Could You Be Saving More on Your Income Taxes?

As we progress in our career, it's natural that our chargeable income increases, which is likely to result in higher income tax. Fortunately, you can reduce chargeable income effectively by understanding the different tax relief schemes available.

Current Tax Rate In Singapore

Singapore has a progressive personal income tax ranging from 0% at its lowest to 22% at its highest, where those earning less than S$30,000 per year are taxed the least and those earning S$320,000+ are taxed the most. In terms of calculating taxes, rates are typically split. A base amount of income is charged a fixed amount, and income beyond the base is charged at a specific tax rate. A chart showing the breakdown of tax rates is shown below.

Tax liability increases significantly as chargeable income increases. For example, if you're earning S$30,000 per year, the first S$20,000 of your salary will not be taxed, and the remaining S$10,000 will be taxed at just 2%. Your gross tax payable would be S$200. Those earning S$60,000, however, must pay S$550 for the first S$40,000 of their income and 7% on the remaining S$20,000. Total tax would add up to S$1,950. As a result, doubling your salary from S$30,000 to S$60,000 would increase your tax payable more than 9-fold.

Fortunately, there are several ways to lower your tax payable, even as you continue to earn more and progress in your career. We've outlined several types of tax relief–and how you can tax advantage of them–below.

Translate CPF Top-Ups into Easy Tax Relief

Singaporeans are required by law to contribute 20% of the first S$6,000 of their monthly income into the Central Provident Fund (CPF). These funds can later be used to pay for housing, medical and retirement needs. While putting aside money may sometimes feel like a burden, you may actually be able to save significantly on your taxes by putting aside just a bit more.

Under the IRAS's CPF Top-Up Relief programme, Singaporeans and Permanent Residents can decrease their tax payable by an amount equal to the cash top-up made to their Special Account (under 55 years old) or Retirement Account (aged 55+). Relief is capped at S$7,000 per individual, which can be achieved with S$7,000 in cash top-ups. Those who can afford to support family members with top-ups can earn up to an additional S$7,000 in relief annually.

Fortunately, there's no need to claim this relief. Relief is granted automatically to those who are eligible, making this one of the easiest ways to decrease your tax payable.

Access Tax Breaks for Home & Family Life

Most Singaporeans end up spending a great deal on their household, on everything from everyday essentials to more significant costs such as their child's education and even support for elderly parents. There are several ways to earn deductions for such expenses.

Qualifying Child Relief & Working Mother’s Child Relief

According to recent research, raising a child up to the age of 21 years old in Singapore costs an average of S$435,707–excluding healthcare, new housing and additional insurance costs. To support families who must face such expenses, the government has devised two forms of tax relief: Qualifying Child Relief and Working Mother's Child Relief.

Under the first, households receive S$4,000 in tax relief per child (S$7,500 if the child is handicapped), which is evenly split between the mother and father. This relief is automatically filled in and applied for on electronic tax forms for those with children born in 2018 and after. Working mothers receive an added bonus, with relief amount corresponding to number of children and total income. These measures are intended to support women who want to start a family, but also want to continue in their career.

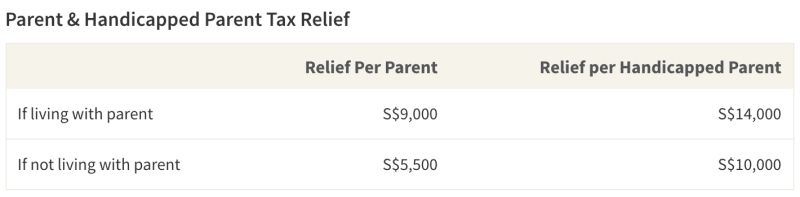

Parent & Handicapped Parent Relief

Another potential way to reduce your taxes is to live with your parents, as part of the Parent Tax Relief deductible. Currently, most Singaporeans move out of their parents' house after marriage, leaving their ageing parents to live alone. As a result, the IRAS provided this form of relief both to promote filial piety and provide added support for those who do decide to take care of their parents.

Singaporeans who live with their father and mother can enjoy a total parent relief of $9,000 per dependent (parent), which amounts to $18,000 total for the family. If you have siblings, the full relief can be shared equally. This means that if you have a brother or a sister, each of you can enjoy an equal parent relief of $9,000.

Foreign Maid Levy Relief

Finally, having two working parents is quite common in Singapore. The dual income helps to support increased expenses from setting up a home and raising children. While having a higher total income is certainly helpful, working parents usually have little time left for household chores. As such, hiring a foreign maid can reduce the burden of cleaning the house and taking care of children during the day.

Foreign Maid Levy Relief is only available to married women, divorcees, and widows with children who are eligible for child relief; it also only applies to foreign domestic workers (rather than Singaporean maids). The amount claimable is twice the levy paid in the previous year on one foreign domestic worker. Beyond such tax relief, you may also be able to save money on your FDW by purchasing high-value maid insurance or seeking out government grants for maids who provide disability or elderly assistance to members of the household.

Turn Rental Expenses into Tax Deductions

According to a 2019 study, the average monthly rent of 3-bedroom flat in Singapore is US$4,215–one of the highest rates in Asia. If you have a property that is rented out, however, the rental income (which includes rent and related payments received) is subject to income tax.

Fortunately, expenses incurred relating to your rental property–loans, insurance, repairs, maintenance and more–can be used to offset such tax when claimed as deductions. The table below shows several common rental expenses and which are eligible for use as deductions.

With the growing popularity of rental income, the Inland Revenue Authority of Singapore (IRAS) has simplified tax-filing and reduced the burden of record-keeping. From Year of Assessment 2016, property owners who lease their residential units can enjoy the convenience of pre-filled rental expenses, which are calculated based on 15% of the gross rent collected. Property owners can also claim the interest on their mortgage loan, as long as they keep records for verification for at least 5 years.

Optimise Your Personal Income Tax for Maximum Deductions

Finally, you can also reduce your tax payable by reviewing the IRAS's page describing all deductions available for individuals. You may find several other forms of relief–from course fee relief to deductions for charitable donations–that better fit your needs and lifestyle. Ultimately, you can receive up to S$80,000 in tax relief per year, which can go quite a long way in offsetting the financial burden of tax season.

The article Could You Be Saving More on Your Income Tax? originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Yahoo Finance

Yahoo Finance