Consolidated Water (CWCO) Q2 Earnings Miss, Revenues Beat

Consolidated Water Co. Ltd. CWCO reported second-quarter 2019 earnings of 16 cents per share, lagging the Zacks Consensus Estimate by a penny but increasing from the year-ago figure of 12 cents by 33.3%.

Total Revenues

The company’s total revenues in second-quarter 2019 came in at $18.3 million, up from the year-ago figure of $15.1 million by 21.2%. Total revenues also surpassed the Zacks Consensus Estimate of $17 million by 7.6%.

The year-over-year improvement can be attributed to greater contribution from its manufacturing segment and higher retail revenues.

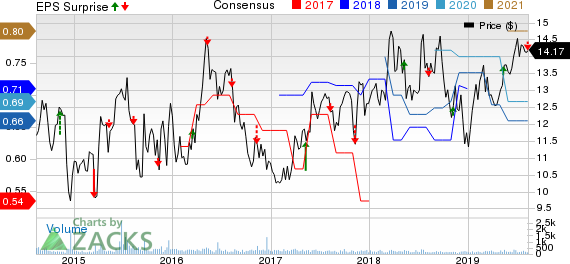

Consolidated Water Co. Ltd. Price, Consensus and EPS Surprise

Consolidated Water Co. Ltd. price-consensus-eps-surprise-chart | Consolidated Water Co. Ltd. Quote

Segment Details

Retail revenues in second-quarter 2019 increased nearly 11.3% year over year to $6.98 million.

Bulk revenues came in at $6.9 million in second-quarter 2019, down 9.6% from the prior-year figure.

Manufacturing revenues amounted to nearly $4.3 million, up a whopping 330% year over year.

Services revenues of $0.1 million were down 26.1% from the year-ago level.

Highlights of the Release

In second-quarter 2019, total cost of revenues increased 21.2% year over year to $10.8 million.

General and administrative expenses increased 12.4% from the year-ago quarter to $4.9 million.

Income from operations in the reported quarter was $2.95 million, up 70.5% year over year.

Financial Highlights

As of Jun 30, 2019, Consolidated Water’s cash and cash equivalents totaled $41.9 million, up from $31.3 million on Dec 31, 2018.

Cash provided (used in) by operating activities in first-half 2019 was $6.1 million versus ($8.1) million in the comparable year-ago period.

Zacks Rank

Currently, Consolidated Water carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Water Supply Utilities’ Release

Here are some other players from the water utility space that have reported second-quarter earnings. American States Water AWR, SJW Group SJW and Connecticut Water Service, Inc. CTWS beat the Zacks Consensus Estimate by 23.1%, 9.4% and 1.5%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American States Water Company (AWR) : Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

Connecticut Water Service, Inc. (CTWS) : Free Stock Analysis Report

SJW Group (SJW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance