Coty (COTY) Benefits From Core Priorities, Cost Inflation Hurts

Coty Inc. COTY is benefiting from its focus on six strategic pillars aimed at sustainable growth. That company made several strategic partnerships to enhance its brand portfolio. Such upsides were visible in the company’s third-quarter fiscal 2022 results, wherein management also raised its earnings guidance for fiscal 2022.

Management is committed to optimizing the overall cost structure amid rising inflationary pressure.

Let’s delve deeper.

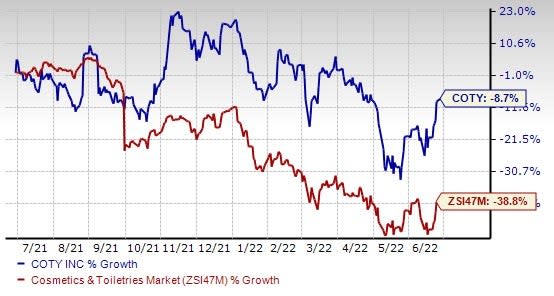

Image Source: Zacks Investment Research

Solid Performance & View

The company posted impressive third-quarter fiscal 2022 results, with the top and the bottom lines rising year over year and surpassing the Zacks Consensus Estimate. The company gained from strong performance across the Prestige and Consumer Beauty segments. Coty witnessed solid gross margin expansion despite an inflationary environment. The company posted adjusted earnings of 3 cents per share, which improved from 1 cent reported in the year-ago quarter. Coty’s net revenues came in at $1,186.2 million, up 15%. The figure includes an adverse currency impact of 4%. LFL revenues rose 19% on growth in the Prestige and the Consumer Beauty business segments. The performance also gained from robust e-commerce business, which registered double-digit sales growth in the quarter.

Considering Coty’s solid year-to-date performance, management raised its fiscal 2022 earnings view and reiterated revenue guidance during the fiscal third-quarter earnings release. Considering the projected impact of exiting operations in Russia, including local Travel Retail and the near-term COVID restrictions lockdowns in China on the fourth-quarter results, management anticipates fiscal 2022 LFL sales at the upper end of its guidance of low-to-mid teens percentage growth. Fiscal 2022 adjusted earnings per share (EPS) is expected in the range of 23-27 cents, up from the earlier guidance of 22-26 cents.

What is Working Well for Coty?

The Zacks Rank #3 (Hold) company is benefiting from its focus on six strategic pillars. These include stabilizing Consumer Beauty make-up brands and mass fragrances; accelerating luxury fragrances and setting up Coty as a core player in prestige make-up; establishing a skincare portfolio in prestige and mass channels; strengthening e-commerce and Direct-to-Consumer (DTC) capabilities; growing presence in China via Prestige and certain Consumer Beauty brands; as well as setting Coty as an industry leader in sustainability.

With respect to stabilizing the consumer beauty brands, the company is on track with repositioning campaigns and disruptive advertising. In its last earnings call, management highlighted that its Consumer Beauty business’ global market share was up 60, 80 and 70 basis points (bps) in January, February and March, respectively. The company is on track to reposition its fifth cosmetics brand, Bourjois, across its key French market. Management is on track with innovation amid the boom in the fragrance market. Recently, Coty launched SKKN BY KIM, an efficacious nine-product skincare collection by Kim Kardashian.

Coty made several strategic partnerships to enhance its brand portfolio. On Nov 18, 2021, Coty signed a licensing agreement with Orveda — an ultra-premium skincare brand made in France. Prior to this, Coty entered into a multi-channel agreement with Perfect Corp. — a well-known beauty tech solutions provider. The partnership will help Coty’s customers shop in the most convenient and personalized manner online and offline. On Mar 3, 2021, the company signed a letter of intent to partner with LanzaTech — a pioneer in producing next-generation green and sustainable ingredients.

Hurdles on Way

Coty is grappling with increased inflation and supply chain-related challenges. The company witnessed a step-up in inflationary pressure to the tune of nearly 1.5% of revenues in the third quarter of fiscal 2022. Management expects increasing inflationary headwinds to restrict year-over-year gross margin expansion in the fiscal fourth quarter. The outbreak of war in Ukraine and COVID-related lockdowns across key parts of China were headwinds. The company also saw select component constraints and long lead-time distances across U.S. and Travel Retail.

That being said, management is on track to mitigate the impact of inflation via cost savings and pricing actions. It is utilizing gross savings to counter the impacts of escalated inflation and higher investments during the back half of 2022. Coty is progressing well with the All In to Win transformation program across five key work areas, driving notable improvement on cost, gross margins, sales growth and cash. Management is committed to its savings initiatives, pricing actions, persistent premiumization and portfolio mix management to counter inflationary headwinds.

COTY’s stock has dropped 8.7% in the past year compared with the industry’s 38.8% decline.

Looking for Better-Ranked Staple Bets? Check These

Some better-ranked stocks are Pilgrim’s Pride PPC, Sysco Corporation SYY and United Natural Foods UNFI.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen and value-added chicken and pork products, sports a Zacks Rank #1 (Strong Buy). PPC has a trailing four-quarter earnings surprise of 31.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pilgrim’s Pride’s current financial year EPS suggests growth of 63.2% from the year-ago reported number.

Sysco, which engages in marketing and distributing various food and related products, sports a Zacks Rank #1. SYY has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for Sysco’s current financial year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago reported number.

United Natural Foods distributes natural, organic, specialty, produce and conventional grocery and non-food products. UNFI currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for UNFI’s current financial year sales and EPS suggests growth of 7.2% and 4.9%, respectively, from the year-ago period’s reported figures. United Natural Foods has a trailing four-quarter earnings surprise of 29.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sysco Corporation (SYY) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance