll need to start using cash) or just to see how much longer you’ll need before you finally pay off this monster of a loan.

To save you the hassle (and frustration) of hunting around on the CPF website, here’s a step-by-step guide with screenshots (yay!) to help you access your CPF withdrawal account statement:

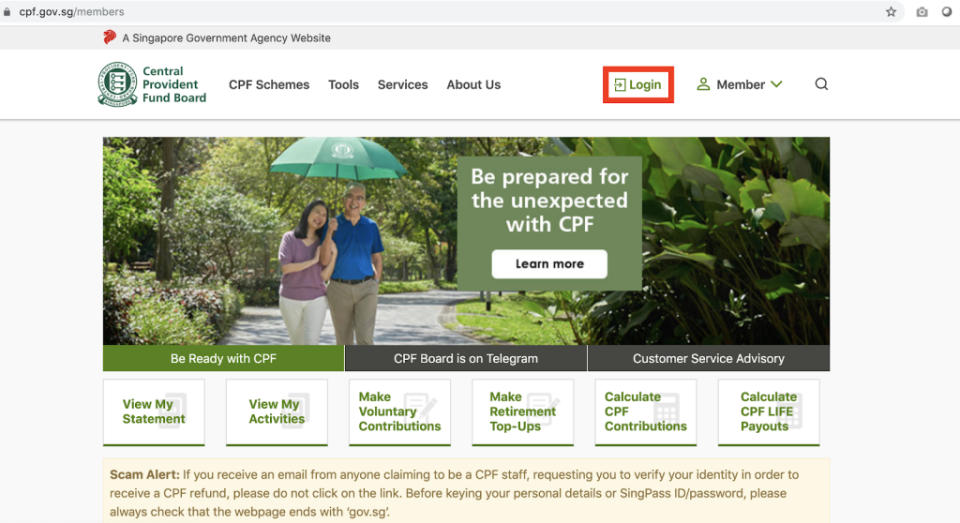

Access the CPF website and click Login (top-right)

You’ll first be directed to the SingPass login page; key in your details and you’ll be redirected back to the CPF website once you’ve successfully logged in.

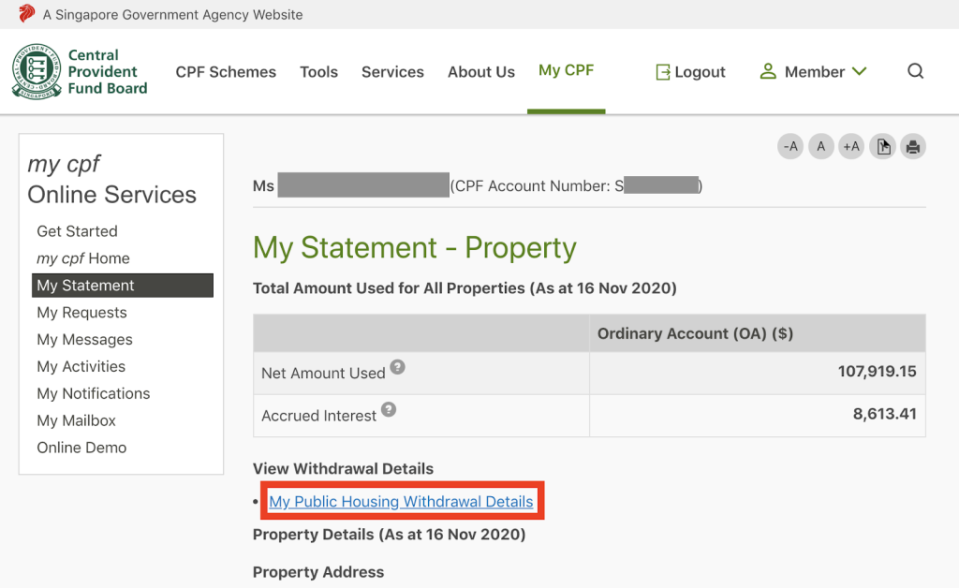

Click on My Statement in the menu listing on the left

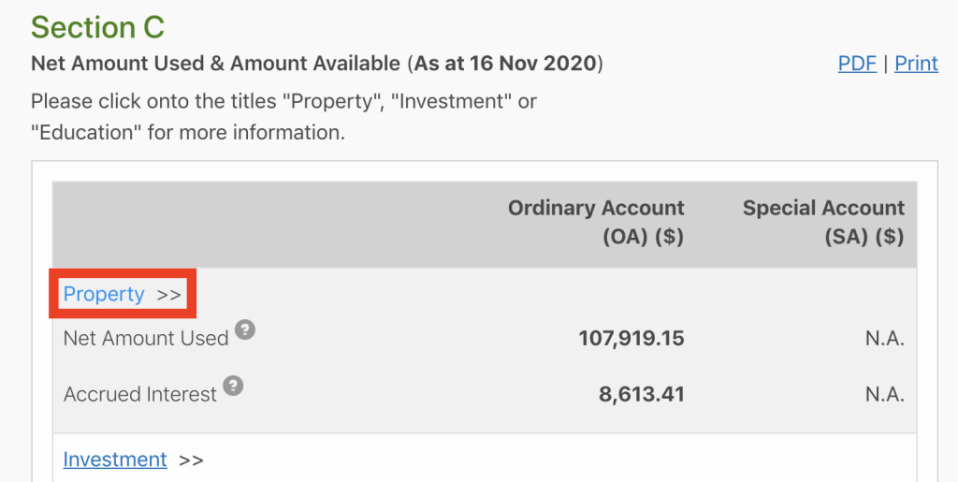

Look for Section C and click on Property to access more information

Click on My Public/Private Housing Withdrawal Details

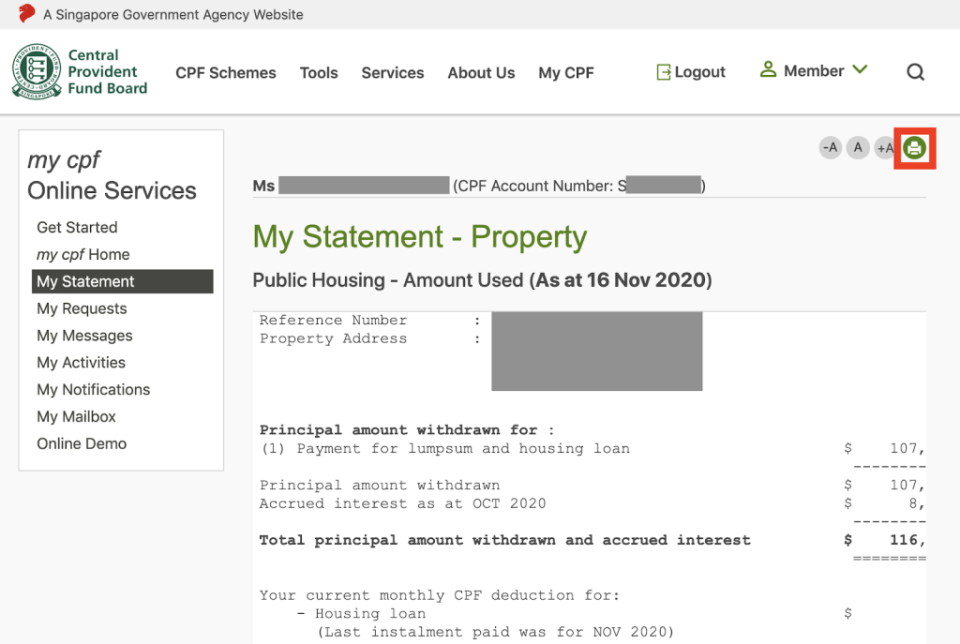

Save your statement!

Click on the printer icon (top-right), a pop-up window will appear. Right-click and choose print > print as PDF to save the file. This might vary depending on the Internet browser you’re using…

Aaand, that’s all there is to it! Do what you will with this CPF Withdrawal Account Statement.

Still unsure about refinancing? Check out our PropertyGuru Finance page, which is a one-stop resource portal for advice, best rates from all major banks, affordability calculators and more.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time.Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs.PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.

This article was written by Mary Wu, who hopes to share what she's learnt from her home-buying and renovation journey with PropertyGuru readers. When she's not writing, she's usually baking up a storm or checking out a new cafe in town.

Yahoo Finance

Yahoo Finance