Cost of Getting A Car In Singapore 2019: What Contributes To The High Car Price?

Car prices in Singapore can be pretty daunting

Singapore has been doing a great job in retaining its number one title as one of the most expensive cities in the world, with one of the main factors being the average cost of owning a car.

Based on a survey done in 2014, Singapore came in tops while comparing the price of owning a Volkswagen Golf 1.4 across 156 countries.

source: carbuyer.com.sg

Here’s how the price of a car in Singapore compares to other countries:

Note that the currency below is in USD for better comparison.

Country | Price of car |

|---|---|

Singapore | $110,479.80 |

Gabon | $108,243.99 |

Venezuela | $53,546.90 |

Papua New Guinea | $50,009.62 |

Maldives | $48,137.57 |

Vietnam | $47,427.08 |

Demark | $45,747.33 |

Faroe Islands | $45,747.33 |

Malaysia | $45,724.74 |

Norway | $44,514.79 |

Simply put, the cost of owning a car once we pass the causeway is about 2.5 times cheaper.

Breaking down the factors that make cars so expensive in Singapore

As Singapore is physically small and space constraint is a major concern, pushing prices of cars upwards seems to be a viable measure that the Government has employed.

Below are 7 factors contributing to cost of owning a car in Singapore:

Registration Fees

Open Market Value (OMV)

Excise Duty

Certificate of Entitlement (COE)

Additional Registration Fee (ARF)

Vehicular Emissions Scheme (VES)

Others

Registration Fees

According to Land Transport Authority (LTA), a registration fee of S$220 will be collected upon registration of the car.

Open Market Value (OMV)

The Open Market Value is determined by the Singapore Customs.

It is based on:

Actual price paid for the purchase of the car

Freight cost of the car

Insurance and other possible charges involved in the sale and delivering of the car to Singapore.

Excise Duty

The Excise Duty is a tax collected by Singapore customs. It is directly correlated to the OMV.

The Excise Duty for cars in Singapore is 20% of the car’s OMV.

Certificate of Entitlement (COE)

The term COE should not be of a stranger to most Singaporeans.

In short, it is a certificate that gives car owners the legal right to register, own and use a vehicle in Singapore for a period of 10 years. The cost of COE depends a lot on the demand and supply of the market. This means that if the demand for the car is high, the cost of COE can even be more expensive than the car itself.

COE consists of 5 categories:

CAT A – Car up to 1600CC and 97KW

CAT B – Car above 1600CC or 97KW

CAT C – Goods vehicle and bus

CAT D – Motorcycle

CAT E – Open-all except for motorcycle

For comparison, here’s the latest June 2019 COE result vis-a-vis May 2019’s numbers:

Category | Certificate of Entitlement (COE) - May 2019 | Certificate of Entitlement (COE) - June 2019 |

|---|---|---|

CAT A | $27,000 | $26,999 |

CAT B | $42,564 | 35,906 |

CAT C | $27,400 | $25,501 |

CAT D | $3,202 | $3,000 |

CAT E | $47,000 | $39,400 |

Addition Registration Fee (ARF)

Additional Registration Fee is imposed upon registration of the car. It is taxed based on the OMV of the car.

For now, any vehicle with OMV of up to S$20,000 will be subjected to 100% OMV.

As for vehicles with OMV above S$20,000, they will be taxed differently based on the incremental OMV.

OMV of vehicle | Additional Registration Fee |

|---|---|

S$20,000 and below | 100% |

S$20,001 to S$50,000 | 140% |

Amount after S$50,000 | 180% |

Vehicular Emissions Scheme (VES)

The Vehicular Emissions Scheme (VES) was implemented starting 1 January 2018 on all new cars, taxis and newly imported used cars.

The objective of it is to encourage buyers to choose a more environmental model of car.

It assesses vehicles on four additional pollutants – hydrocarbons (HC), carbon monoxide (CO), nitrogen oxides (NOx), and particulate matter (PM). All these on top of carbon dioxide (CO2) emissions. The VES rebate or surcharge for the vehicle will be determined by the worst-performing pollutant of the five being assessed.

Here are the different bands and their rebate or surcharge (applicable from 1 January 2018 to 30 June 2018):

Others

The rest of the cost includes:

Road Tax

IU fee

Carplate number fee

Sales commission of dealers

Let’s also not forget Goods and Services Tax (GST) which is imposed on OMV and Excise Duty.

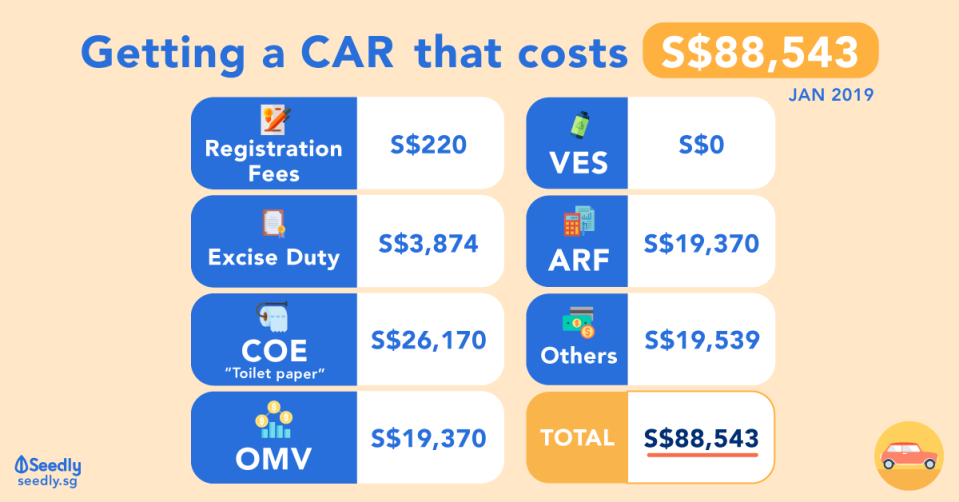

Example: Price of A Honda Civic i-VTEC in Singapore

Here’s an example of the cost breakdown of a car in Singapore:

Factors that affects car prices in Singapore | Costs |

|---|---|

Registration Fees | S$220 |

Open Market Value (OMV) | S$19,370 |

Excise Duty | S$3,874 |

Certificate of Entitlement | S$26,170 |

Additional registration Fee | S$19,370 |

Vehicle Emissions Scheme | S$0 |

Others | S$19,539 |

Final Price of Car | S$88,543 |

source: SGCarMart.com

Renew your COE vs buying a new one (taking up a loan)

We took to the Seedly Personal Finance Community to understand what people are discussing about cost of cars in Singapore.

“Our car is near the 10-year mark, we are considering options. How many of you will actually renew your COE vs buying a new one (which is quite expensive now) and taking up loan again.”

Seedly Community members shared their opinions and personal experiences:

Ken Tan

Bought a new car and sort of regretted it. Should have gotten a resale instead.Sau Yee Fong

My car has less than 2 years worth of COE and I intend to renew the COE for another 10 years.

Just to share with you my thought process, hope it will be helpful to you. My car has low mileage (75K as of now) and hence I am betting that there will be less wear and tear.

My car, if bought in today’s context, would be classified under CAT B. But I get to renew my COE under CAT A since it was under CAT A eight years ago.

So I get to enjoy CAT B power by paying CAT A COE.

With the introduction of VES, I would expect COE premiums stay relatively constant at the current level.

An old car that renews COE is not subjected to VES but a new car is.Bea Tang

Renewed COE (cash only) last year at a 10 year low (but still 4x of the value it was when I first got the car).

Depreciation for next 10 years works out to $5k+ per annum (including loss of PARF but excluding higher road tax) which is far lower than a new car of similar capacity (2000cc). Having said that my mileage was low (<70k) and the car was in good condition.

I did however stock up on some parts as Honda no longer manufacture that model and I was already facing difficulty getting parts.William Seah

How well does your car run? If maintenance is cheap, and the car works, then sure renewing is a good idea.

Having said that, most cars will need a certain degree of higher maintenance cost as it gets older due to lack of spare parts, or even wear and tear of parts (gearboxes for example are designed to run for possibly 200k km give or take, which after ten years is a possibility) so some repairs won’t show up till after you renewed.

In my case, I renewed my COE. After that, I also renewed my transmission, clutch, Aircon, and will have to renew my suspension soon. Such wonderful opportunities of renewal only came after I bought a COE back in 2016. So beware!Lucas AI

Take your car’s scrap value into consideration.

(Scrap value + renewed COE price) divided by the number of years renewed = depreciation per year.Hence, Smaller or cheaper b&b cars usually more worth to renew as they have lower OMV.

With that in mind, a new car does not necessarily mean high depreciation. A brand new small Toyota can have a depreciation of about 8-9k. This is similar to a Toyota with renewed COE for 5 years. The difference lies in the financial outlay.Furthermore, do note that a renewed COE Car has road tax that will increase year on year till its 50% more. So then again, it’s more expensive to renew a bigger capacity car.

Read more on COE-related questions:

“Does it make more financial sense to purchase a COE car (Cars renewed for 5 years, but i get no money back) or a newer car that allows me to get back the PARF value?”

The post Cost of Getting A Car In Singapore 2019: What Contributes To The High Car Price? appeared first on Seedly - Get Rich Or Die Tryin'

Yahoo Finance

Yahoo Finance