Could CenturyLink Be a Millionaire Maker Stock?

CenturyLink (NYSE: CTL) has done something this year -- so far -- that investors haven't seen it do since 2014: make them money.

For the first time since 2014, shares of its stock are on track to finish the year higher than they started. At of this writing (on Nov. 28), shares are up 12.8% in 2018. Add in the substantial dividend, and the total return jumps to 26.7% so far.

And while there's still a month left for a turn for the worse -- the stock price is down 21% from the 2018 peak, and more selling to harvest the tax loss could send shares down -- things are decidedly looking up for the company. About a year in, its merger with Level 3 Communications is paying off: Combined costs have fallen, profit margins are improving, and cash flows are surging.

Image source: Getty Images.

Although it's not the kind of stock that is likely to turn a few grand into a million bucks, there is a strong case to be made that CenturyLink has moved from risky turnaround to solid value. I'm firmly of the opinion that it has a place in many investors' portfolios, offering substantial potential for capital growth -- with a big dividend that's well within the company's ability to maintain.

Making good, finally, on a turnaround

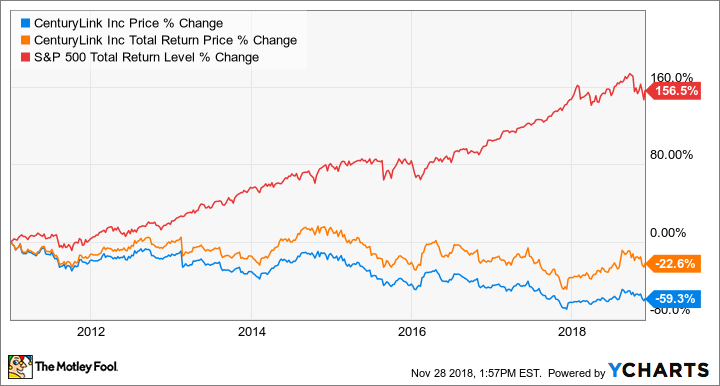

As a regional landline telecom, CenturyLink has struggled to adapt to a changing environment. Over the past decade, millions of Americans have cut the cord -- in traditional home telephone service and, more recently, cable TV. CenturyLink investors have paid a huge toll since 2011, with its stock price down 59%; even when adding dividends back in, investors who've held for the long term have still lost over 22%.

At the same time, the stock market has been on one of its best, most-sustained bull runs in history, delivering 157% in total returns:

Things have been so bad over this period, CenturyLink stock produced only two positive years: 2012 and 2014 (before 2018 -- if current gains hold up).

So what makes this year's gains different? The merger with Level 3 Communications is working. The combined company is more efficient and has solid long-term prospects. It's also generating cash at a much higher rate than anticipated. Free cash flow nearly doubled in the third quarter, and management increased full-year guidance by $400 million to a range of $4 billion to $4.2 billion.

CenturyLink has never generated that much free cash flow:

CTL Free Cash Flow data by YCharts. TTM = trailing 12 months.

But it should also be noted that the company needs to generate a bunch of cash. Debt also spiked after closing the Level 3 merger:

CTL Total Long Term Debt (Quarterly) data by YCharts.

Debt reduction is the main priority for excess cash. The company has already been able to pay off about 3% of its debt this year, but its accelerating cash flows should allow it to accelerate the reduction. After paying the dividend and capital expenditures, the company is on track to generate $1.7 billion to $1.9 billion in excess cash this year, most of which it will use to pay down debt.

Why it's worth buying now

CenturyLink's dividend, yielding over 10% at recent prices, looks both compelling but also screams "dividend trap!" Management has emphatically stated on multiple occasions that maintaining the dividend is a high priority. On the last earnings call, CFO Neel Dev -- who was just promoted to the role but has worked under CEO Jeff Storey for more than a decade -- said management was "comfortable" with the dividend. He also pointed out that it is well supported, requiring only about half of free cash flow to pay.

But I wouldn't buy it (or any other stock) just for the dividend; plenty of managements have expressed optimism about their dividends only to cut them soon after. The good news is that CenturyLink isn't a pig dressed up in a high yield. It's a solid business trading at what to me looks like very good value.

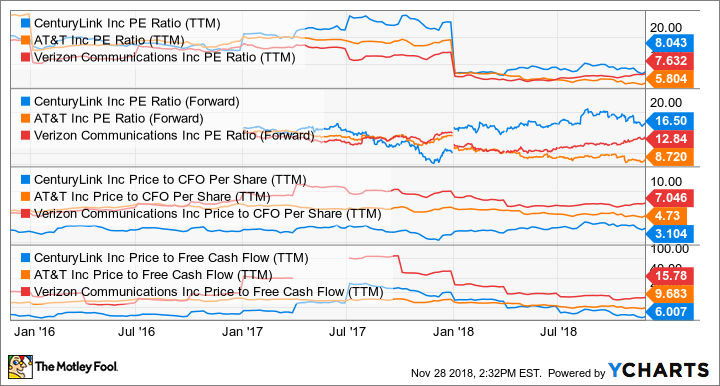

CTL PE Ratio data (TTM) by YCharts.

On a GAAP earnings basis, CenturyLink isn't cheap, at least versus telecom giants like AT&T and Verizon. But GAAP earnings shouldn't be the only metric used to evaluate a company. That's particularly true right now with CenturyLink, which is using tax loss carry-forwards that came along with Level 3 to artificially reduce its GAAP earnings (and hence its tax bill) over the next several years.

If we measure CenturyLink based on its cash flows, it's just plain cheap. Yes, its cash flows are being temporarily boosted by the tax loss carry-forwards, but the benefit is only a bare fraction of the discounted price it trades for.

Add it all up, and it's not likely that CenturyLink is going to be the next big thing in telecom, creating massive wealth for investors over the next decade. But with a substantial dividend that's well within its ability to pay, the quite-cheap price its shares trade for, and the improved prospects the company has following the Level 3 merger, 2018 should be just the first of plenty more moneymaking years ahead.

More From The Motley Fool

Jason Hall owns shares of CenturyLink. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance