Economist: Coronavirus recession 'turning into the Great Depression II' amid jobless spike

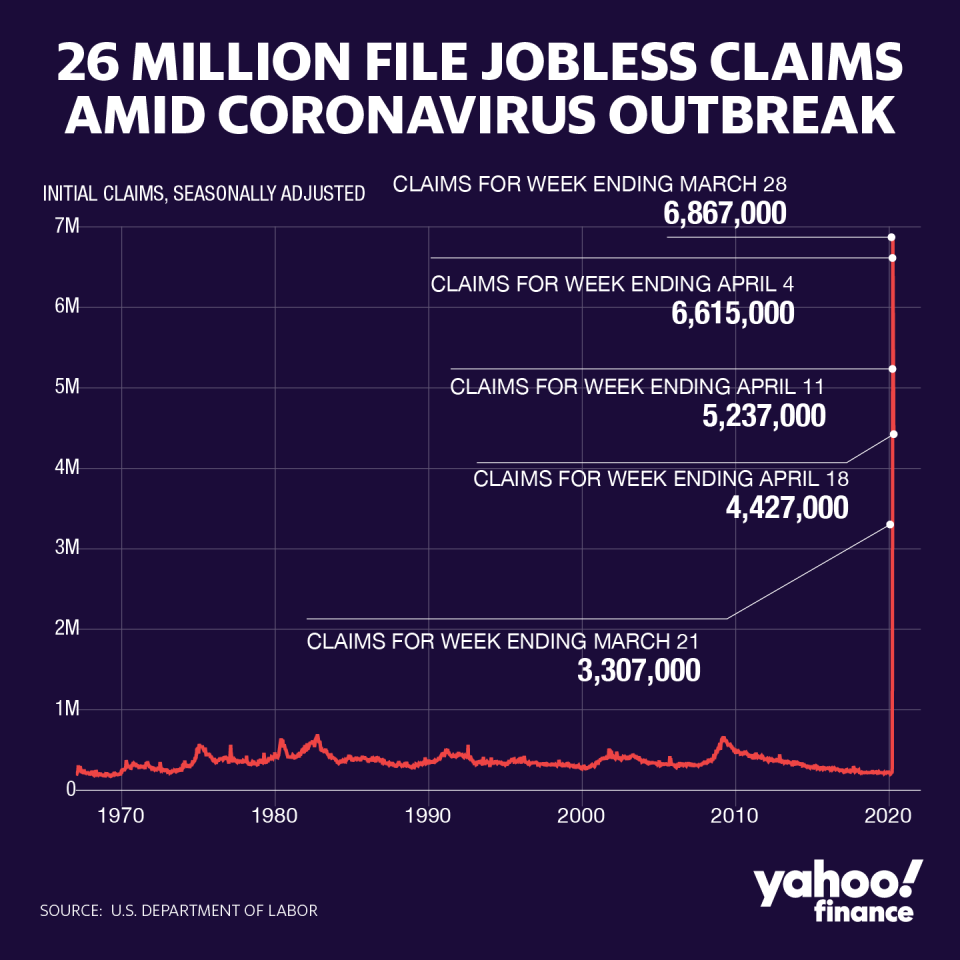

The 26 million unemployment claims filed in the U.S. amid the coronavirus pandemic has dire implications for the future of the U.S. economy, one economist warned.

“At this point it would take a miracle to keep this recession from turning into the Great Depression II,” Chris Rupkey, MUFG managing director and chief financial economist, wrote in a note on Thursday. “It is going to take years not months to put these pandemic jobless workers back to work at the shops and malls and factories and restaurants across the country.”

‘A disaster for the country’

The initial wave of job losses were concentrated in the retail and hospitality sectors, but that’s spreading to suppliers and other industries, ING Chief International Economist James Knightley stated in another note on Thursday.

“We're sitting here today at a 17% unemployment rate, which is a disaster for the country," BNY Mellon Chief Strategist told Yahoo Finance. “Because the longer this goes on, the greater the likelihood that those individuals... become detached from their employers."

The job losses in the last five reports were “more than the entire Great Recession a decade ago,” Rupkey added. The 2008 Financial Crisis saw 15.35 million people out of work at the worst point.

Glassdoor Senior Economist Daniel Zhao stressed that point further, adding: “Today’s report shows the labor market is almost certainly pushing into new territory, jolting the unemployment rate up above the Great Recession’s 10% peak and wiping out more jobs than we've gained in the recovery.”

‘Jobless claims are warning that the worst isn’t over’

In March, Rupkey predicted that April will have the “first Depression-magnitude job losses the country has seen since the 1930s.” But the actual manifestation of those numbers is still not easy to digest.

“Net, net, jobless claims are warning that the worst isn’t over yet for the American economy with businesses and consumers alike being sucked down into the abyss of the pandemic recession,” Rupkey wrote on Thursday. “The risks to the outlook are that the economy is digging itself such a big deep hole that its ill become harder to climb back out of it.”

And then “it will be too tired to run as fast as before,” Rupkey added, shrugging off ideas of a fast or a V-shaped recovery.

And if “consumers remain reluctant to go shopping or visit a restaurant due to lingering COVID-19 fears, then employment is not going to rebound quickly,” Knightly added. “As such, it would be another signal that a V-shaped recovery for the U.S. economy is highly unlikely.”

—

Aarthi is a reporter for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

More than 66 million U.S. jobs are at 'high risk' of layoffs amid coronavirus, St. Louis Fed finds

Coronavirus stimulus bill: 7 ways student loan borrowers benefit

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

Yahoo Finance

Yahoo Finance