Copa Holdings' Traffic Falls, Load Factor Rises in January

Copa Holdings, S.A. CPA reported below par traffic numbers for January 2020. Consolidated traffic, measured in revenue passenger miles (RPMs), slipped 5.7% to 1.82 billion in the month. On a year-over-year basis, consolidated capacity (measured in available seat miles/ASMs) dropped 7% year over year to 2.16 billion.

The downside was caused by reduced capacity due to the extended grounding of the Boeing 737 MAX jets. The carrier with six Boeing MAX 9 jets in its fleet removed all MAX flights from its schedule through March 2020. Consequently, multiple fight cancellations are affecting revenues. The company’s fourth-quarter performance is likely to get impacted by this drab scenario.

Meanwhile, with traffic declining less than the amount of capacity contraction, load factor (% of seats filled by passengers) increased 120 basis points to 84.2% in January.

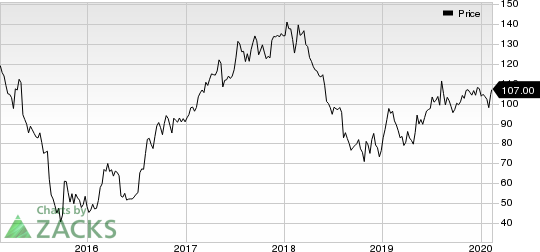

Copa Holdings, S.A. Price

Copa Holdings, S.A. price | Copa Holdings, S.A. Quote

Zacks Rank & Key Picks

Copa Holdings carries a Zacks Rank #4 (Sell). Few better-ranked airline stocks are Azul SA AZUL, Ryanair Holdings plc ( RYAAY and Delta Air Lines DAL. All three carriers sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Azul, Ryanair and Delta have rallied more than 6%, 6% and 3%, respectively, in the past three month.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

AZUL SA (AZUL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance